Hong Kong: The New Hub for Cryptocurrency Trading

As the world of cryptocurrency continues to evolve, Hong Kong is emerging as a major player in the market. The city’s Securities and Futures Commission (SFC) has approved the launch of spot bitcoin and ether exchange-traded funds (ETFs), making it the first jurisdiction in Asia to do so. This move is seen as a significant step forward for Hong Kong, cementing its role as a virtual-asset hub.

Hong Kong’s skyline, a symbol of its growing importance in the world of cryptocurrency

Hong Kong’s skyline, a symbol of its growing importance in the world of cryptocurrency

The SFC’s approval of spot bitcoin and ether ETFs is a significant development, as it allows retail and institutional investors to directly invest in these cryptocurrencies. This move is expected to attract a large number of investors, including those from mainland China, where cryptocurrency trading is banned.

The first batch of approved ETFs is managed by Chinese fund managers Harvest International and China Asset Management, with a jointly managed product offered by Mainland Chinese Bosera Asset Management and Hong Kong virtual asset firm HashKey Capital. This is a significant development, as it marks the first time that Chinese fund managers have been involved in the launch of cryptocurrency ETFs.

“With the growing adoption of ETFs in institutional asset allocation and retail trading in Hong Kong, we expect robust demand for our offerings,” said Thomas Zhu, head of digital assets and Family Office Business at China Asset Management.

The SFC’s nod to spot bitcoin and ether ETFs is a significant departure from the approach taken by mainland China, where cryptocurrency trading is banned. This has led to Hong Kong being seen as a haven for cryptocurrency investors, with many flocking to the city to take advantage of its more relaxed regulations.

The logos of Bitcoin and Ethereum, the two largest cryptocurrency tokens

The logos of Bitcoin and Ethereum, the two largest cryptocurrency tokens

The launch of spot bitcoin and ether ETFs in Hong Kong is also significant because it allows for in-kind creation models, which enable direct exchange of cryptocurrencies for ETF shares. This is in contrast to US bitcoin ETFs, which can only be purchased with dollars.

“The in-kind subscription and redemption mechanism increase the flexibility and inclusiveness of virtual asset spot ETFs, and it has certain arbitrage space, which is favourable to not only crypto-native investors but also traditional financial investors,” said Jason Jiang, senior researcher at OKG Research.

However, Jiang warned that in-kind creation models will increase investment risks due to the complexity of the process involving bitcoin and ether ETFs exchange, custody, and conversions.

Despite these risks, Hong Kong’s regulatory system is seen as comprehensive and capable of dealing with the risks associated with cryptocurrency trading.

“Hong Kong has established a relatively comprehensive regulatory system that is capable of dealing with relative risks,” said Jiang.

The launch of spot bitcoin and ether ETFs in Hong Kong is expected to attract a large number of investors, including those from mainland China. This is likely to lead to a significant increase in trading volume, with some estimates suggesting that the market could reach US$200 billion in the next few months.

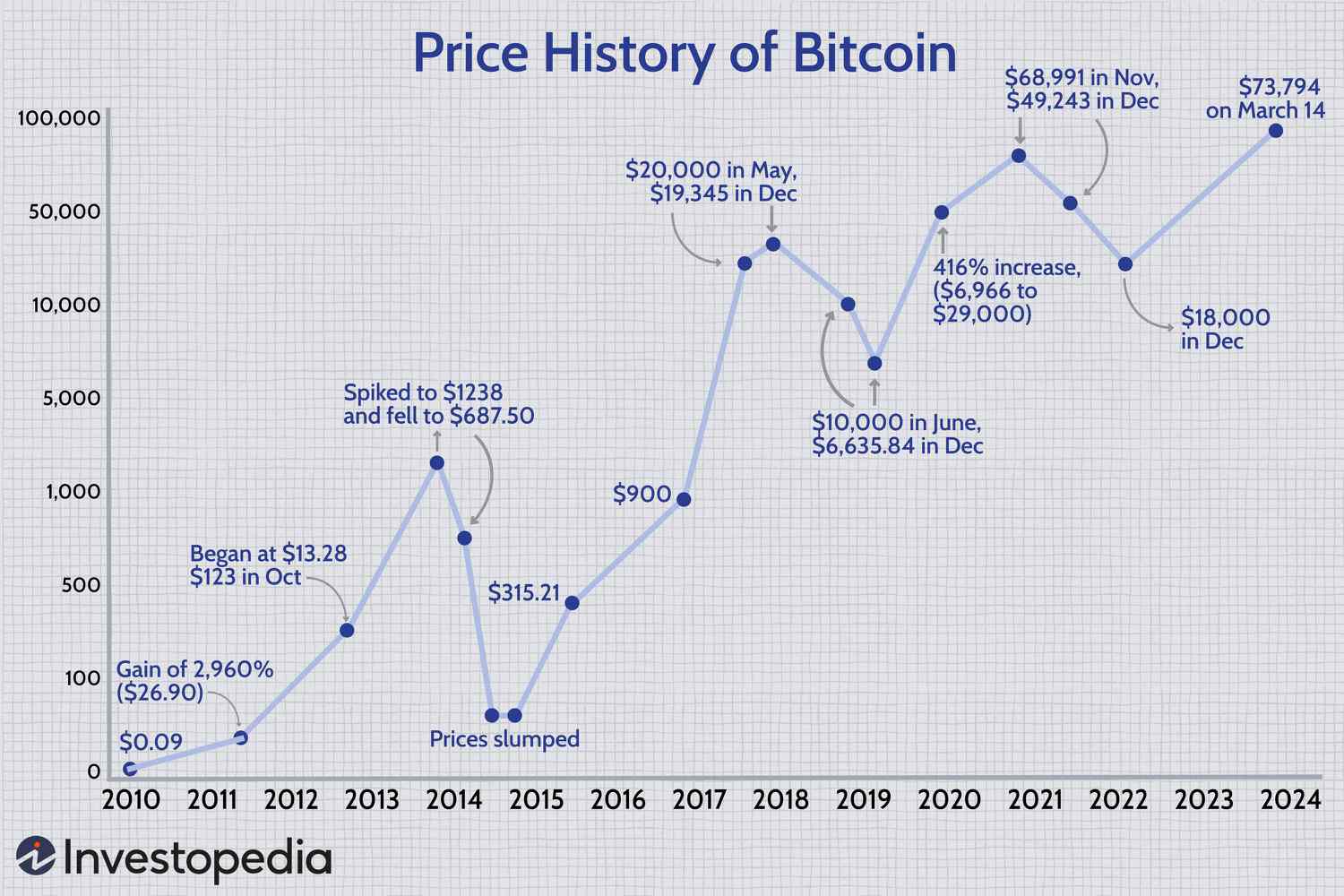

A graph showing the potential growth of cryptocurrency trading in Hong Kong

A graph showing the potential growth of cryptocurrency trading in Hong Kong

In conclusion, Hong Kong’s approval of spot bitcoin and ether ETFs is a significant development in the world of cryptocurrency trading. The city’s relaxed regulations and comprehensive regulatory system make it an attractive destination for investors, and its proximity to mainland China makes it an ideal location for Chinese investors.

As the market continues to evolve, it will be interesting to see how Hong Kong’s cryptocurrency market develops. One thing is certain, however - Hong Kong is fast becoming a major player in the world of cryptocurrency trading.