Bitcoin’s Price Surge: What the Halving Means for Investors

The cryptocurrency market is abuzz with excitement as Bitcoin’s price surges to $64,000 in the final hours before the highly anticipated halving event. But what does this mean for investors, and how will it impact the cryptocurrency’s value in the long run?

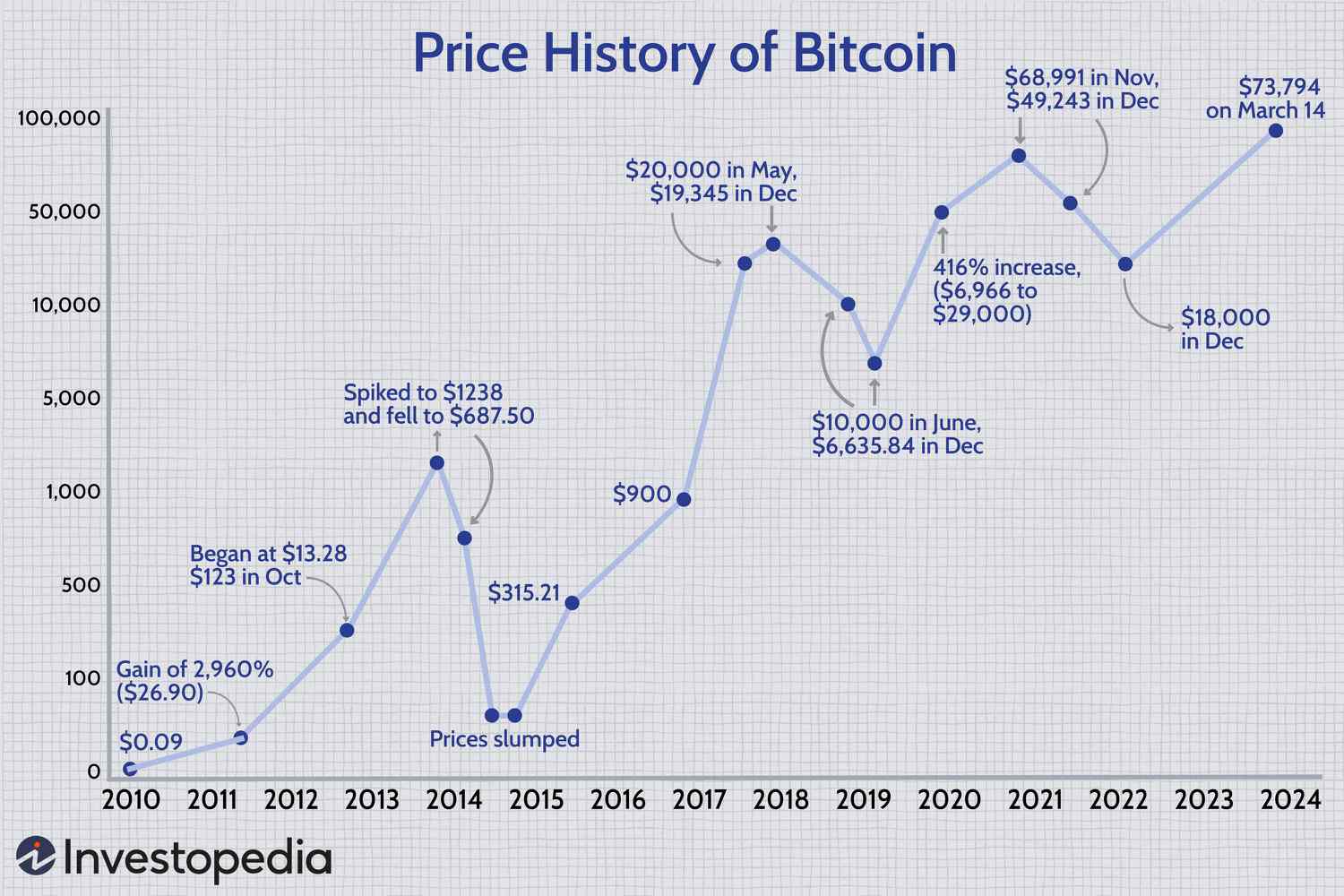

Bitcoin’s price surge ahead of the halving event

Bitcoin’s price surge ahead of the halving event

The halving, a pre-programmed event that reduces the reward for mining Bitcoin by half, is expected to have a significant impact on the cryptocurrency’s price. But unlike previous halvings, this one is expected to be different. With the cryptocurrency market more mature and widely adopted than ever before, the effects of the halving are likely to be felt across the entire ecosystem.

The cryptocurrency market is more mature and widely adopted than ever before

The cryptocurrency market is more mature and widely adopted than ever before

So, what can investors expect from the halving? Will it lead to a surge in Bitcoin’s price, or will it have a more nuanced impact on the market? In this article, we’ll explore the implications of the halving and what it means for investors.

The Halving: A Brief Explanation

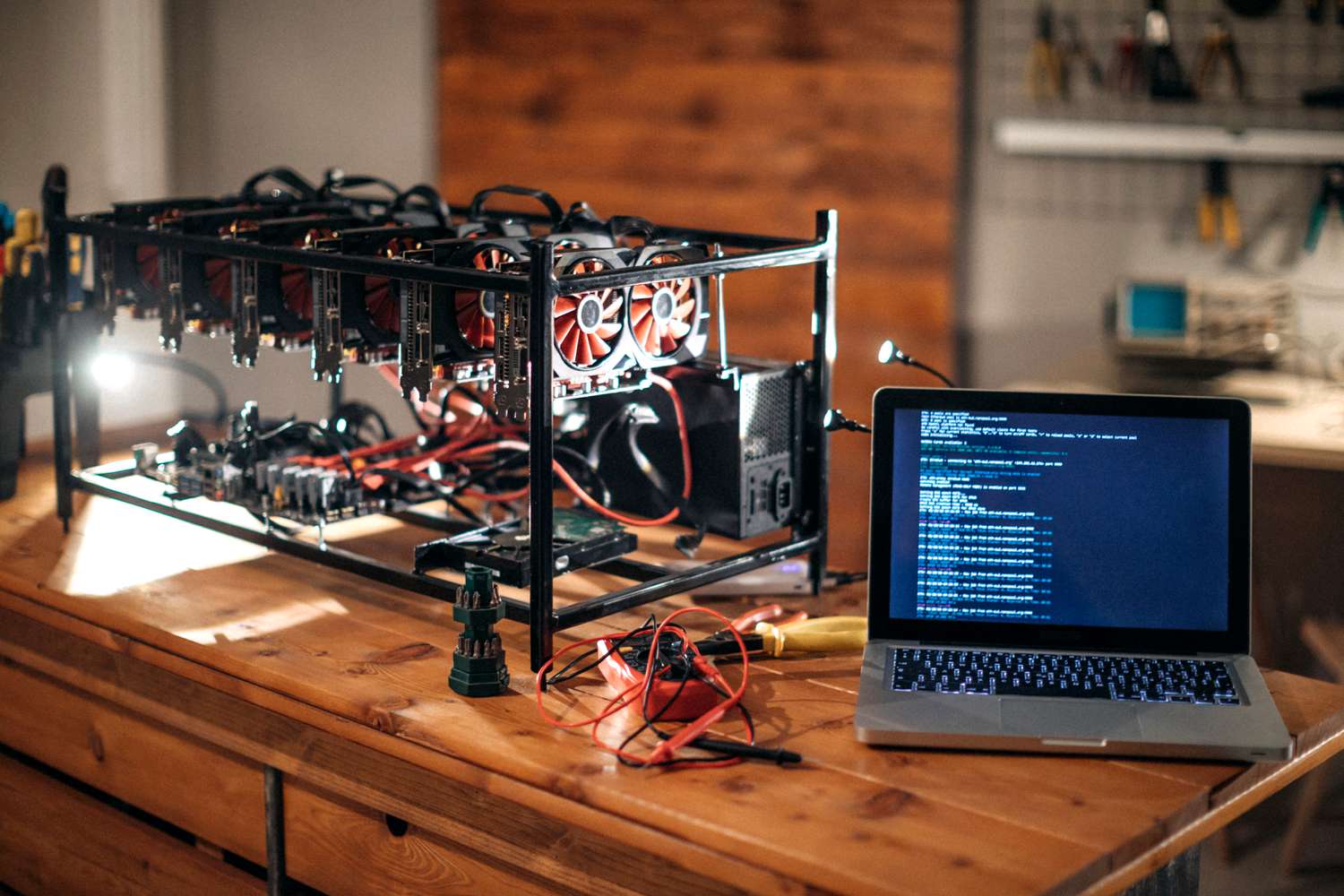

For the uninitiated, the halving is a pre-programmed event that reduces the reward for mining Bitcoin by half. This event is designed to slow down the rate at which new Bitcoins are created, thereby reducing the supply of new coins entering the market.

Bitcoin mining: the process of verifying transactions and creating new coins

Bitcoin mining: the process of verifying transactions and creating new coins

The halving is a key component of Bitcoin’s design, and it’s intended to help control inflation and maintain the value of the cryptocurrency. But what does it mean for investors, and how will it impact the market?

The Impact on Investors

The halving is likely to have a significant impact on investors, particularly those who have invested in Bitcoin or other cryptocurrencies. With the supply of new coins entering the market reduced, the demand for existing coins is likely to increase, driving up the price.

The halving could lead to an increase in Bitcoin’s price

The halving could lead to an increase in Bitcoin’s price

But the impact of the halving won’t be limited to Bitcoin alone. The entire cryptocurrency market is likely to be affected, with other coins and tokens feeling the ripple effects of the event.

Conclusion

The halving is a significant event in the world of cryptocurrency, and it’s likely to have a profound impact on the market. With the supply of new coins entering the market reduced, the demand for existing coins is likely to increase, driving up the price. But the impact of the halving won’t be limited to Bitcoin alone - the entire cryptocurrency market is likely to be affected.

The outlook for the cryptocurrency market is uncertain, but one thing is clear: the halving will have a significant impact

The outlook for the cryptocurrency market is uncertain, but one thing is clear: the halving will have a significant impact

As investors, it’s essential to stay informed and adapt to the changing landscape of the cryptocurrency market. With the halving just around the corner, now is the time to educate yourself and make informed investment decisions.