The Ripple Effects of China’s $1.3 Billion Ethereum Sell-off

Chinese authorities have once again made headlines in the cryptocurrency world by transferring 7,000 Ether (ETH) to various exchanges, a move that has sparked alarm among investors. This transfer is part of a staggering 542,000 ETH, seized from the notorious PlusToken Ponzi scheme back in 2018, and it has sent shockwaves through the market.

The current state of Ethereum as it faces potential sell-offs.

The current state of Ethereum as it faces potential sell-offs.

Understanding the Current Situation

As of now, Ethereum is trading around $2,401, recently witnessing a nearly 2% dip in its price. This decline is coupled with an overall bearish sentiment in the cryptocurrency domain, where the Fear and Greed Index has dropped to a concerning 39. Such numbers indicate a climate of uncertainty that feels palpable among traders. Investors are increasingly anxious about how these government actions could affect Ethereum’s stability and value.

Just so you know, this recent ETH movement was rather unexpected. The 7,000 ETH is only a fraction of the total amount linked to PlusToken, which had swindled billions from unsuspecting investors. At its height, PlusToken amassed over 830,000 Ether and 194,000 Bitcoin, which remained largely untouched until this recent transaction.

Analyzing Potential Impacts on Ethereum

Many analysts are now voicing concerns over a potential “supply overhang.” This phrase is quite crucial in the cryptocurrency context, referring to a situation where there are more tokens available to sell than buyers willing to purchase them. Should the Chinese government opt to liquidate a larger part of the remaining 542,000 ETH, we could see significant downward pressure on Ethereum’s price.

Recent reports suggest that just a few days prior, on October 9, authorities withdrew another hefty tranche of 15,700 ETH, with a considerable portion flowing into prominent exchanges such as Binance and OKX. This kind of pattern is reminiscent of previous sell-offs when Chinese authorities liquidated a large amount of Bitcoin in 2020, leading to steep price declines and widespread market disruption.

Surge in Exchange Activity

The recent influx of ETH into exchanges has dramatically increased Ethereum’s exchange reserves. According to Crypto Quant data, reserves have swelled by over 110,000 ETH, marking a three-week high. High activity levels are usually indicative of traders preparing to sell, potentially leading to further price decreases.

Traders closely watch the fluctuations in Ethereum.

Traders closely watch the fluctuations in Ethereum.

Furthermore, data from Into The Block reveals a notable rise in large transaction volumes involving Ethereum. However, it appears that this uptick isn’t translating into positive price action, which could indicate that larger trades are predominantly sales rather than purchases. Such trends hint at larger investors liquidating their holdings, which adds further downward pressure to ETH prices.

The Effect of Market Liquidations

The escalating exchange activity has inevitably impacted Ethereum’s market structure. Coinglass reports that over $31 million worth of ETH was liquidated in a mere 24-hour period, with about $27 million coming from long positions. These liquidations often lead traders to close positions to avoid incurring heavy losses, compounding the price pressure we’ve observed.

This data signals a clear trend: the market is favoring selling over buying. With apprehension dominating the trading atmosphere, many investors are left to ponder whether it’s still wise to hold their ETH assets or if selling is a more prudent option at this point.

Strategic Guidance for Investors

Given the rapidly evolving nature of the situation, it is crucial for investors to stay updated and to evaluate their strategies critically. Ethereum has demonstrated its resilience in market fluctuations before, yet the current climate presents a challenge that could usher in heightened volatility in the weeks ahead.

Market pundits recommend that investors vigilantly observe the activities surrounding the seized ETH and gauge the overall market sentiment. Grasping the reasons behind the large trades and anticipating any further sell-offs will be pivotal for making savvy investment decisions.

If you are currently invested in Ethereum, playing it cautious might be the route to take. Consider reassessing your investment strategies, implementing stop-loss orders, or diversifying your portfolio to offset risks. The cryptocurrency market is known for its unpredictability, and having a robust understanding of the current landscape can be key to navigating the tricky waters ahead.

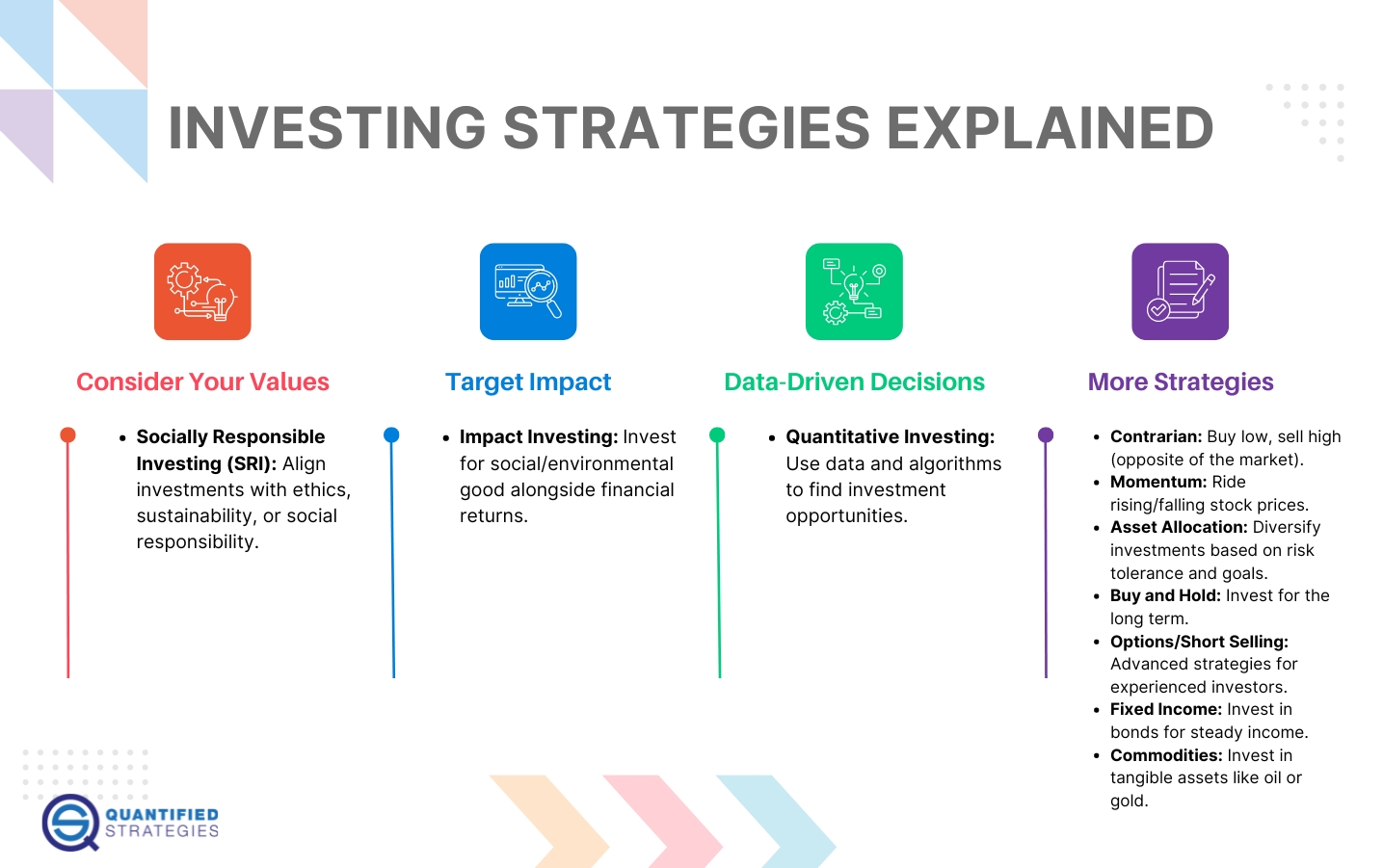

Strategies for navigating the turbulent cryptocurrency markets.

Strategies for navigating the turbulent cryptocurrency markets.

Eyes on the Horizon

In conclusion, the looming potential for Chinese authorities to sell off over $1.3 billion worth of Ethereum raises substantial concerns for the broader cryptocurrency market. As traders and investors react to these developments, the uncertainty surrounding Ethereum’s future continues to proliferate.

Whether you are a longtime investor or a newcomer to the crypto universe, staying informed during these transitions is critical. The forthcoming days could be formative in shaping the trajectory of Ethereum and the entire market. As these dynamics unfold, keeping a close watch on the actions of Chinese authorities and the broader reactions from investors is essential for anyone looking to successfully navigate this fast-paced and ever-evolving environment.