Could a Financial Crisis End Crypto’s Bull Run?

These are heady times for the blockchain and crypto sector. In the first half of 2024, spot Bitcoin ETFs debuted on Wall Street, a major U.S. presidential candidate came out in favor of cryptocurrencies, and BTC experienced its fourth quadrennial “halving” and reached new market highs. Moreover, Ether — the world’s second-largest cryptocurrency — stands on the verge of another milestone, with an Ether ETF potentially launching in the U.S. as early as July 8.

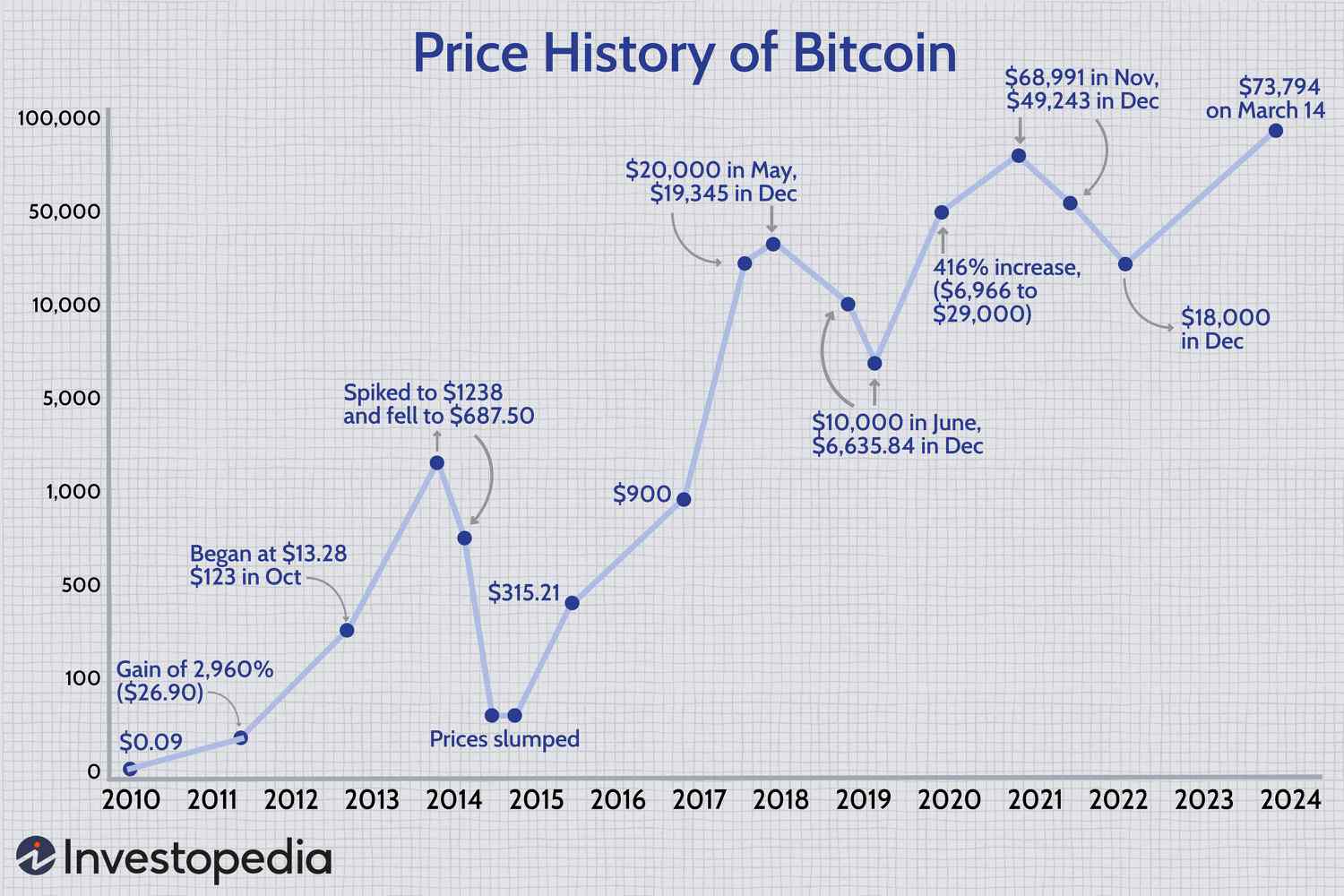

Crypto market growth continues to soar

But crypto doesn’t exist in a vacuum, and the outside world has become a less secure place, wracked by several major wars, extreme weather events, and persistent monetary inflation. Given the circumstances, a cross-border meltdown in the traditional financial system by year’s end isn’t unthinkable. So, it bears asking: If a TradFi crisis does materialize, what becomes of the latest crypto bull run?

TradFi Upheaval “Cannot Be Ruled Out”

“It’s definitely possible that major corrections in financial markets will happen before the end of the year, although they might not lead to a full-blown crisis,” Paolo Tasca, an economist and founder of the University College London Centre for Blockchain Technologies, tells Magazine.

The trigger? Probably a correction in AI stocks, “but the main market to look at is debt, in my opinion,” says Tasca. The U.S. has been running massive fiscal deficits, which may make interest rate cuts unlikely, and as a result, the bond and equity markets could “suffer from the continued restrictive monetary policy.”

Ongoing inflation, geopolitical tensions, as well as “the speculative nature of certain asset bubbles, including those in the tech and AI sectors,” are potential catalysts, adds Yu Xiong, a professor and director of the Surrey Academy for Blockchain and Metaverse Applications at the Surrey Business School. Xiong tells Magazine that “a global financial crisis in 2024 cannot be ruled out.”

Global economic uncertainty is on the rise

Seek Refuge in Decentralized Assets

So what should one expect crypto-wise if the entire global economy heads south? “Historically, during the onset of financial crises, all assets, including cryptocurrencies, see a sell-off as investors seek liquidity,” says Xiong. Crypto market prices could plummet along with everything else.

In the mid-term, though, after the initial panic abates, there might be a “recovery phase where investors seek refuge in decentralized assets, potentially reigniting the crypto bull run,” he continues. In the longer term, though, the benefits of blockchain-based technologies should prevail: “Due to the strong development of AI, more people will push for the use of blockchain and other decentralized technologies, empowering individuals.”

Therefore, while cryptocurrencies may experience instability with a TradFin crisis in 2024, “the likelihood of a major [crypto] crash is not high,” says Xiong. “Indeed, in the long term, such a crisis could significantly boost crypto adoption.”

Impossible to Predict

Many agree that economic crises are cyclical events, and for that reason, a historical perspective can be useful. Asked about a global economic crisis in 2024, Mark Higgins, author of Investing in U.S. Financial History: Understanding the Past to Forecast the Future, a book that explains the economic forces that have shaped U.S. financial history since 1790, tells Magazine:

“The only thing I will say is if a crisis occurs, it is most likely to be caused by a risk that most people do not see — rather than one that people fear most.”

Is BTC a Safe Haven?

Some observers maintain that crypto is — or is on the verge of becoming — an uncorrelated financial asset, which means that when stocks and bonds plummet, crypto won’t necessarily sink as well. But such thinking could be wishful.

“Crypto has shown to be massively procyclical so far,” notes Tasca, and he wouldn’t expect anything to be different in 2024: “The academic literature doesn’t support the notion that BTC is a safe haven: if stocks go down and monetary or fiscal policy becomes more restrictive, I expect crypto to go down too.”

What if the Internet Fails?

Perhaps a more pertinent question is whether Bitcoin and other cryptocurrencies could survive an enduring TradFi crisis, which could be brought on by a geopolitical disruption like a war. Cryptocurrencies need the internet to be traded, which in turn requires electricity and telecom providers. If geopolitical tensions deepen and “bad actors” engage in cyber or physical attacks upon critical infrastructure like power stations and data centers, wouldn’t cryptocurrencies go dark as well?

“Bitcoin sits atop one of the most vulnerable systems,” notes Reza Bundy, CEO of Atlas Capital Team. Should geopolitical tensions boil over, he expects “asymmetric” strikes on power networks, among other infrastructure. “Armies won’t be marching across borders. Rather, attacks will be made on the banking sector and electrical providers.” Crypto access could be knocked out over large parts of the world.

More Use Cases Needed

Others think the crypto industry needs to develop more compelling use cases if it is to survive a prolonged TradFi crisis and beyond. “Crypto adoption has nothing to do with financial contingencies but with the development of proper practical use cases, which so far have been scarce,” says Tasca. “Long-term growth will not be affected by short-term speculative trends.”

The crypto industry may need to think more realistically about how it fits into the TradFi world. “Self-sovereignty” is a crypto illusion, asserts Bundy. If the global economy collapses, crypto isn’t going to save you.

He suggests that crypto can be part of the solution for a safer, more equitable world, but it is not “the” solution. The industry could help itself begin by focusing more on real-world assets, i.e., cryptocurrencies backed by assets from the physical world, such as real estate and commodities, or traditional financial assets like treasury bonds, says Bundy.

Predicting the Unpredictable?

Of course, trying to predict economic crises and panics may just be a fool’s errand, Higgins implies. Economist and Nobel laureate Paul Samuelson once famously joked that the stock market “had predicted nine of the past five recessions.” The fact that predictions have long outstripped actual occurrences has been the source of some mirth, Green acknowledges, underscoring the difficulty of actually forecasting such events. But that doesn’t mean one must necessarily shy away from them: “While speculative, these predictions can still be useful for risk management. They prompt investors to diversify portfolios and consider hedging strategies to protect against potential downturns.”

And the fact is that many, if not most, experts don’t expect global financial collapse any time soon. “I don’t see any reason to expect a global financial crisis,” David Yermack, Albert Fingerhut Professor of Finance and Business Transformation at New York University, tells Magazine. “The economy is strong, and markets are near all-time highs. Most of the world’s financial problems are confined to China.”

In any event, “It’s hard to draw any connection between crypto prices and the world economy,” says Yermack. “There’s little theoretical reason to expect one. Any forecast about crypto prices should probably be independent of global market conditions.”

Still, others believe that if a calamity were to arise, crypto and blockchain’s core attributes, including decentralization, security, transparency, and traceability, should ensure its survival. “While a TradFi crisis could temporarily derail the crypto bull run, the fundamental strengths and unique value propositions of blockchain and crypto technologies could result in a stronger, more resilient adoption trajectory in the long term,” says Xiong.

Crypto resilience in the face of uncertainty