Why I’m Betting Big on Bitcoin

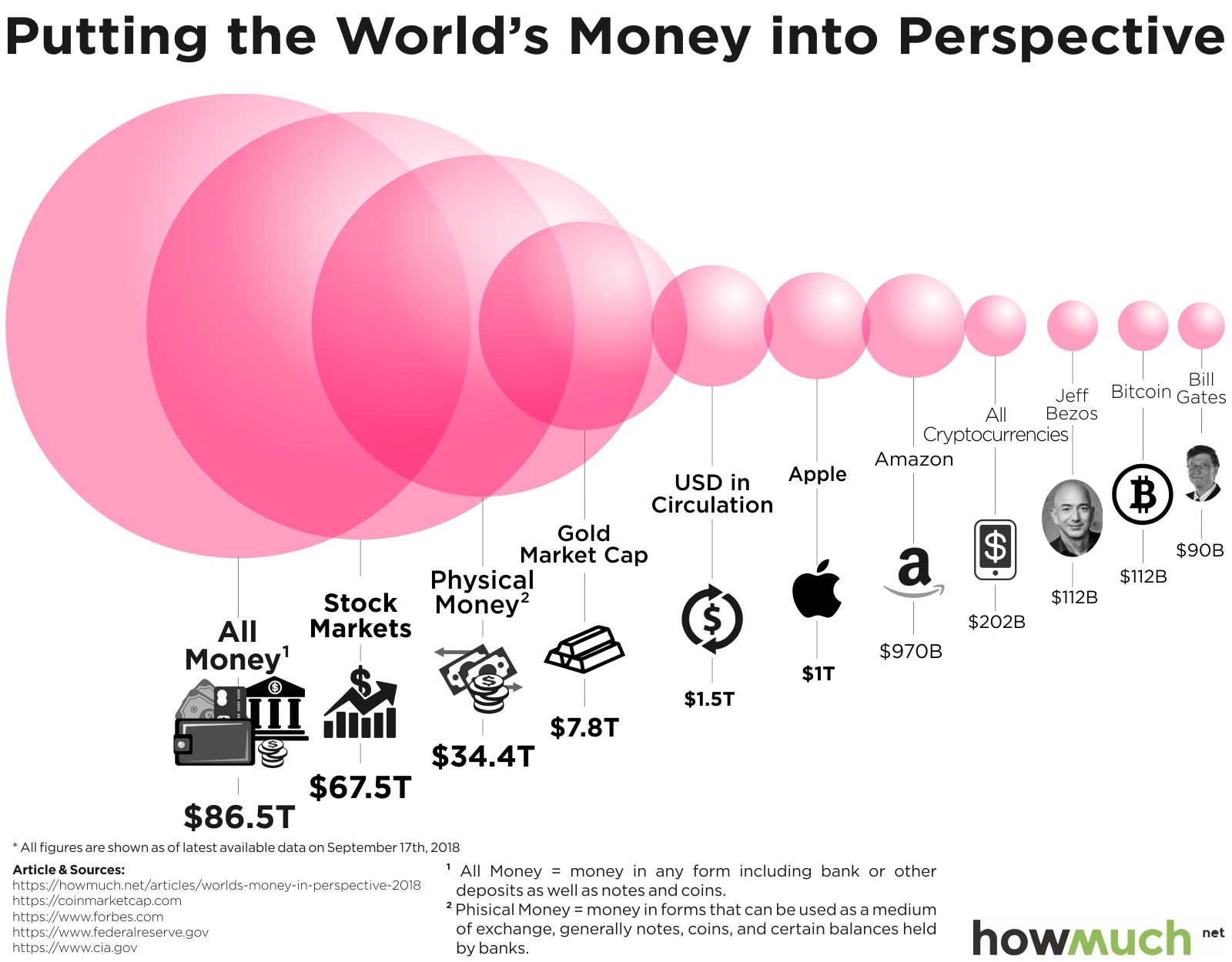

The cryptocurrency market has made a remarkable comeback in 2023, with its valuation soaring to over $2.2 trillion. And at the heart of this resurgence is Bitcoin, the most valuable digital asset out there. With its price surging over 100% in the past 12 months, it’s no wonder investors are taking notice. But what’s driving this growth, and why do I think Bitcoin is the ultimate cryptocurrency to buy with $1,000 today?

A Resurgent Market

After a dismal 2022, the cryptocurrency market has bounced back with a vengeance. And Bitcoin, being the largest and most influential player, has been the biggest beneficiary. Its current valuation of over $1.2 trillion is a testament to its growing appeal among investors.

The cryptocurrency market has made a remarkable comeback in 2023.

The cryptocurrency market has made a remarkable comeback in 2023.

Catalysts for Growth

So, what’s driving Bitcoin’s growth? For starters, the approval of spot Bitcoin exchange-traded funds (ETFs) by the Securities and Exchange Commission (SEC) in January has provided a regulatory-compliant method for individuals and institutions to gain exposure to this crypto conveniently. This has undoubtedly contributed to the price surge.

The approval of spot Bitcoin ETFs has been a major catalyst for growth.

The approval of spot Bitcoin ETFs has been a major catalyst for growth.

Another key factor is the recent halving of Bitcoin’s network, which reduces the new supply of Bitcoin hitting the market. Historically, this event has been an extremely bullish development for the digital asset.

The recent halving of Bitcoin’s network has reduced the new supply of Bitcoin.

The recent halving of Bitcoin’s network has reduced the new supply of Bitcoin.

Escape the Fiat System

Bitcoin’s defining characteristics are that it isn’t controlled by a single entity and that its ultimate supply has a hard cap of 21 million coins. This makes it an attractive alternative to fiat currencies, which are plagued by inflation and economic uncertainty.

Bitcoin offers a hedge against the troubles lurking within the current financial system.

Bitcoin offers a hedge against the troubles lurking within the current financial system.

As investors learn more about Bitcoin and its unique properties, they may realize that owning even a tiny bit can be viewed as a hedge against the troubles lurking within the current financial system.

Optionality

The ultimate long-term goal of Bitcoin is to be utilized as a medium of exchange. And the network may also one day underpin larger transactions as a settlement method, like for banks or even governments. This would drive up demand for Bitcoin and increase its value.

Bitcoin’s utility in various transactional settings could drive up demand and increase its value.

Bitcoin’s utility in various transactional settings could drive up demand and increase its value.

Conclusion

In conclusion, Bitcoin looks like a smart investment opportunity today. With its growing appeal, regulatory-compliant investment options, and potential to disrupt the current financial system, it’s hard to ignore its potential. A $1,000 allocation to the world’s leading digital asset, as part of a well-diversified overall portfolio, could be a smart money move.

A $1,000 allocation to Bitcoin could be a smart money move.

A $1,000 allocation to Bitcoin could be a smart money move.