Crypto Assets: The Great Reserve Misunderstanding

In recent discussions about financial stability and digital currency, a study by the World Bank has stirred a significant wave of speculation. Titled Can Crypto Assets Play a Role in Foreign Reserve Portfolios?, the study’s conclusion is clear: cryptocurrencies such as Bitcoin and Ethereum are not poised to become part of central banks’ foreign exchange reserves any time soon.

As I read through the findings presented by Erik Feyen, Daniela Klingebiel, and Marco Ruiz, my thoughts drift to this pivotal question: What does this mean for the future of digital currencies when institutions that hold the majority of the world’s monetary reserves are hesitant to embrace them?

The Crux of the Matter

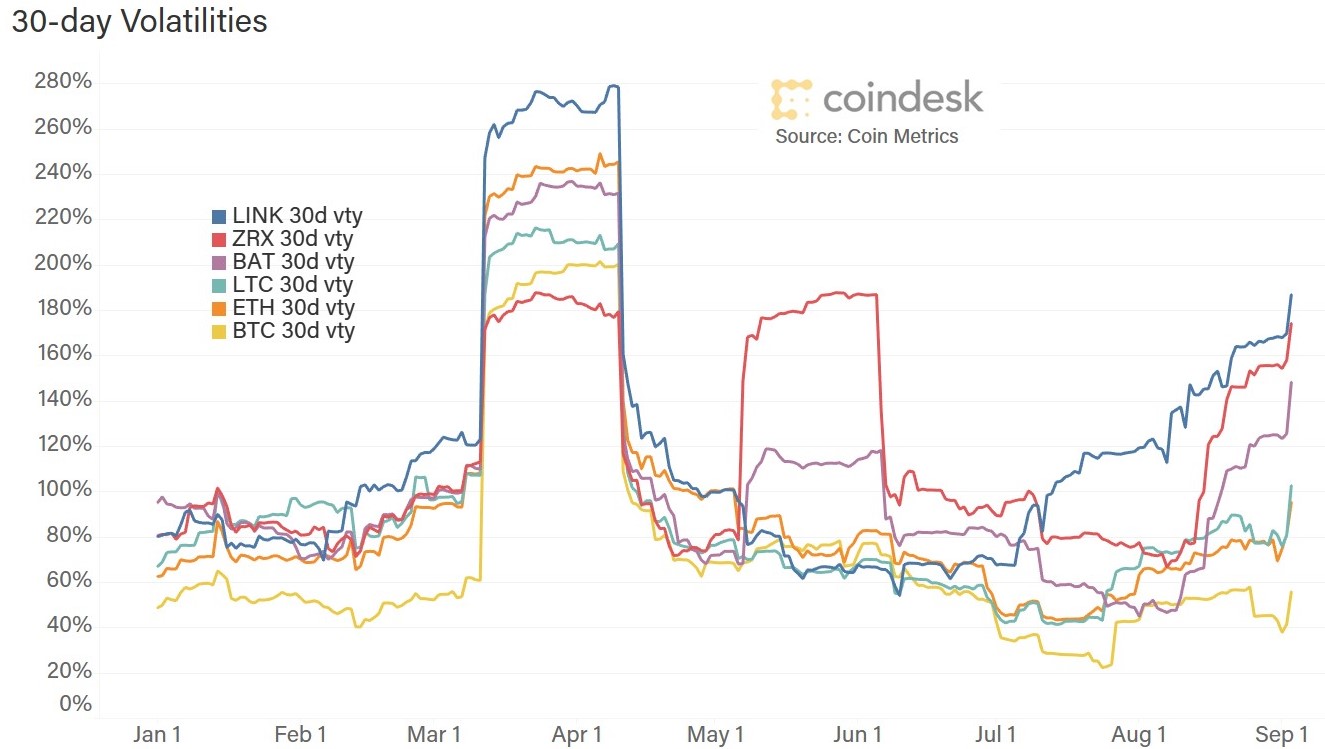

The authors suggest that central banks need reserves to be stable, liquid, and low-risk. That’s where cryptocurrencies fail to deliver the necessary assurances. While Bitcoin and Ethereum may boast high market caps, their extreme volatility poses a considerable risk for institutional investors. Imagine a central bank holding a substantial amount of its reserves in Bitcoin, only to see a sharp decline in value overnight. It’s the nightmare scenario for financial stability that central banks are sworn to uphold.

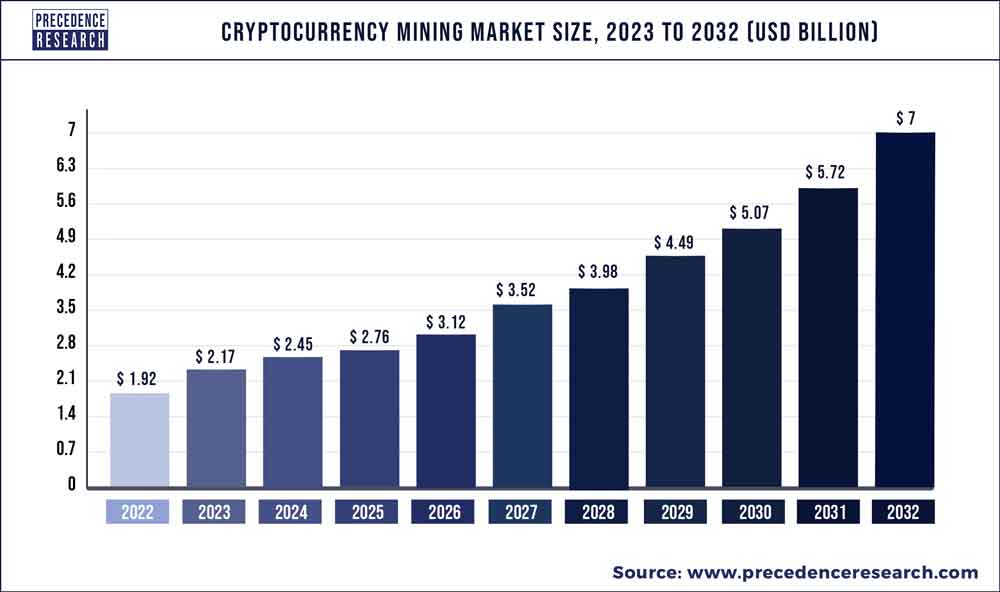

Volatility in crypto assets compared to traditional currencies.

Volatility in crypto assets compared to traditional currencies.

Central Banks Move Cautiously

The study asserts that central banks are unlikely to pivot toward non-CBDC (Central Bank Digital Currency) digital currencies “any time soon.” This cautious approach is understandable. The global economy is still recovering from recent tumultuous financial events, and introducing risky assets like cryptocurrencies into reserves could create unforeseen consequences.

To put this into perspective, I recall attending a seminar where a central bank official candidly expressed their views on digital assets. “We can’t afford to take risks with our reserves at a time when global economic stability hangs in the balance,” they proclaimed. It was a wake-up call that many skeptics still fail to recognize.

Are CBDCs the Way Forward?

With all the discussions surrounding cryptocurrencies, it’s important to dive deeper into the potential role of CBDCs in reshaping financial stability. Central banks are keen to develop their own digital currencies, mainly to improve the efficiency of payment systems and to maintain control over monetary policy.

Countries such as China have already taken significant steps in this direction with the digital yuan, showcasing that the future may lie in government-backed digital currencies rather than decentralized cryptocurrencies. This dichotomy raises another pressing question: Can traditional cryptocurrencies coexist with CBDCs?

The rise of Central Bank Digital Currencies around the world.

The rise of Central Bank Digital Currencies around the world.

Analyzing the Findings

According to the World Bank’s study, the volatility and speculative nature of cryptocurrencies are major barriers to their adoption in reserve portfolios. This leads me to ponder whether the dream of a decentralized financial system is merely that—a dream. The practicality of having stable, reliable financial systems often takes precedence over appealing technological advancements.

“Not today, and likely not in the near future,” is the report’s resounding conclusion, and it resonates loudly in the corridors of financial power.

The Road Ahead

It seems evident that even as excitement around crypto assets grows, the trajectory of their acceptance in mainstream finance is riddled with obstacles. Regulatory frameworks are only beginning to emerge, and current infrastructure struggles to support the complexities of decentralized finance.

Furthermore, as economic pressures heighten globally, let us not forget how central banks strive for predictability—traits cryptocurrencies lack. Whether we like it or not, we may have to wait a while before we see Bitcoin or Ethereum in the same breath as foreign exchange reserves. Until then, the focus should perhaps shift toward the compatibility of traditional systems with emerging digital innovations.

In conclusion, while the allure of digital currencies is undeniable, their application as reliable reserve assets is still a task for the future. The balance between innovation and stability should guide our progress in this fascinating monetary evolution.

Moving Forward

As we engage in these discussions about the future of money, it’s crucial to understand the prudence reflected in these findings. With every leap toward digitalization, we mustn’t lose sight of the foundational need for stability and trust in our monetary systems. Will the charm of crypto assets eventually win over traditional frameworks? Only time will tell.

Stay tuned as we navigate this rapidly evolving landscape together.