The Ultimate Cryptocurrency to Buy With $1,000 Right Now

With Bitcoin hitting a new all-time high of $73,750 earlier this year before pulling back to a current level of $67,600, many investors are understandably mixed on its future prospects. Some are concerned that it might already be too late to invest in Bitcoin, while others are concerned that the digital currency might still be too risky and volatile for their portfolios. Fair enough. But it’s hard to find a cryptocurrency with a better risk-reward profile than Bitcoin, or a cryptocurrency with this much support from Wall Street and large institutional investors. If you’re thinking of investing $1,000 in crypto, I can’t think of a better option than Bitcoin.

Mainstream adoption of Bitcoin

The launch of the new spot Bitcoin exchange-traded funds (ETFs) in January was a watershed moment in the history of crypto. All of a sudden, it became possible for retail and institutional investors to get exposure to Bitcoin without the need to invest in crypto directly. They can now buy Bitcoin via a trusted, easy-to-understand investment product that has the regulatory approval of the Securities and Exchange Commission (SEC). Gone are the days when you needed a digital wallet or an account with a cryptocurrency exchange in order to buy Bitcoin. So, as you might imagine, the launch of the new ETFs has unlocked a torrent of new money flooding into Bitcoin. The easiest way to see this is by tracking net investor inflows into the nearly dozen new spot Bitcoin ETFs. On some days, more than $1 billion is flowing into these ETFs. And all of that new money should continue to push up the price of Bitcoin. Even better, this is going to be a long-term phenomenon, not just a short-term portfolio rebalancing act. That’s because investors could finally be ready to ramp up their Bitcoin portfolio allocations considerably. According to Ark Invest in its new “Big Ideas 2024” report, the optimal Bitcoin allocation percentage increased from 1% in 2017 to 6% in 2022 before skyrocketing to 19.4% in 2023. The higher the Bitcoin allocation percentage, the more money that’s moving into Bitcoin, and the higher the price of Bitcoin will go. You can call it a self-fulfilling prophecy or a virtuous cycle.

Future upside potential

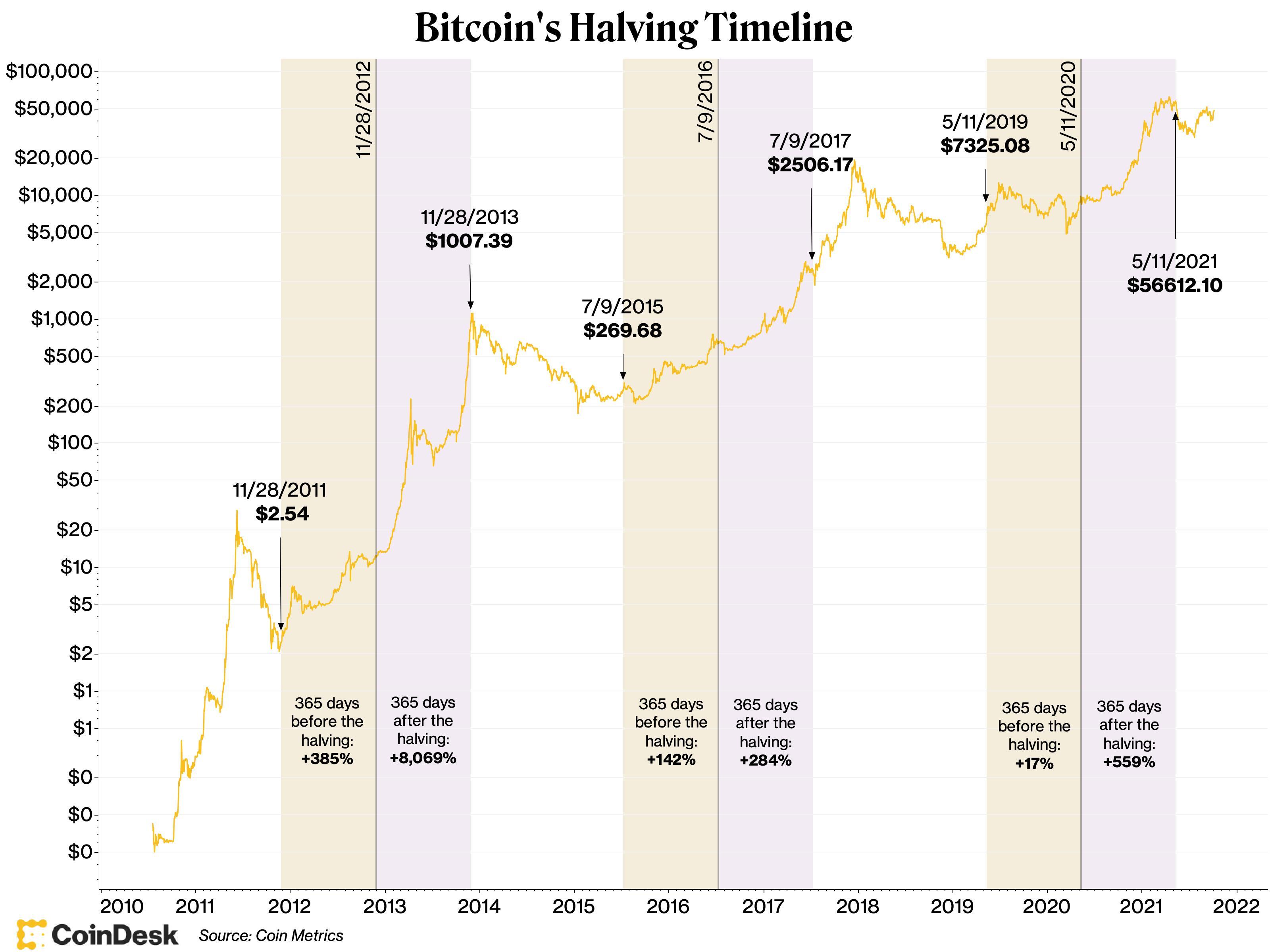

And, of course, it’s impossible to talk about Bitcoin without mentioning its future upside potential. During the decade from 2011 to 2021, Bitcoin was the best-performing asset in the world, and it wasn’t even close. During that time period, Bitcoin delivered annualized returns of 230%. As a result, it has taken Bitcoin only 13 years to soar from a price of $1 per coin (which it first hit in February 2011) to nearly $68,000 today. While it might be too much to expect Bitcoin to repeat that same kind of performance over the next decade, there are plenty of analysts who think Bitcoin still has plenty more room to run. The growing consensus, for example, is that Bitcoin will hit a price of $100,000 by the end of 2024. And Standard Chartered recently suggested that Bitcoin could climb as high as $250,000 by the end of 2025. But even that price target might be too low. As a result of Bitcoin’s blistering performance over the past few months, Cathie Wood of Ark Invest has doubled down on her earlier price forecast of $1 million for Bitcoin. In fact, she now thinks Bitcoin will overcome this important price hurdle before 2030. So, if you’re investing $1,000 today, it’s certainly within the realm of possibility that you could see a 10x to 15x return on your investment within just five years.

Digital gold

While many high-risk, high-upside assets have the potential to skyrocket during the good times, there are few, if any, that tend to prosper as well during the bad times. And that’s what makes Bitcoin so unique. As Cathie Wood pointed out last year, Bitcoin can perform well in both inflationary and deflationary environments. That’s part of what makes Bitcoin the ultimate cryptocurrency to buy right now – you’re getting the rare risk-reward profile that combines high upside with at least some downside risk protection.

Gold coins with the Bitcoin logo.

In fact, many investors are so enamored with Bitcoin as a long-term store of value that they refer to it as “digital gold.” Similar to physical gold, Bitcoin can act as a potential hedge against inflation, economic uncertainty, and geopolitical risk. Just look at what happened during the regional banking crisis of 2023, when many investors immediately moved their money into Bitcoin.

The Bitcoin gold rush?

The good news is that it’s not too late to buy Bitcoin. In fact, according to prominent Bitcoin bull Michael Saylor, the executive chairman and co-founder of MicroStrategy, we’re just now entering into the era of the “Bitcoin gold rush.” Over the next decade, there could be a stampede of new money into Bitcoin from both retail and institutional investors, as well as a rising tide of global adoption. Even if Bitcoin never hits the $1 million price level, it still has the potential to become the best crypto investment of the next decade.

Should you invest $1,000 in Bitcoin right now? Before you buy stock in Bitcoin, consider this: The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now and Bitcoin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years. Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002.

Dominic Basulto has positions in Bitcoin. The Motley Fool has positions in and recommends Bitcoin. The Motley Fool has a disclosure policy.

The Ultimate Cryptocurrency to Buy With $1,000 Right Now was originally published by The Motley Fool