A Small Allocation to Bitcoin Can Make Sense, Regardless of Your Thesis

Investors and advisors are often too focused on understanding the intricacies of bitcoin, and in doing so, may be missing out on a valuable investment opportunity. According to Matt Horne, head of digital asset strategies at Fidelity Digital Assets, a small allocation to bitcoin can make sense, regardless of one’s thesis on the cryptocurrency.

“You could have multiple investment theses on bitcoin, and that’s okay,” Horne said at the 2024 Vision conference, a crypto investing conference for advisors hosted by the Digital Assets Council of Financial Professionals in Austin, Texas.

Horne emphasized that most investors are saving money or investing with an advisor to meet a long-term goal, such as retirement. In this context, a non-zero position in bitcoin could make sense for many clients, given a long-term horizon and appropriate position sizing.

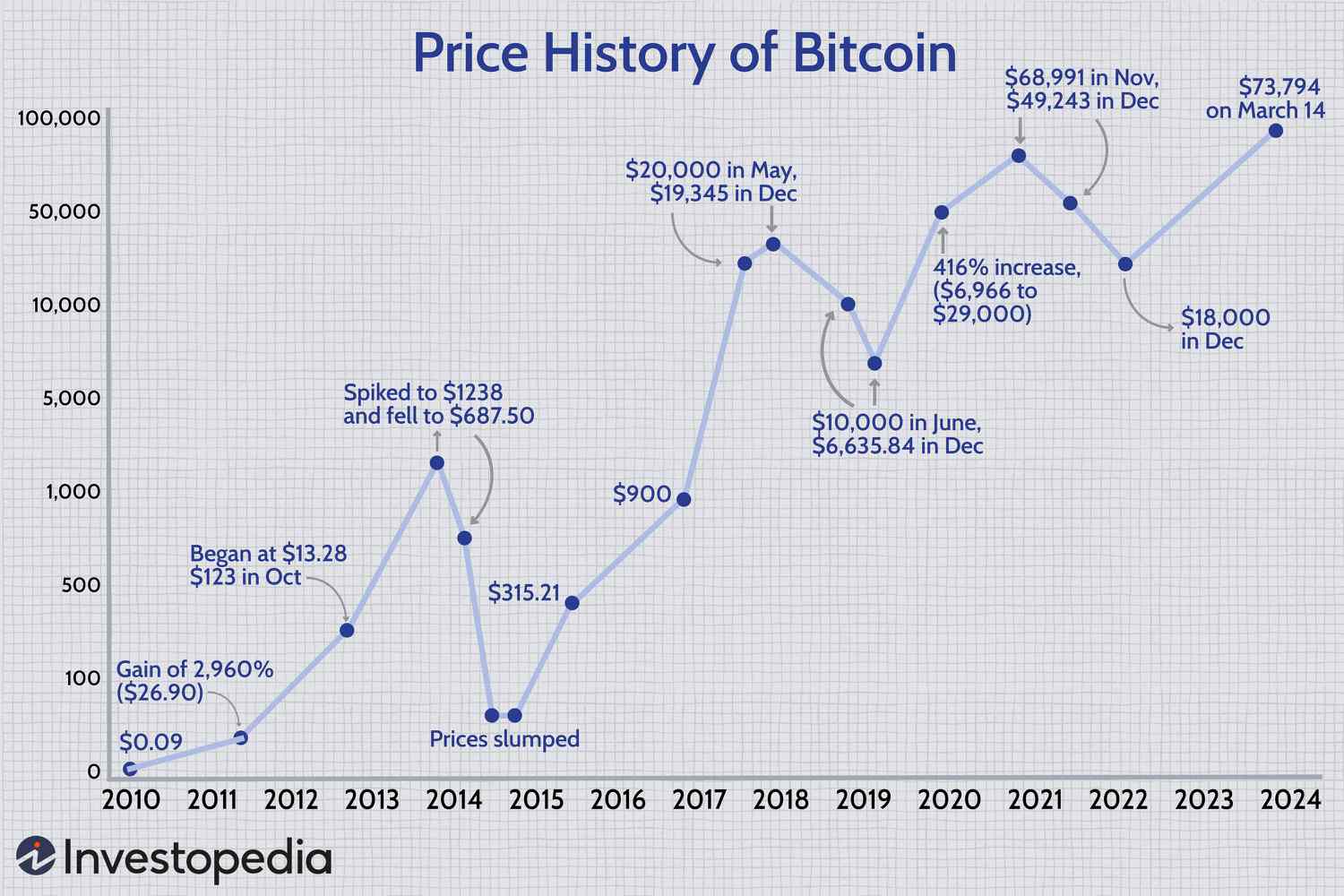

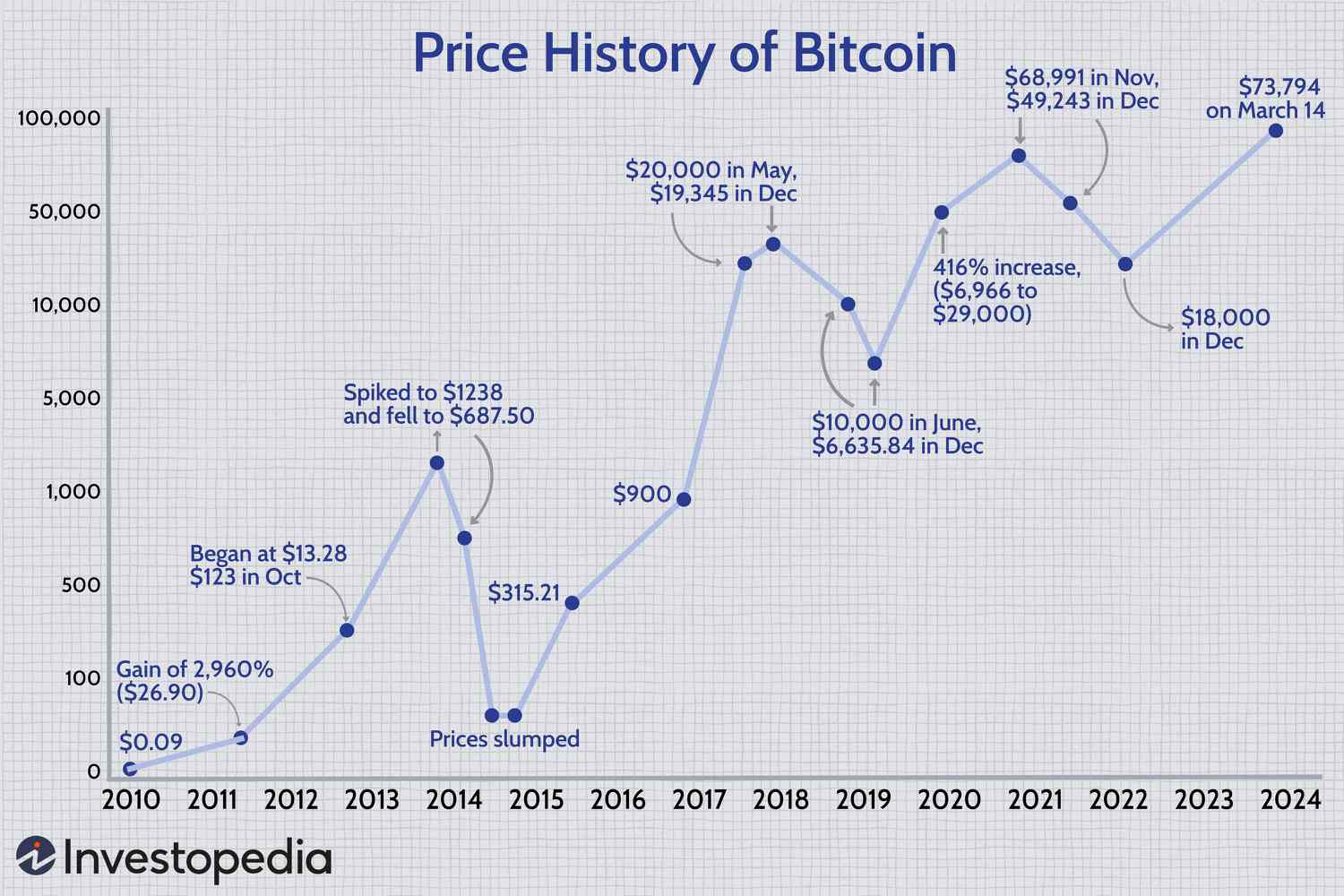

Bitcoin’s year-to-date performance

Bitcoin’s year-to-date performance

The recent introduction of bitcoin ETFs in the US market has provided a regulated way for investors to gain exposure to the cryptocurrency. However, many advisors have been hesitant to invest in bitcoin due to concerns over volatility, lack of understanding, and regulatory uncertainty.

Horne suggests that investors should not get bogged down in the details of their thesis on bitcoin. Instead, they should focus on the potential benefits of a small allocation to the cryptocurrency. “What your thesis is is probably going to dictate position sizing and maybe where you source it from in a portfolio,” he added.

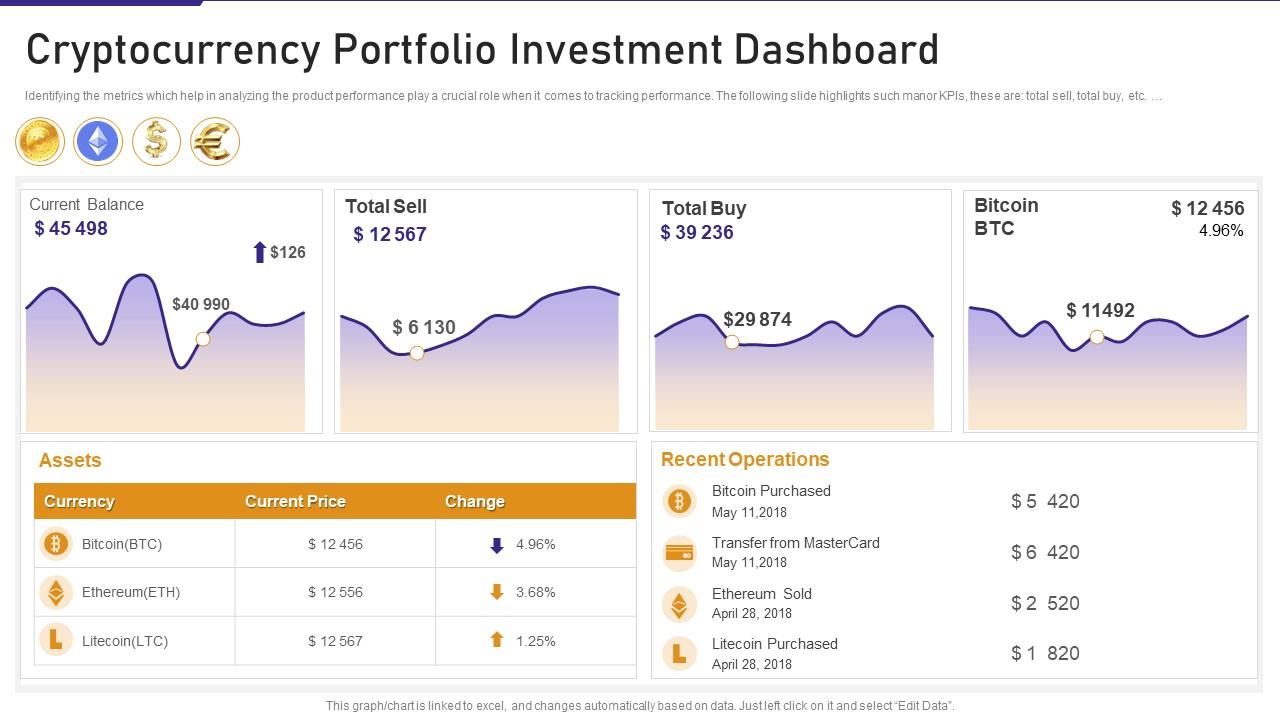

Investing in bitcoin can add risk to a portfolio

Investing in bitcoin can add risk to a portfolio

Many investors and wealth managers recommend a small allocation to bitcoin, typically between 1% and 5%, to add risk to a portfolio without exposing it to excessive volatility. “If it does (worst case) go to zero, the impact on the broader portfolio is minimal because of that condition size,” Horne said. “If it does what many of us expect it to, gain over time, then you want to make sure your clients have some of that exposure in there.”

Understanding the potential of bitcoin and blockchain technology

Understanding the potential of bitcoin and blockchain technology

Horne acknowledged that bitcoin’s short lifespan makes it challenging to model out, but he emphasized the importance of education and understanding the potential of this new asset class. “It’s tough because a lot of professional investors are able to model out every [other] asset class given the amount of data that’s at our fingertips now,” he said. “With digital assets, you don’t have the luxury … and I think that’s fine.”

The importance of education in digital assets

The importance of education in digital assets

By taking a step back and focusing on the potential benefits of a small allocation to bitcoin, investors and advisors can make more informed decisions about their investment portfolios.