Weekly Cryptocurrency Roundup: Trends, Insights, and Trumpcoin

The world of cryptocurrency continues to evolve rapidly, with major developments taking place each week. From institutional interest in Bitcoin to the emergence of new digital currencies, this roundup captures the latest trends and insights from the crypto space.

A Shift in Cryptocurrency Strategy for India

As the global cryptocurrency landscape shifts, it may be time for India’s Reserve Bank to revisit its strategies regarding digital currencies. Recent discussions, spearheaded by notable industry figures, suggest a reevaluation of their historical opposition to Bitcoin is necessary.

Rameesh Kailasam, CEO of Indiatech.org, highlights that countries like the US are exploring proposals such as the Bitcoin Purchase Program, designed to acquire a substantial amount of Bitcoin over a period of five years. Similar considerations are being made by nations like Brazil, Japan, and Russia, showcasing a growing global interest in integrating Bitcoin into mainstream finance.

Global strategies for Bitcoin adoption

Amid these developments, the launch of spot Bitcoin ETFs by firms like BlackRock and Fidelity has been pivotal, driving significant inflows and adoption. This underscores Bitcoin’s increasing relevance in the financial ecosystem.

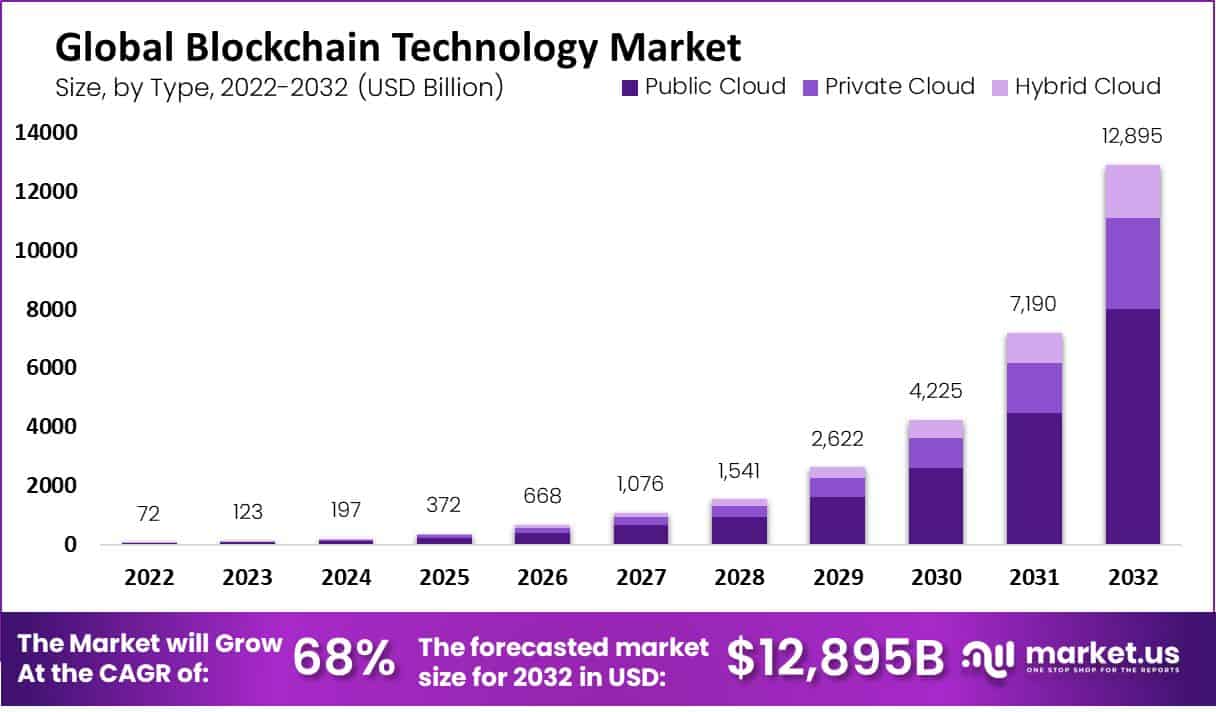

Crypto Market Outlook for 2025: Key Trends to Watch

As we look towards 2025, the cryptocurrency market is anticipated to undergo remarkable transformations. Anush Jafer, from Mudrex Research, discussed crucial trends during an ETMarkets live stream, noting key achievements in 2024, including Bitcoin surpassing the $100K mark.

The introduction of spot Bitcoin and Ethereum ETFs significantly boosted market metrics, drawing in over $35 billion in net inflows. Notably, Jafer emphasized the impact of macroeconomic factors, such as global interest rate cuts, which have facilitated increased investments in digital assets.

Projecting future market trends in cryptocurrency

Projecting future market trends in cryptocurrency

Furthermore, daily active addresses on major blockchains have surged, signaling robust adoption. Sectors like DeFi, meme coins, and real-world assets are gaining traction as well.

There is a consensus among experts that AI’s integration within crypto will be a defining narrative for 2025. The convergence of technologies promises to unlock new opportunities in this space.

Bank of America’s Bold Cryptocurrency Stance

In a recent statement, Bank of America’s CEO Brian Moynihan expressed readiness to adopt cryptocurrencies for payments, contingent on regulatory approval. Speaking at the World Economic Forum in Davos, Moynihan articulated a vision where, if laws facilitate crypto transactions, the banking sector will eagerly participate.

Financial institutions embracing digital currency transactions

Financial institutions embracing digital currency transactions

Despite the lingering skepticism surrounding digital currencies, Moynihan’s confidence illustrates a notable shift within the banking industry. He pointed out that, should regulatory backed advancements materialize, traditional banks would swiftly adjust to include digital assets as payment options.

Controversy Surrounding Trumpcoin

The topic of meme coins has taken an intriguing turn with the introduction of Trumpcoin, a digital currency launched by Donald Trump and associates. With an initial offering of 200 million coins and ambitions for tremendous growth, Trumpcoin quickly experienced a 300% surge in value overnight.

The emergence of such coins raises significant concerns regarding the regulation of digital currencies and their implications in political finance, potentially allowing for unmonitored money movements within political systems.

Trumpcoin and its implications for political finance

This situation underscores a broader trend of integrating cryptocurrencies into various sectors, but also the potential risks associated with their unregulated growth.

Conclusion

The cryptocurrency realm is a dynamic and rapidly transforming landscape, characterized by innovative trends and complex challenges. As we progress into 2025, global attitudes towards digital assets are on the brink of significant reevaluation, driven by institutional interest and technological advancements. Stay tuned for more updates as this evolution unfolds.