Weekly Crypto Roundup: Coinbase’s New Wrapped Bitcoin and the Surge of Meme-Coins

As we dive into the latest happenings in the cryptocurrency world, it’s evident that both innovation and volatility continue to shape this dynamic landscape. This week, Coinbase has stirred the pot with the announcement of a new Bitcoin alternative on its layer-2 blockchain, while the meme-coin sector has caught investors’ attention with explosive growth potential.

Coinbase introduces a new alternative for Bitcoin enthusiasts.

Coinbase introduces a new alternative for Bitcoin enthusiasts.

Coinbase Unveils cbBTC: A New Era for Wrapped Bitcoin

In an exciting move, Coinbase has teased the upcoming launch of cbBTC, a wrapped Bitcoin alternative tailored for its Base blockchain. Following unclear social media hints, Jesse Pollak, head of Base, emphasized the ambition to cultivate a robust Bitcoin economy on their platform. Wrapped tokens, like the proposed cbBTC, allow users to utilize Bitcoin across different networks, enhancing liquidity.

Coinbase’s endeavor comes at a time when wBTC, the dominant wrapped Bitcoin solution, faces uncertainty. Recent dynamics in the market, including BitGo’s announcement of a partnership with BiT Global, raises questions about the future of wrapped Bitcoin offerings.

Meme-Coins Making Waves: Crypto All-Stars Takes Off

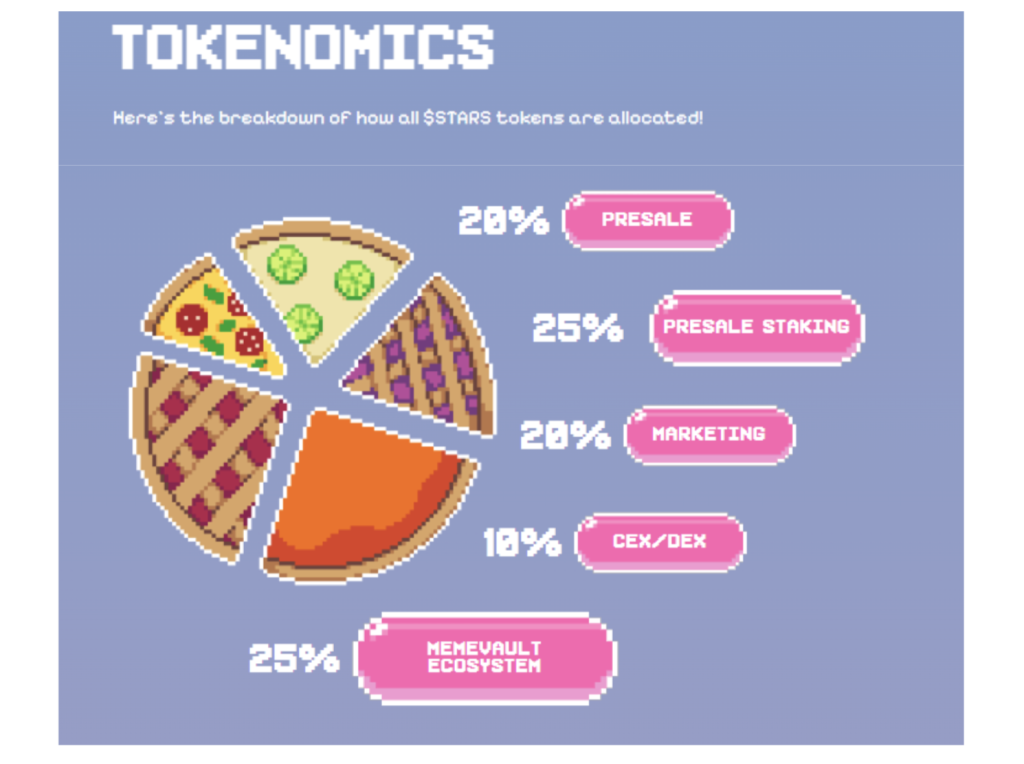

Shifting gears, the meme-coin landscape is buzzing with activity. Recently launched token Crypto All-Stars ($STARS) has garnered over $350,000 in just 48 hours during its presale. Targeting fans of established meme coins like Dogecoin and Shiba Inu, the project promises exciting staking opportunities, with returns anticipated to exceed 5000% APY.

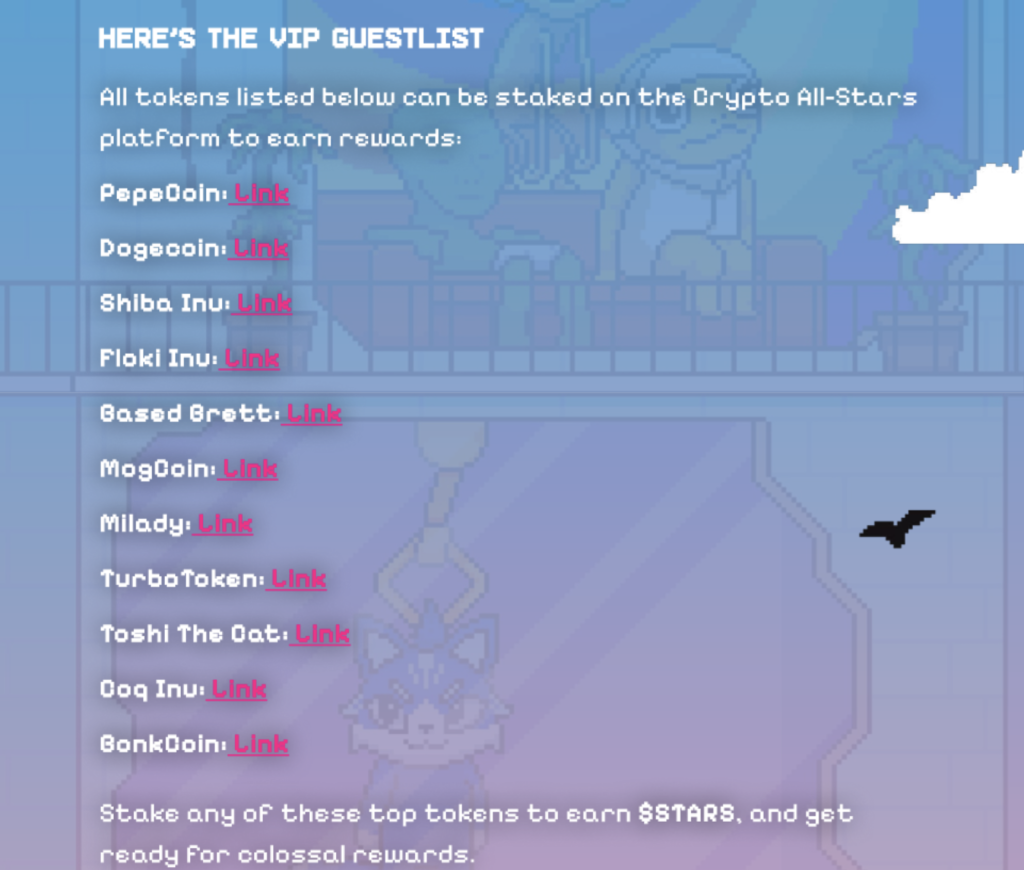

Crypto All-Stars aims to unify popular meme coins through its innovative staking platform, MemeVault, enabling participants to earn $STARS while leveraging their existing crypto holdings. Investors can stake well-known tokens directly on their site, turning idle assets into passive income streams.

The meme-coin market sees explosive growth as investors look for high returns.

The meme-coin market sees explosive growth as investors look for high returns.

ETF Market Sees Correction Amidst Global Turbulence

The cryptocurrency arena hasn’t been immune to broader market turbulence this week, leading to a noticeable decline in ETF performances. The fierce geopolitical climate, alongside economic indicators suggesting a potential recession, have amplified fears among traders.

Both Bitcoin and Ether struggled to maintain their positions, with Bitcoin dipping to around $50,000 and Ether falling below $2,400. This volatility has trickled down to crypto ETFs, with overall sector losses hitting 7.23%, encompassing significant drops in Bitcoin and Ether ETFs, reflecting the ongoing uncertainty in the market.

ETF performance reflects broader market shake-ups as volatility reigns.

ETF performance reflects broader market shake-ups as volatility reigns.

Conclusion: Navigating Uncertainties with Opportunities

As we absorb the recent developments, it’s clear that the crypto space is full of both opportunities and challenges. Coinbase’s cbBTC could reshape the wrapped Bitcoin strategy, potentially providing a new avenue for users within the Base ecosystem. Meanwhile, the rise of meme-coins and their appealing staking rewards signal a fervor that should not be overlooked by investors. Staying informed will be key as the market continues to evolve.

Staking emerges as a strategy for investors looking to capitalize on volatility.

Staking emerges as a strategy for investors looking to capitalize on volatility.