Weekly Crypto Roundup: BRICS Mining, Bitcoin Trends, and More

As the crypto market shifts and evolves, several pivotal events have taken place this week, impacting everything from Bitcoin’s price to the emergence of innovative projects. Here’s a comprehensive look at what you need to know.

Recent trends in Bitcoin pricing and market dynamics.

Bitcoin’s Recent Price Movements

Bitcoin saw further declines, dipping below $67,000 at various points this week. The cryptocurrency market cap is currently at $1.3 trillion, with a remarkable 60% yield projected for 2024. Market analysts suggest that volatility will remain high leading up to the U.S. presidential election, with a significant breakout potentially awaiting us after that decision.

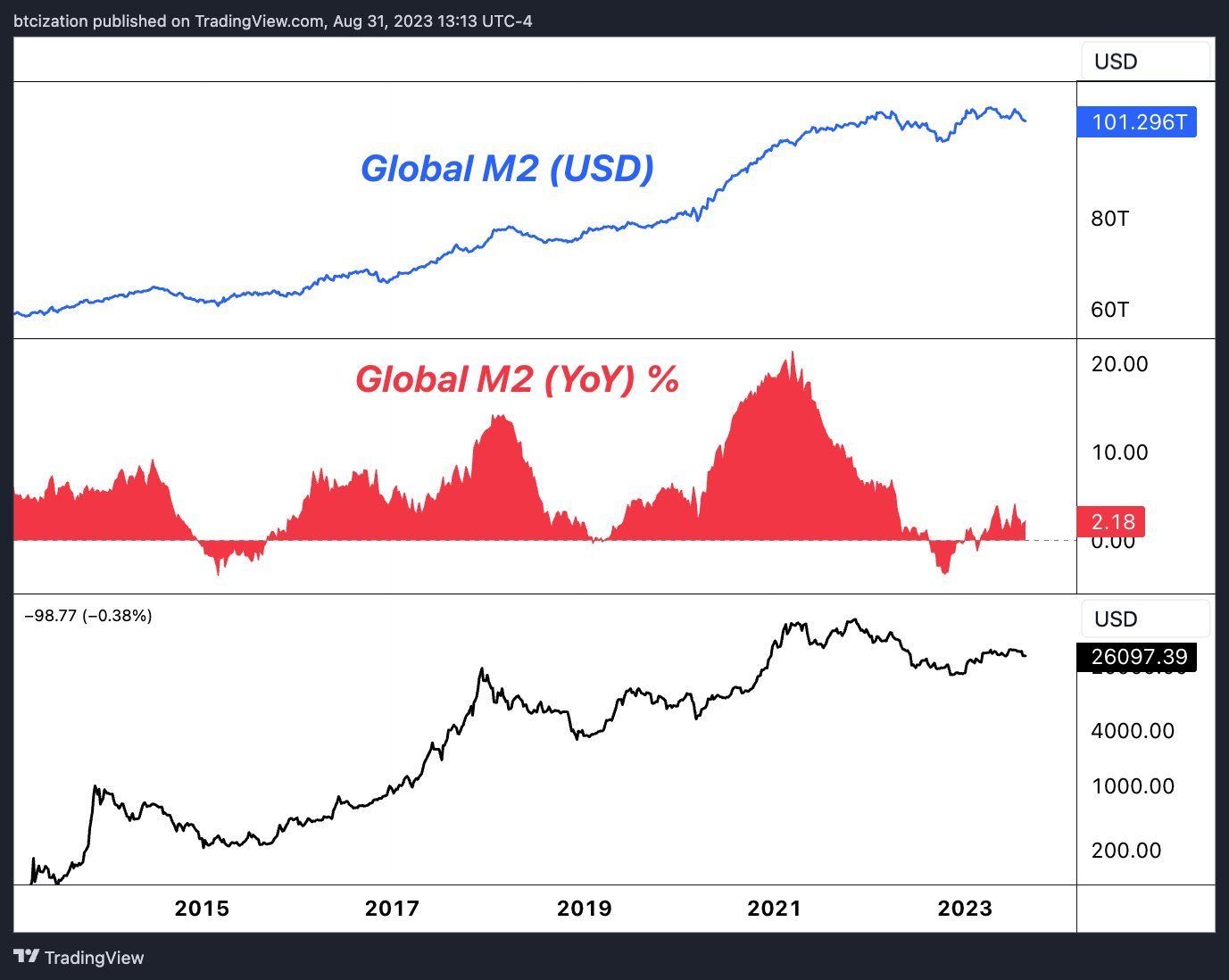

A key focal point for Bitcoin remains the M2 money supply, which significantly correlates with Bitcoin valuation. Specialists are predicting that as the M2 expands, it may provide prolonged momentum for Bitcoin, pushing it higher over the next 1.5 years.

“An increase in the M2 money supply could sustain market liquidity and potentially extend the current bullish cycle.”

BRICS Mining Initiative and CBDC Plans

The BRICS nations are expanding their mining and AI infrastructure.

The BRICS nations are expanding their mining and AI infrastructure.

This week, the BRICS nations announced a partnership spearheaded by BitRiver, Russia’s largest data center operator, with intentions to enhance their mining capacity. This initiative arises at a crucial time as these nations strive for technological independence and increased computing power in cryptocurrency mining. According to sources from the BRICS Business Forum, the goal is to create high-performance data centers capable of supporting both cryptocurrency mining and artificial intelligence workloads, which may ultimately bolster Bitcoin’s position within the global market.

The legal framework established in August 2024 for mining operations in Russia is also significant. It allows for greater transparency and regulatory structure, which is pivotal for long-term Bitcoin stability.

Impact of U.S. Interest Rate Cuts on Cryptocurrency

The 50 basis point interest rate cut by the U.S. Federal Reserve this past week is anticipated to have a profound impact on the crypto market. According to Shivam Thakral, CEO of BuyUcoin, this reduction will likely spur investor interest in cryptocurrencies, linking the attraction to diminished borrowing costs and an environment ripe for increased risk-taking.

As the 2024 U.S. presidential election draws closer, the influence of younger, pro-crypto voters is becoming increasingly pivotal. Some politicians are making strides to secure support from this demographic, which could lead to transformative shifts in crypto-related policies.

Spotlight: Crypto All-Stars and the Meme-Coin Staking Realm

The rising phenomenon of meme-coin staking through Crypto All-Stars.

The rising phenomenon of meme-coin staking through Crypto All-Stars.

Crypto All-Stars is a notable newcomer in the meme-coin landscape, garnering over $2.6 million in its presale. What sets this project apart is its emphasis on the staking of meme-coins, providing a unique opportunity for investors to reap rewards proportional to their holdings. Currently, the APY stands at an impressive 500%, drawing significant interest from potential long-term investors.

The simple process for purchasing these tokens, which includes various payment methods such as ETH, USDT, and BNB, makes it accessible for early adopters looking to capitalize on this burgeoning market.

Conclusion

This week’s highlight reel underscores the dynamic nature of the cryptocurrency space, influencing everything from Bitcoin’s valuation to the birth of new projects like Crypto All-Stars. As market structures evolve and regulatory frameworks become clearer, the potential for robust investor engagement and innovative technologies seems promising.

Stay tuned for more updates as we continue navigating the shifting landscapes of the crypto world.