Warren Buffett’s Stance on Bitcoin: A Contradiction in Berkshire Hathaway’s Investments

Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, has been vocal about his skepticism towards Bitcoin and cryptocurrencies. In a 2018 interview with Yahoo! Finance, Buffett likened Bitcoin to “rat poison,” stating that it doesn’t produce anything and is only valuable because people hope someone else will pay more for it. At the 2022 Berkshire shareholders meeting, Buffett reiterated his stance, saying that even if he were offered all the Bitcoin in the world for $25, he wouldn’t take it because he wouldn’t know what to do with it.

Despite Buffett’s anti-Bitcoin rhetoric, Berkshire Hathaway has invested heavily in Brazilian fintech company Nu Holdings Ltd., which offers cryptocurrency services through its platform Nucripto. Nu Holdings has been one of Berkshire’s strongest performers in 2023, with its stock price surging nearly 100%. This raises questions about the consistency of Buffett’s stance on cryptocurrencies.

Brazilian fintech company Nu Holdings Ltd.

Nu Holdings, founded in 2013, initially offered low-cost bank accounts and personal loans through a digitized format. In 2022, the company launched Nucripto, allowing users to buy and sell over 15 tokens. Although its crypto business is a relatively small portion of its revenue, it still operates in the crypto sphere and has seen significant growth.

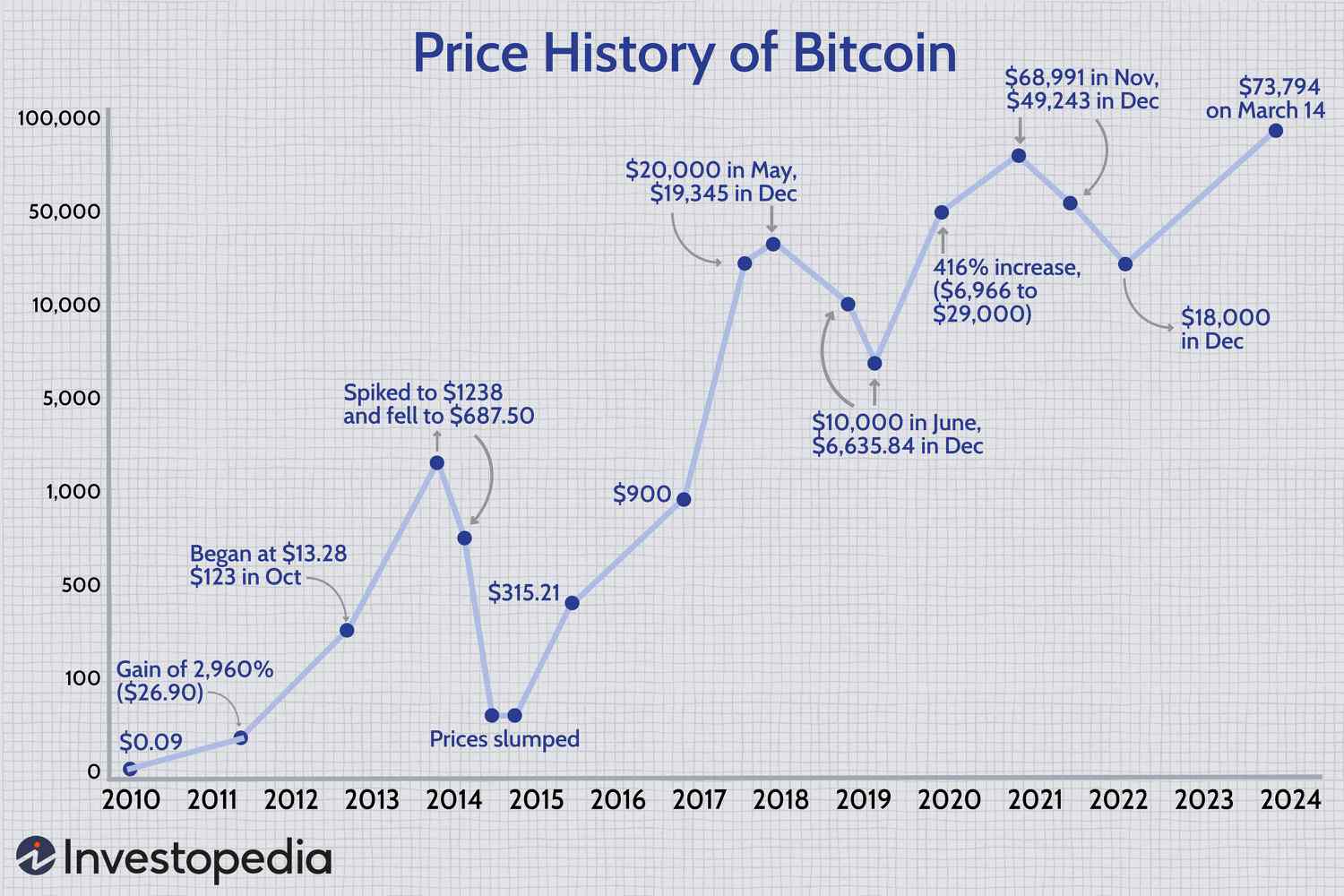

Bitcoin’s price has surged in 2024, outperforming major indices.

Bitcoin’s price has surged in 2024, outperforming major indices.

Berkshire Hathaway’s investment in Nu Holdings has paid off, with the stock price up nearly 50% in 2024 alone. This significant gain could potentially shift Buffett’s focus towards crypto. Seeing the profits earned on a crypto-related business could cause the investor to rethink his strategy and stance on crypto. Bitcoin has outperformed most major indices in 2024, with its price surging nearly 70%.

Warren Buffett, CEO of Berkshire Hathaway.

Warren Buffett, CEO of Berkshire Hathaway.

As Bitcoin and crypto continue to gain attention, all eyes are on Berkshire Hathaway and Buffett to see if they will continue investing in Bitcoin-adjacent businesses or even the tokens themselves. Will Buffett’s stance on crypto soften, or will he maintain his skepticism?