Warren Buffett’s Stance on Bitcoin: A Contradiction in Berkshire Hathaway’s Investment Portfolio

Despite Warren Buffett’s vocal criticism of Bitcoin, Berkshire Hathaway Inc. (NYSE: BRK) has benefited significantly from its investment in Brazilian fintech Nu Holdings Ltd. (NYSE: NU). This seeming contradiction raises questions about the billionaire investor’s stance on cryptocurrencies.

Warren Buffett, a long-time Bitcoin skeptic

Warren Buffett, a long-time Bitcoin skeptic

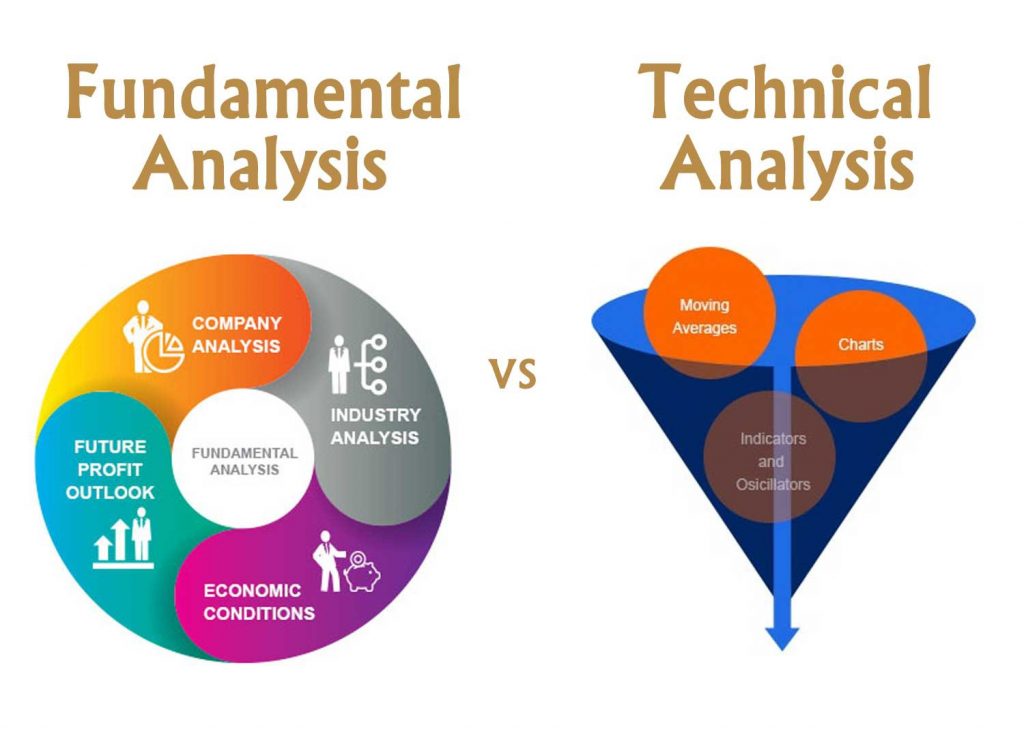

In a 2018 interview with Yahoo Finance, Buffett expressed his skepticism towards Bitcoin, calling it “rat poison” and questioning its value. He argued that even if he were offered all of the Bitcoin in the world for $25, he wouldn’t take it because he wouldn’t know what to do with it. This stance has been consistent with his views on the lack of production and reliance on future price increases.

Bitcoin, the cryptocurrency Buffett has been critical of

Bitcoin, the cryptocurrency Buffett has been critical of

However, Berkshire Hathaway’s investment in Nu Holdings has paid off significantly. Initially investing $500 million in a Series G funding round and an additional $250 million later, the company’s involvement has yielded substantial gains. Nu Holdings, established in 2013, launched the Nucripto platform in 2022, allowing users to trade over 15 tokens.

Nu Holdings, the Brazilian fintech company benefiting Berkshire Hathaway

Nu Holdings, the Brazilian fintech company benefiting Berkshire Hathaway

The company’s performance has been impressive, with a 100% market surge in 2023 and another 50% rise in early 2024. This investment success has put Buffett in a tricky position, as Nu Holdings’ performance, up nearly 125% this year, is sharply contrasting with his negative stance on Bitcoin.

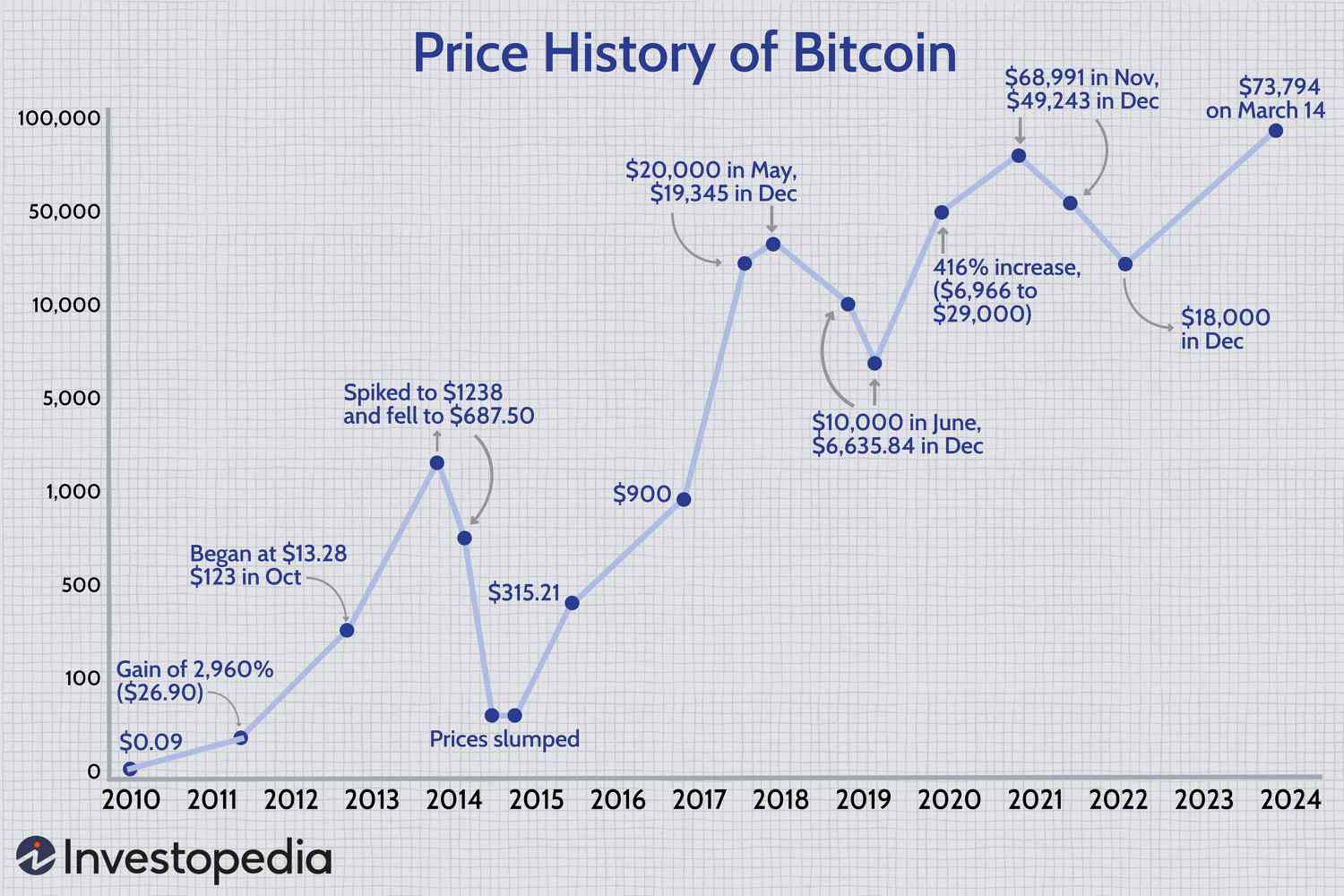

Bitcoin’s remarkable year in 2024, outperforming indices like the S&P 500

Bitcoin’s remarkable year in 2024, outperforming indices like the S&P 500

Meanwhile, Bitcoin itself is having a remarkable year in 2024, significantly outperforming indices like the S&P 500. This raises questions about the future of cryptocurrencies and their potential for growth.

The cryptocurrency market, a space Berkshire Hathaway is benefiting from

The cryptocurrency market, a space Berkshire Hathaway is benefiting from

In conclusion, Berkshire Hathaway’s investment in Nu Holdings has yielded significant gains, despite Warren Buffett’s criticism of Bitcoin. As the cryptocurrency market continues to evolve, it will be interesting to see how Buffett’s stance on Bitcoin changes, if at all.