What the Cryptocurrency Industry Still Gets Wrong

The cryptocurrency market has experienced an unprecedented surge in value over the past year, culminating in Bitcoin’s record-breaking peak of over $64,000 in April 2021. Despite this remarkable success, the industry continues to grapple with significant challenges and enduring criticisms.

Lack of Regulatory Framework

A prominent issue plaguing the crypto sphere is the absence of a comprehensive regulatory framework. While some view this regulatory vacuum as a catalyst for decentralization and innovation, others caution that it fosters a volatile and uncertain environment for investors.

Regulatory challenges in the cryptocurrency industry

Regulatory challenges in the cryptocurrency industry

Energy Consumption Concerns

Critics frequently highlight the exorbitant energy consumption associated with cryptocurrencies. For instance, Bitcoin’s energy usage surpasses that of entire nations like Argentina. This not only raises environmental red flags but also prompts serious inquiries into the sustainability of the industry.

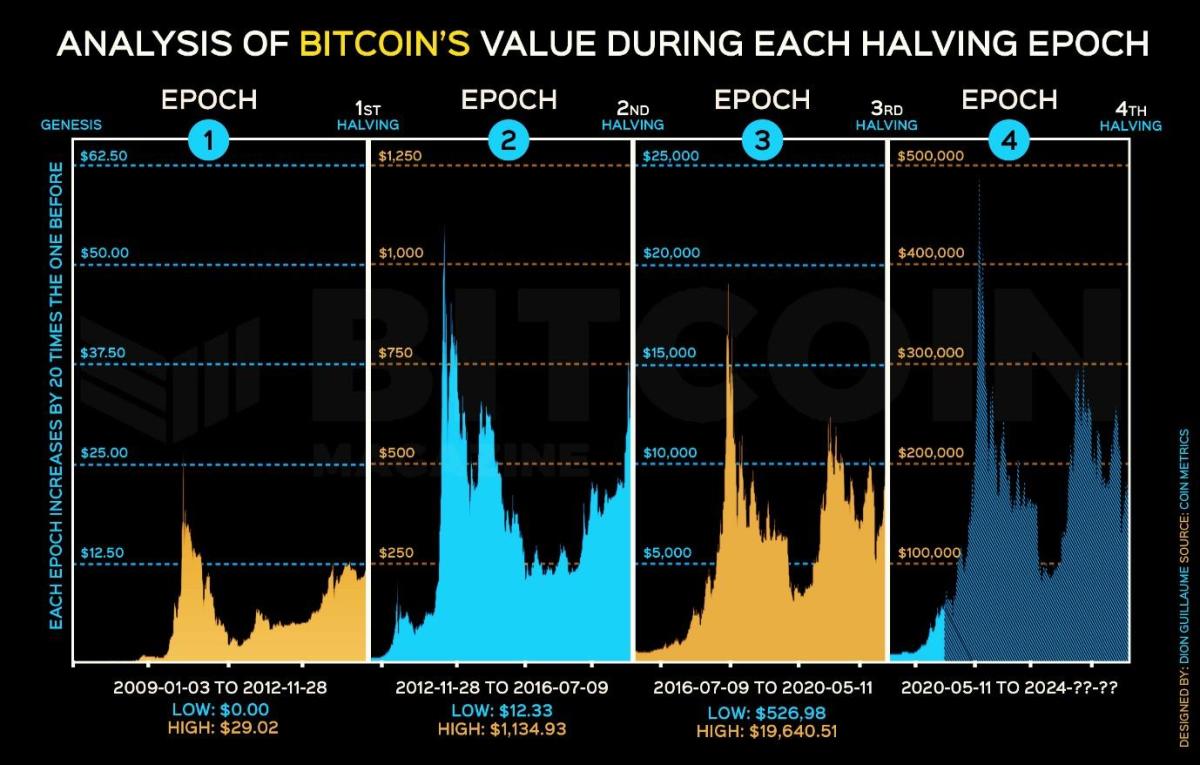

Volatility Woes

Cryptocurrencies are notorious for their extreme volatility, with prices oscillating unpredictably on a daily basis. This volatility poses a significant hurdle for investors seeking stability and can result in substantial financial losses.

Persistent Security Vulnerabilities

Despite leveraging blockchain technology renowned for its security features, cryptocurrencies remain susceptible to cyber threats, including hacking and various forms of cybercrime. In 2020 alone, cybercriminals absconded with over $1.3 billion in cryptocurrency through illicit means.

The Future of Cryptocurrency

Despite these formidable challenges, the cryptocurrency sector continues its trajectory of growth and transformation. The industry stands at a crossroads, prompting critical reflections on how to effectively address these pressing issues while weighing the advantages of decentralization and innovation against the inherent risks.