Why the Crypto Market Downturn Might Be a Blessing in Disguise

As the sun sets on the crypto market today, investors are left wondering what caused the sudden downturn. The once-booming market has taken a hit, with Bitcoin’s price plummeting below $63,000 and major altcoins following suit. But is this downturn really a cause for concern, or could it be an opportunity in disguise?

Market Capitalization Plummets

The total market capitalization of the cryptocurrency market dropped by 7.68% to $2.27 trillion on March 19. Bitcoin, the flagship cryptocurrency, led the decline with a 7% drop to around $62,650. Ethereum, the second-largest crypto, also saw an 8% decrease to $3,200. Other top tokens experienced similar losses, painting a grim picture for investors.

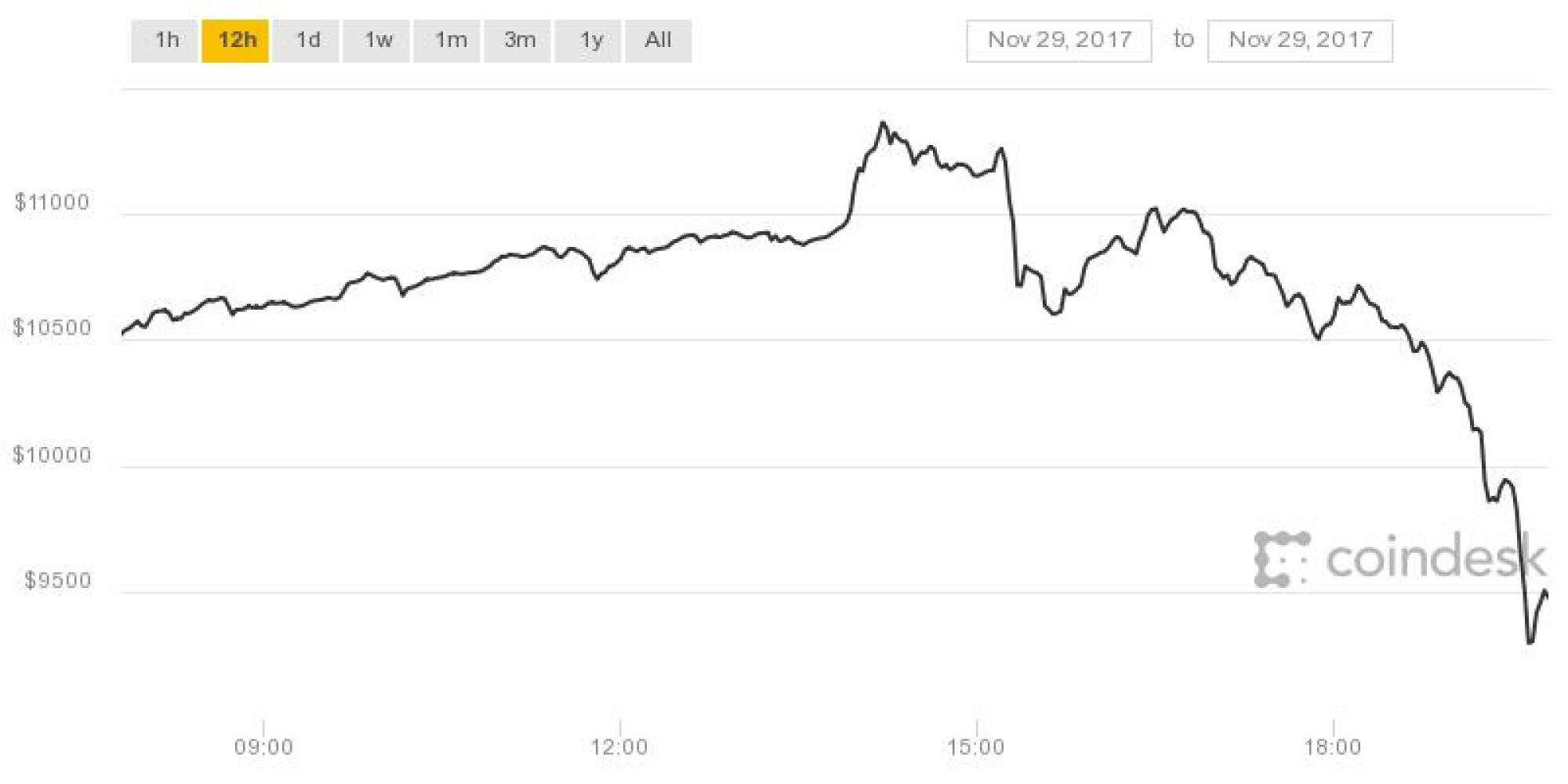

Image for illustrative purposes

Image for illustrative purposes

Unraveling the Mystery Behind the Downturn

Spot Bitcoin ETFs Experience Massive Outflows

The decline in market capitalization coincided with record outflows from Bitcoin exchange-traded funds (ETFs). Grayscale Bitcoin ETF saw outflows of $642.5 million, while Fidelity’s Bitcoin ETF recorded its lowest inflow day at $5.9 million. This trend of capital outflows from spot Bitcoin ETFs raises concerns about the market’s stability.

Overbought Correction or Opportunity?

The recent downturn is part of a broader correction that began on March 14. Bearish divergence signals and overvaluation indicators preceded the correction, hinting at a market correction. The Net Unrealized Profit and Loss (NUPL) chart also signaled a prime opportunity for profit-taking, suggesting that the correction might be a healthy adjustment for the market.

Long Liquidations Add to the Sell-Off

The sharp drop in cryptocurrency prices triggered a wave of liquidations in the derivatives market, with over $182 million in positions liquidated in the past day. Long positions accounted for $140 million of the total liquidations, adding downward pressure on asset prices.

Embracing the Downturn

While the current market downturn may seem alarming, it could also present opportunities for savvy investors. Corrections are a natural part of any market cycle, and they often pave the way for healthier growth in the long term. By reassessing their investment strategies and staying informed about market trends, investors can navigate the downturn with confidence.

In conclusion, the crypto market downturn might be a blessing in disguise, offering investors a chance to reevaluate their positions and capitalize on new opportunities. As the market continues to evolve, adaptability and foresight will be key to success in the ever-changing world of cryptocurrency.