Bitcoin: A Lucrative Investment Opportunity

In recent years, Bitcoin has emerged as a top-performing investment globally, showcasing a consistent upward trend in demand. The introduction of new spot Bitcoin ETFs is poised to further expand investment opportunities within the cryptocurrency market.

Understanding Bitcoin’s Investment Appeal

The investment thesis for Bitcoin revolves around the fundamental economic principle of supply and demand. Unlike traditional assets, Bitcoin’s supply is limited to 21 million coins due to the halving mechanism that reduces mining rewards over time. This scarcity is a key driver of Bitcoin’s value proposition, as highlighted by the fact that altering the supply would require a near-impossible consensus among network participants. Therefore, the primary determinant of Bitcoin’s price trajectory remains its demand dynamics.

“The supply limit is theoretically subject to change, but the odds of that are slim to nonexistent.”

Currently, the demand for Bitcoin is on an upward trajectory, as evidenced by the surge in the number of wallet addresses holding significant Bitcoin reserves, reaching an all-time high in late December 2023, as reported by Fidelity.

Ark Invest’s Projections for Bitcoin’s Future

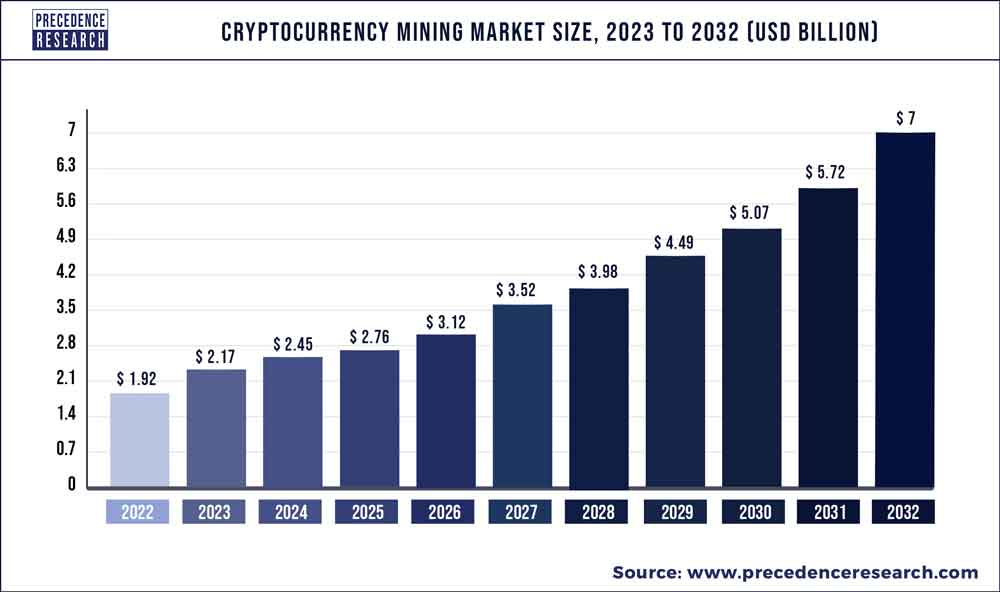

In 2023, Ark Invest unveiled a comprehensive Bitcoin valuation model outlining three potential price trajectories for the cryptocurrency by the end of the decade. These trajectories, including the bear, base, and bull cases, present substantial upside potential from the current price level.

- Bear case: $258,500 (360% upside)

- Base case: $682,800 (960% upside)

- Bull case: $1.48 million (2,100% upside)

Ark Invest’s analysis underscores the critical role of demand drivers in propelling Bitcoin’s value. While various sources of demand contribute to Bitcoin’s growth, Ark emphasizes that emerging market currencies, high-net-worth individuals, institutional investors, and gold play pivotal roles in driving the cryptocurrency’s price appreciation.

Bitcoin: A Viable Investment for the Future

Bitcoin’s volatile nature makes it an attractive yet high-risk asset suitable for investors with a long-term investment horizon and a tolerance for market fluctuations. Individuals meeting these criteria are encouraged to consider establishing a modest position in Bitcoin to capitalize on its potential growth prospects.

By Riley Emerson