The Hidden Truth About Crypto Taxes: Why the IRS Is Getting It All Wrong

As the price of bitcoin skyrockets, the IRS is tightening its grip on crypto investors, but are they really on the right track? Let’s delve into the murky waters of crypto taxes and uncover the real story behind the headlines.

Questioning the IRS’s Approach

While the IRS is ramping up its efforts to track crypto transactions, some experts argue that their methods are flawed. The recent surge in bitcoin prices has led to a frenzy of activity in the crypto market, but does this justify the IRS’s heavy-handed tactics?

A Different Perspective on Reporting

The IRS’s push for more detailed reporting on digital assets has left many investors feeling uneasy. But what if I told you that there’s a simpler way to handle your crypto taxes without all the hassle? Let’s explore an alternative approach to reporting that could save you time and stress.

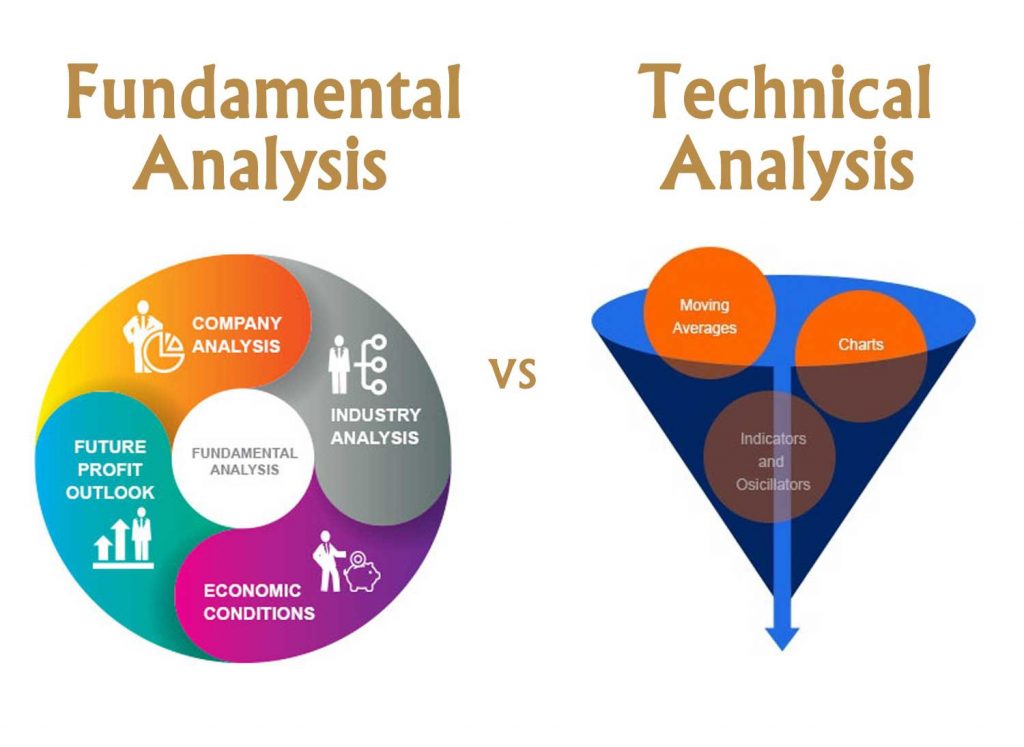

Debunking the Myth of Crypto Tax Calculations

Calculating crypto taxes can be a daunting task, especially for new investors. But what if I told you that the IRS’s tax calculations may not be as accurate as they seem? Dive into the world of crypto tax calculations and discover the truth behind the numbers.

The Future of Crypto Tax Reporting

With proposed regulations on the horizon, the future of crypto tax reporting is uncertain. But what if I told you that there’s a simpler way to navigate the complex world of crypto taxes? Explore the potential impact of upcoming regulations and how they could affect your tax reporting.

Conclusion: Rethinking Crypto Taxes

In conclusion, the IRS’s approach to crypto taxes may not be as straightforward as it seems. By questioning the status quo and exploring alternative perspectives, we can uncover a more nuanced understanding of crypto tax reporting. It’s time to rethink the way we approach crypto taxes and strive for a more balanced and efficient system.