The Crypto Market Rollercoaster: Analyzing Bitcoin’s Leverage and Market Heat

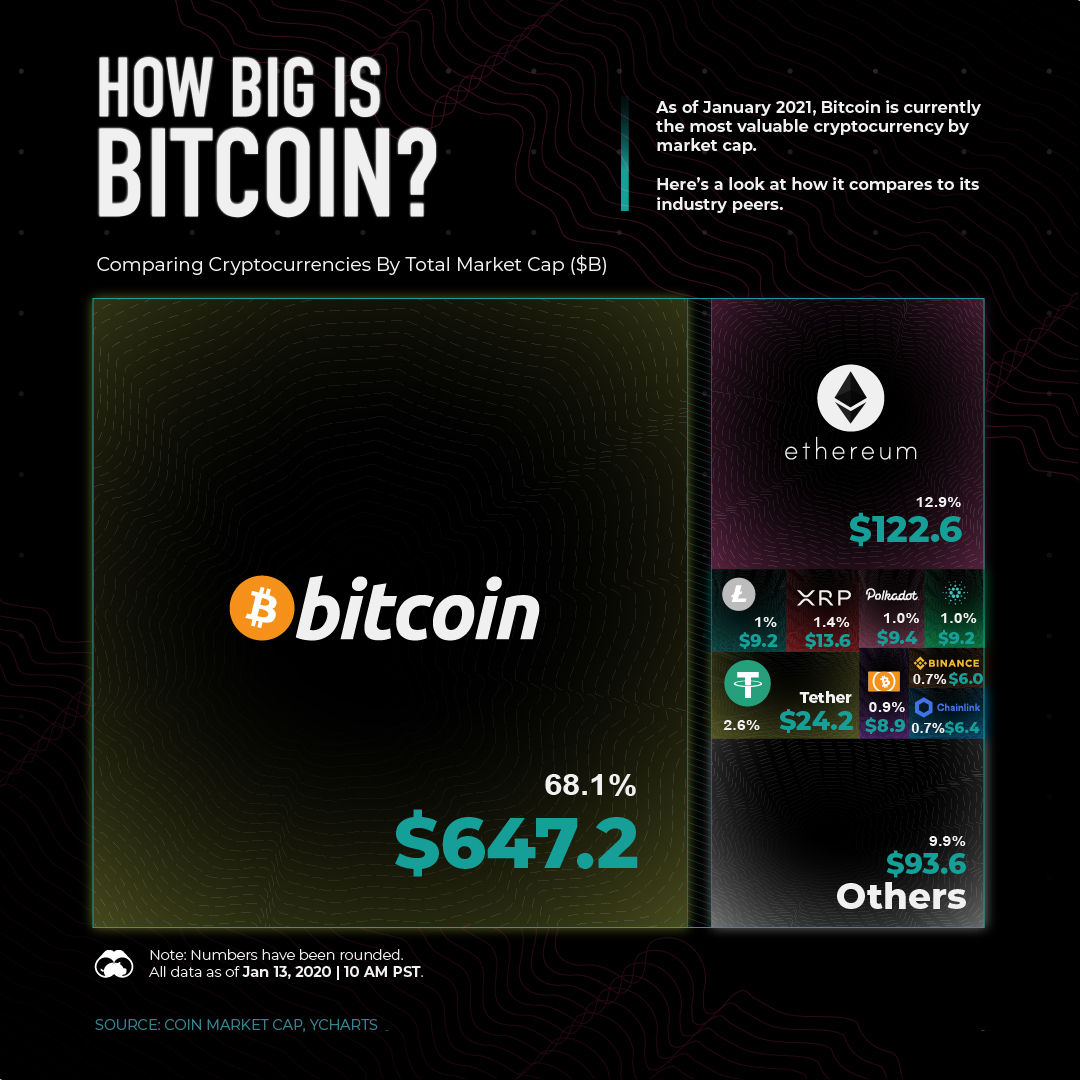

The recent surge in Bitcoin’s leverage has raised concerns about the overheating of the crypto market. According to analytics firm IntoTheBlock, funding rates on major exchanges have reached unprecedented levels, indicating a strong bias towards long positions. Lucas Outumuro, head of research at IntoTheBlock, highlighted the abnormally high funding rates on platforms like Binance and Bybit, signaling a market heavily skewed towards bullish sentiment.

Outumuro’s analysis also pointed out the significant increase in debt issuance through Aave on Ethereum, with over $700 million worth of Wrapped Bitcoin flowing into the platform. These indicators, coupled with the average 90-day return of the top crypto-assets, suggest a market that may be reaching unsustainable levels of exuberance.

While Bitcoin’s price currently hovers around $68,462, a slight dip from previous highs, the broader market sentiment remains cautious. The article delves into the implications of these leverage trends and the potential risks they pose to the overall stability of the crypto ecosystem.

The Impact of Institutional Investment and Regulatory Developments

In parallel, the article explores the recent surge in institutional investment in cryptocurrencies, driven by inflows into U.S. spot Bitcoin ETFs. The record-breaking inflows into crypto investment products have sparked optimism among proponents of digital assets, anticipating further market growth and mainstream adoption.

Moreover, regulatory developments, such as the U.K. Financial Conduct Authority’s approval of crypto-linked exchange-traded products, signal a shifting landscape towards greater institutional acceptance of digital assets. The potential listing of Bitcoin and Ether ETNs on the London Stock Exchange could pave the way for increased institutional participation in the crypto space.

Market Volatility and Investor Sentiment

The article also delves into the recent market volatility triggered by higher-than-expected inflation data and profit-taking by traders. The sharp decline in crypto market capitalization, with major tokens like Bitcoin, Ethereum, and others experiencing significant losses, underscores the fragility of the current market environment.

Analysts warn of further price corrections in the near term, emphasizing the importance of monitoring key support levels and market dynamics. The article provides insights into the factors driving market sentiment and the potential implications for investors navigating the turbulent waters of the crypto market.

Looking Ahead: Challenges and Opportunities

As the crypto market continues to navigate through periods of heightened volatility and regulatory scrutiny, investors and industry participants face a myriad of challenges and opportunities. From the impact of leverage on market stability to the evolving regulatory landscape, the article offers a comprehensive analysis of the key trends shaping the future of cryptocurrencies.

Stay tuned for more updates on the evolving crypto landscape and the latest developments impacting digital assets and blockchain technology.