The Ultimate Cryptocurrency Investment Guide

Cryptocurrency markets have been on a rollercoaster ride, with total market values swinging dramatically. Despite the volatility, there are compelling reasons to consider investing in cryptocurrencies, particularly Bitcoin. Let’s delve into why now might be the perfect time to allocate $1,000 towards this digital asset.

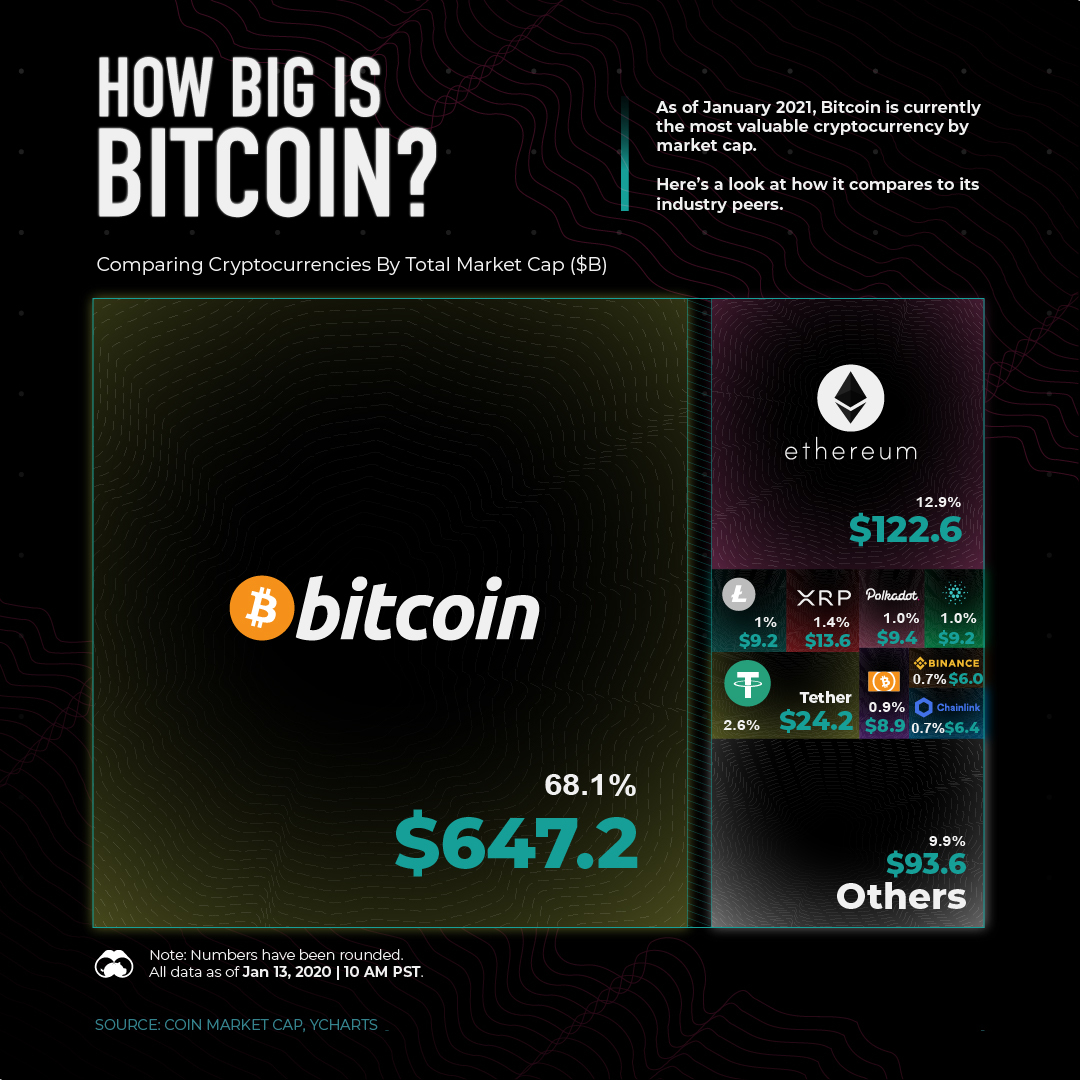

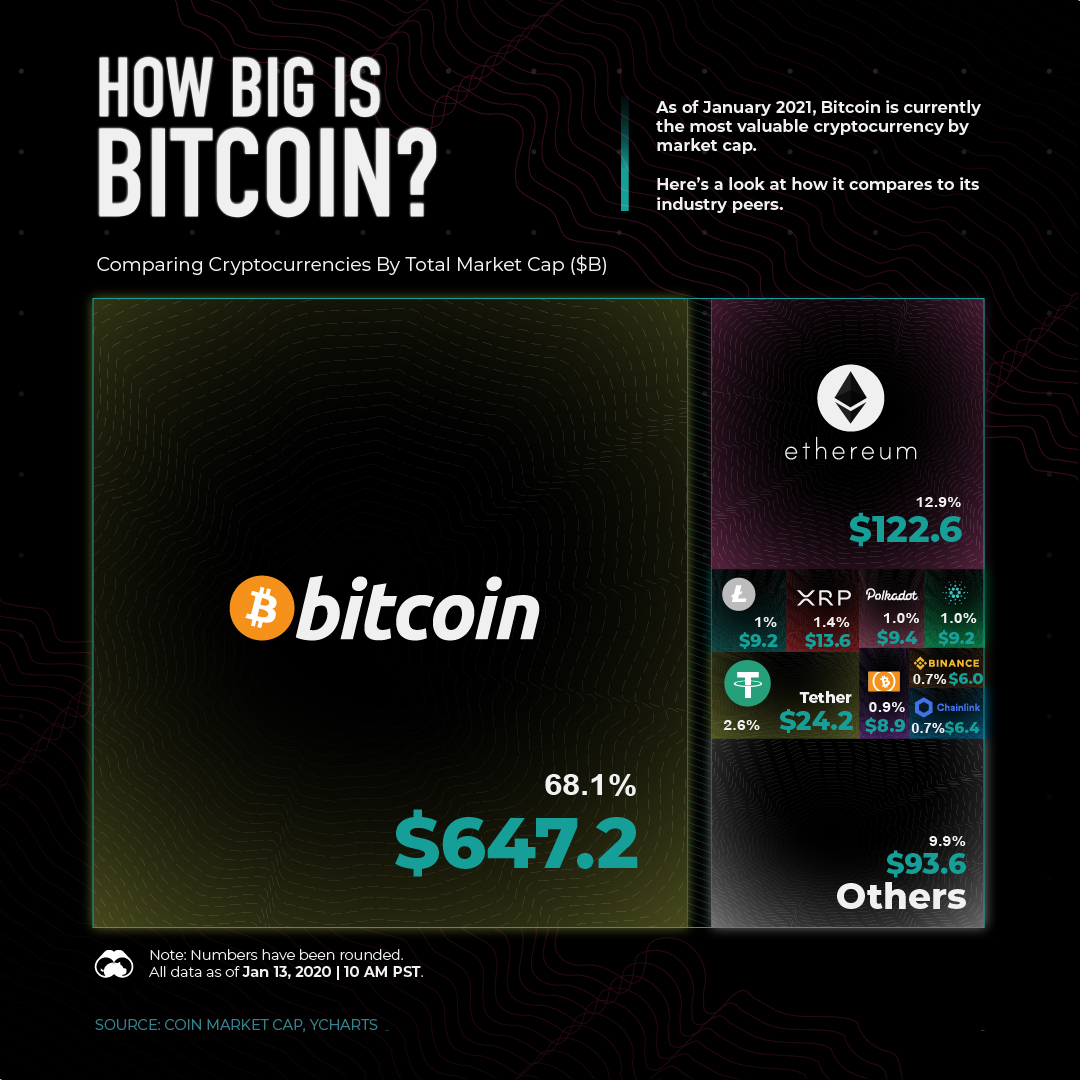

The Current Crypto Landscape

The cryptocurrency market recently reached a total value of $2.8 trillion, nearing its all-time high of $3.0 trillion. This surge in market value has been accompanied by increased volatility, as fear and greed indexes oscillate between caution and optimism.

Cryptocurrency Market

Cryptocurrency Market

Bitcoin’s Halving and Price Catalysts

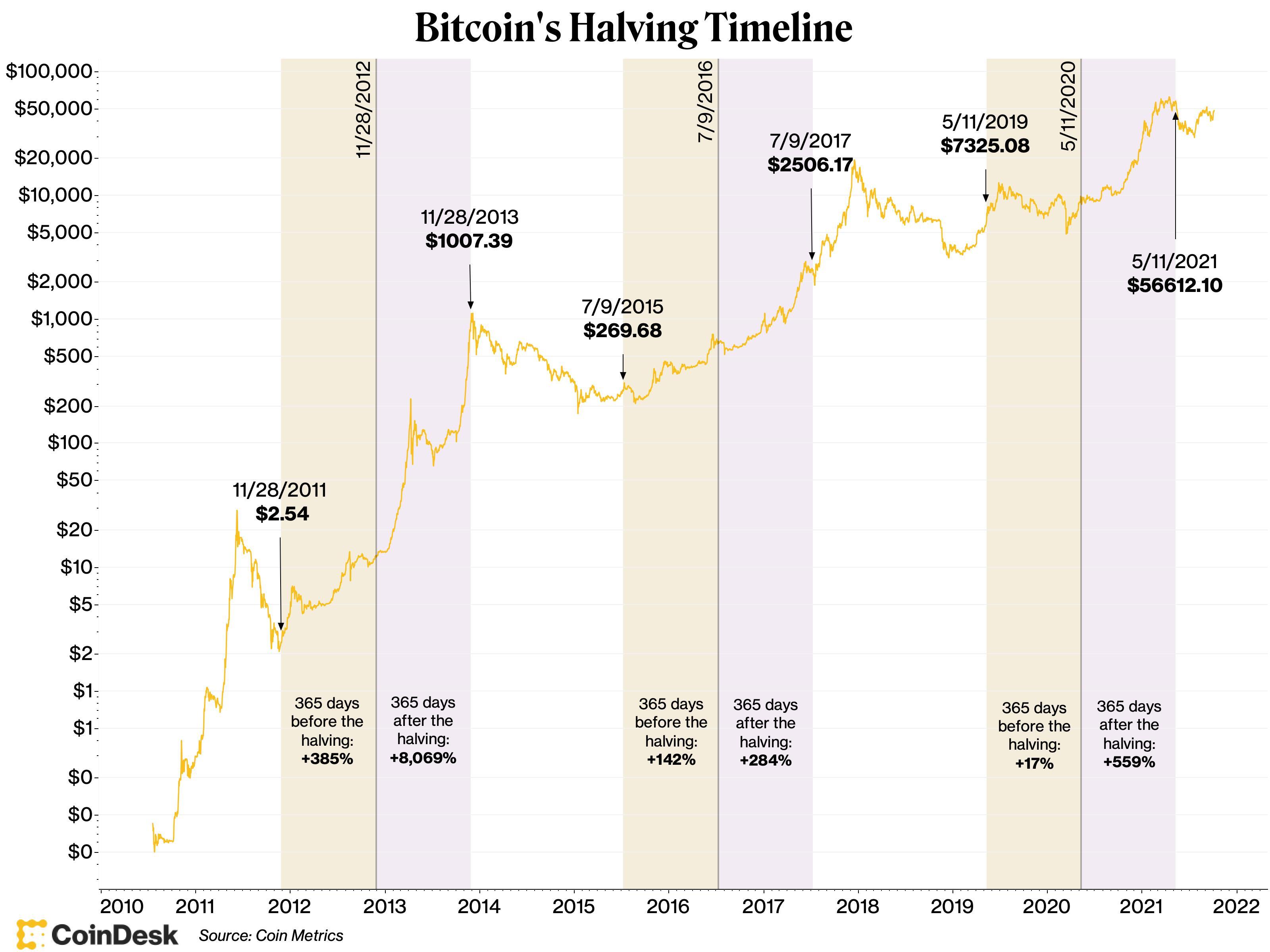

Bitcoin, the pioneer cryptocurrency, is gearing up for its fourth halving event, where mining rewards will be halved. Historical data shows that previous halving events have led to significant price surges over the following months.

Bitcoin Halving

Bitcoin Halving

Rise of Bitcoin ETFs

A notable development is the approval of Bitcoin-based exchange-traded funds (ETFs) by the Securities and Exchange Commission (SEC). These ETFs provide a regulated way for investors to gain exposure to Bitcoin’s price movements, attracting significant capital inflows.

Bitcoin ETFs

Bitcoin ETFs

Diversifying Crypto Investments

For those considering entering the crypto space, diversification is key. While Bitcoin remains a solid foundation for a crypto portfolio, spreading investments across various cryptocurrencies and related assets can help mitigate risks.

Conclusion: Is Now the Time to Invest?

Despite the market’s ups and downs, investing $1,000 in Bitcoin could prove fruitful, especially given the upcoming halving event and the influx of institutional capital through ETFs. Remember, patience and diversification are crucial in navigating the volatile crypto market.

In conclusion, the cryptocurrency market presents unique opportunities for investors, with Bitcoin standing out as a promising investment option. By understanding the market dynamics and key catalysts, investors can make informed decisions to capitalize on the potential growth of digital assets.