Why Bitcoin Needs Fresh All-Time Highs to Break the Cycle

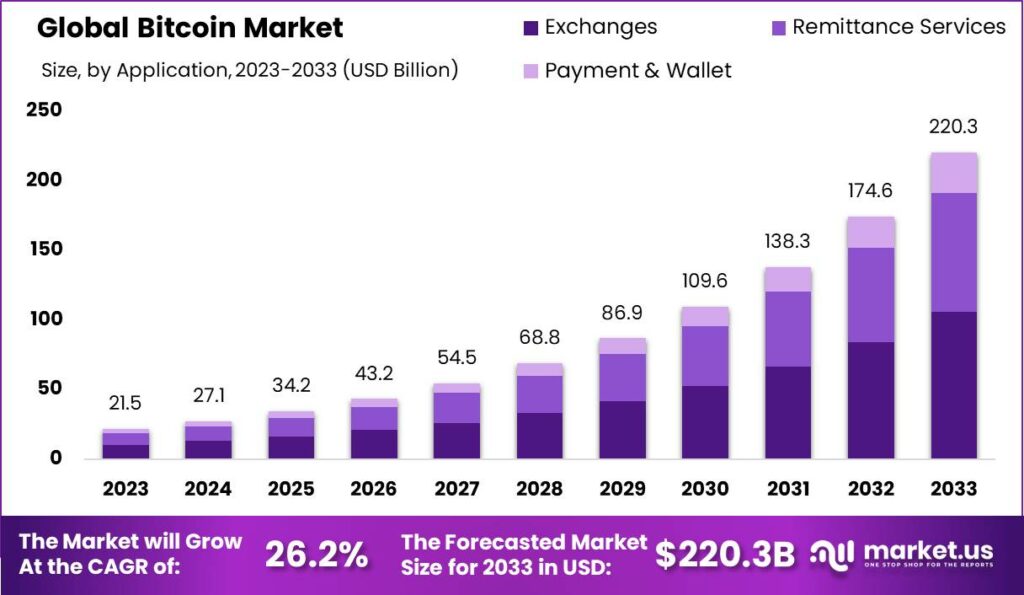

As the cryptocurrency market continues to navigate turbulent waters, Bitcoin’s price action has sparked discussions among traders. For many, the pressing question is, what will it take for Bitcoin to break free from its recent cycle of consolidation? Recent analysis suggests that a significant liquidity boost, potentially driven by Bitcoin reaching “fresh all-time highs,” could be crucial in reversing the trend of pump-and-dump cycles that have characterized the market in recent months.

Current trends in Bitcoin’s liquidity and price action

Current trends in Bitcoin’s liquidity and price action

Current Market Conditions

Bitcoin bears seem to be in control, selling on nearly every rally. This has resulted in a stagnant phase for the asset, which has been bouncing between the $66,500 and $72,000 range. Market analyst Daan Crypto Trades pointed out that “the market is in need of a big liquidity boost,” emphasizing the critical role liquidity plays in price movement.

As of now, Bitcoin is trading at approximately $67,474, remaining about 10% below its all-time high of $73,808 set in March 2024. The trader’s insights suggest that Bitcoin’s price could swiftly pick up momentum, asserting that “it doesn’t always need some catalyst besides price simply going up.” This statement underscores the events that contribute to market sentiment and influences volatility in cryptocurrency pricing.

The Role of Liquidity

Liquidity is vital in ensuring that market participants can buy more Bitcoin, which narrows the bid-ask spread and potentially drives the price higher. A promising development for Bitcoin bulls is the recent announcement by MicroStrategy to raise $500 million through a convertible senior note offering aimed at acquiring additional Bitcoin and other corporate purposes. This news could inject significant liquidity into the market, as Daan Crypto Trades noted:

“That’s a fresh $500M liquidity impulse for you right there.”

The role of major investors in Bitcoin liquidity

The role of major investors in Bitcoin liquidity

Additionally, the increasing inflows into spot Bitcoin ETFs are expected to contribute substantially to this liquidity. Analyst observations reveal that over $100 million flowed into these ETFs recently, with hopes that similar levels of investment will continue in light of MicroStrategy’s news. Fellow trader Jelle stated, “Let’s see if they show up again - especially now that Saylor has announced he’ll be buying another $500 million worth of coins soon.”

Bitcoin’s Current Range and Future Predictions

Despite these optimistic signals, Bitcoin’s price remains confined in what many analysts describe as a post-halving reaccumulation phase. Popular analyst Rekt Capital suggests that this range could persist until September 2024. He pointed out that the current consolidation period is notably lengthy, raising the prospect of a future breakout.

Historically, similar cycles have led to significant price increases. After the previous Bitcoin halving in 2020, the cryptocurrency consolidated for 21 days before surging to an all-time high of $69,000 in November 2021. This has led many to speculate that breaking through the current resistance levels could initiate a new bullish trend in Bitcoin’s price action.

Market predictions and historical comparisons

Market predictions and historical comparisons

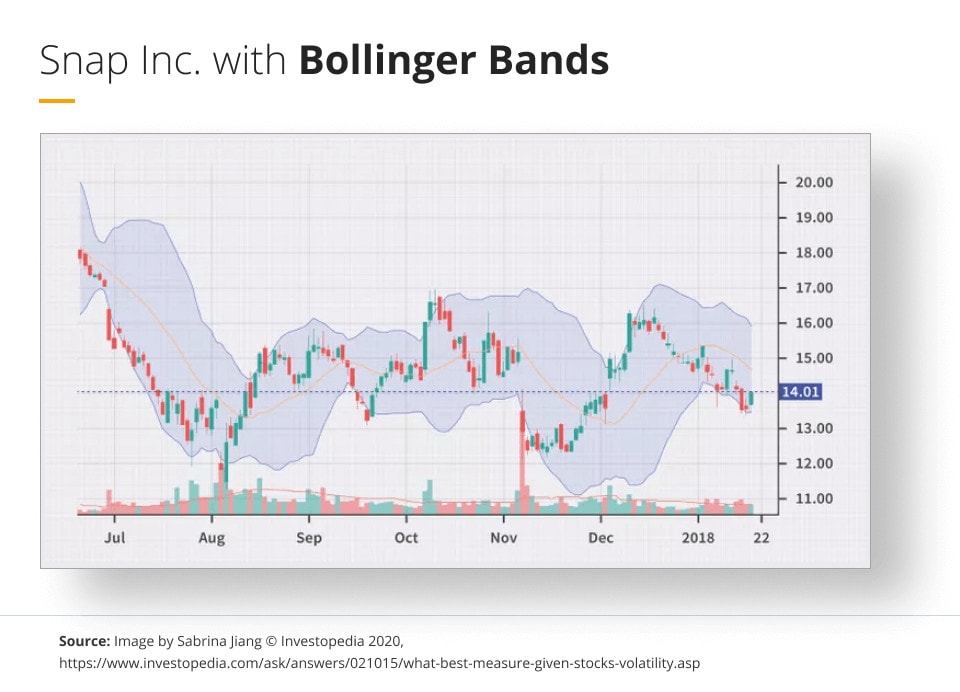

Technical Analysis of Price Levels

Market data from sources like IntoTheBlock highlights the ongoing struggle between buyers and sellers in the Bitcoin market. The in/out of the money around price (IOMAP) model indicates significant support between $63,500 and $67,500, where approximately 1.62 million BTC were purchased by nearly 4 million addresses. Conversely, there is a notable supply congestion zone between $67,600 and $70,500, where about 1.86 million BTC were bought by roughly 3.32 million addresses, making it challenging for bulls to gain momentum.

Daan Crypto Trades summarized this binary position: “Bitcoin is likely to stick to the horizontal levels,” as the market grapples with pushing past crucial resistance points. This situation suggests a careful watch should be set on key indicators that could signal a shift in market dynamics, particularly should liquidity conditions improve.

Conclusion

In summary, while Bitcoin currently finds itself in a consolidation range, the potential for a significant liquidity increase, driven by moves from entities like MicroStrategy and inflows into spot Bitcoin ETFs, could initiate a breakout. Traders and investors alike are keeping a close eye on the charts and news as they await the next significant move in Bitcoin’s price trajectory. Should these conditions materialize, we may witness a surge towards new all-time highs, thus revitalizing investor sentiment and market engagement.

As the cryptocurrency landscape evolves, one thing is clear: understanding the underlying dynamics of liquidity and demand will be essential for navigating the exciting world of Bitcoin investment.