The Rise of Cryptocurrencies: A Decade of Unprecedented Growth

Cryptocurrencies have taken the financial world by storm, outperforming traditional assets like stocks, Treasury bonds, housing, gold, and oil. Over the past ten years, the combined value of digital currencies has skyrocketed, reaching a staggering $2.48 trillion as of March 23, 2024. This exponential growth, with a compound annual rate of nearly 77%, has left even equities in the dust.

A visual representation of the cryptocurrency market

One of the key figures in the cryptocurrency world, Cathie Wood, has set an otherworldly price target for Bitcoin, suggesting a valuation of $75 trillion within the next six years. This bold prediction comes on the heels of the Securities and Exchange Commission’s approval of 11 spot Bitcoin exchange-traded funds (ETFs), signaling a new era of institutional acceptance.

Wood’s revised forecast for Bitcoin paints a picture of unprecedented growth. She envisions a scenario where institutional investors allocate just over 5% of their portfolios to Bitcoin, driving the price to a staggering $3.8 million by 2030. This would represent a remarkable 5,855% increase from the current levels.

“Last year we put out our bull case for Bitcoin. It was $1.5 million. With this institutional green light that the SEC has provided, kicking and screaming though it did, the analysis we’ve done is that if institutional investors were to allocate a little more than 5% of their portfolios to Bitcoin, as we think they will over time, that alone would add $2.3 million to the projection I just gave you.” - Cathie Wood

Wood’s projections imply a market capitalization for Bitcoin that dwarfs even the GDP of the entire U.S. economy, showcasing the immense potential of this digital asset.

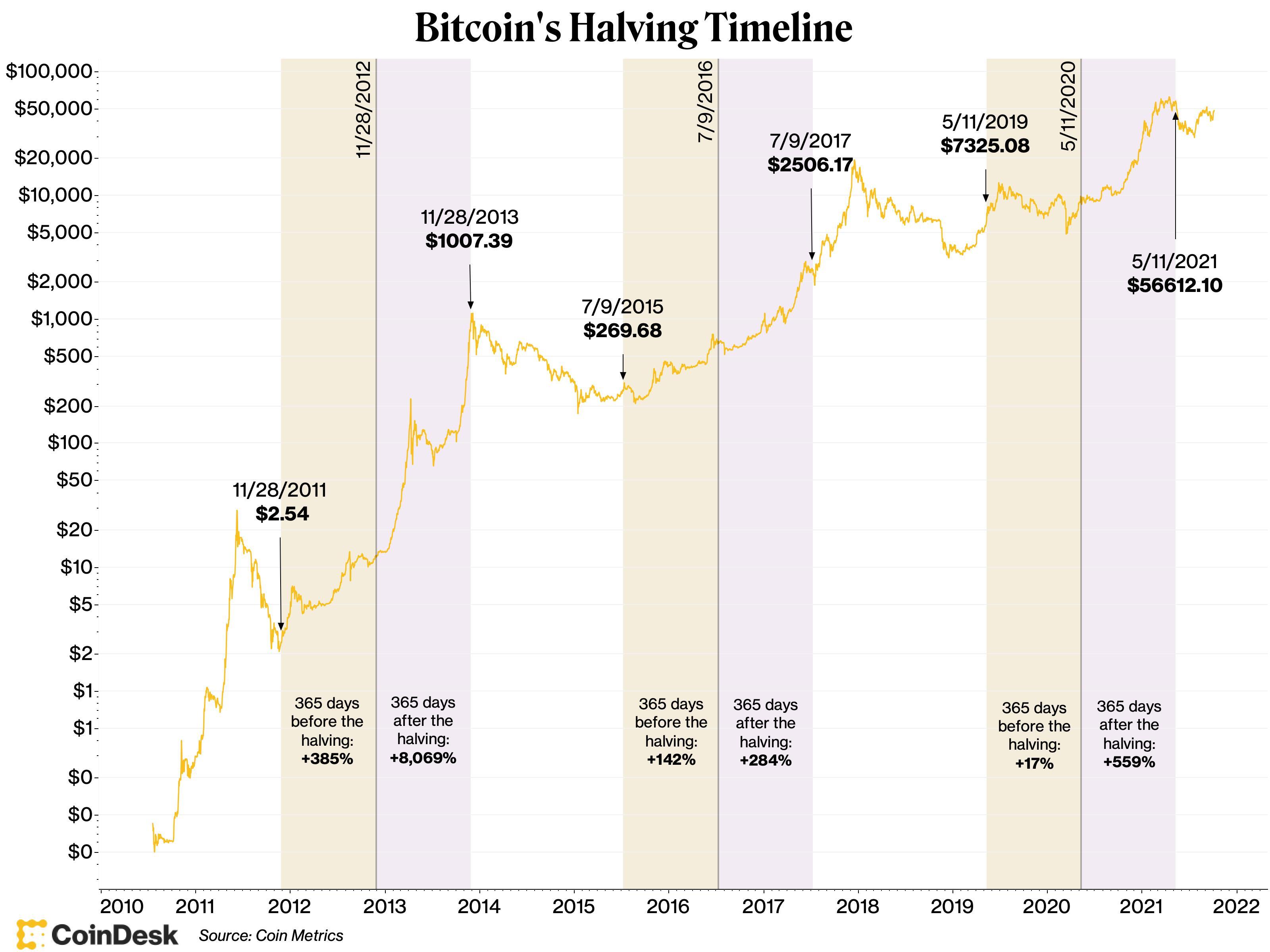

Bitcoin’s First-Mover Advantage and Halving Event

Bitcoin’s dominance in the cryptocurrency space is further solidified by its first-mover advantage and upcoming halving event. With the SEC’s approval of 11 spot Bitcoin ETFs, investors now have direct access to Bitcoin through regulated channels, enhancing its credibility and accessibility.

In addition, Bitcoin is on the brink of a halving event, where the block reward for miners will be halved from 6.25 to 3.125 Bitcoin. This reduction in the rate of new supply entering the market is a bullish signal for investors, as it underscores the scarcity of Bitcoin and its appeal as a long-term investment.

A representation of the Bitcoin halving event

A representation of the Bitcoin halving event

Despite the undeniable advantages Bitcoin holds, Wood’s ambitious price target of $3.8 million by 2030 remains an outlier in the financial world. While the cryptocurrency market continues to evolve and expand, such lofty valuations challenge conventional expectations and raise questions about the future trajectory of digital assets.

Stay tuned to CRYPTOBITE for more insights into the world of cryptocurrencies and the latest developments shaping the financial landscape.