The Road to Approval: Why Spot Ether ETFs Face an Uphill Battle

The cryptocurrency market is abuzz with excitement as the Securities and Exchange Commission (SEC) considers applications for spot exchange-traded funds (ETFs) for ether (ETHUSD), the native token of the Ethereum blockchain and the second largest cryptocurrency by market capitalization. However, experts are increasingly skeptical that approval will come any time soon.

The success of spot bitcoin ETFs earlier this year may have fueled optimism for an approval for ether ETFs, but the two products are very different. The SEC has already delayed decisions on approvals for ether ETFs by Fidelity, BlackRock, and Grayscale, raising concerns over security issues and the classification of ether as a security. Staking, a practice of putting up ether tokens as collateral to support the operations of the Ethereum blockchain in exchange for rewards, may be a significant concern for the SEC.

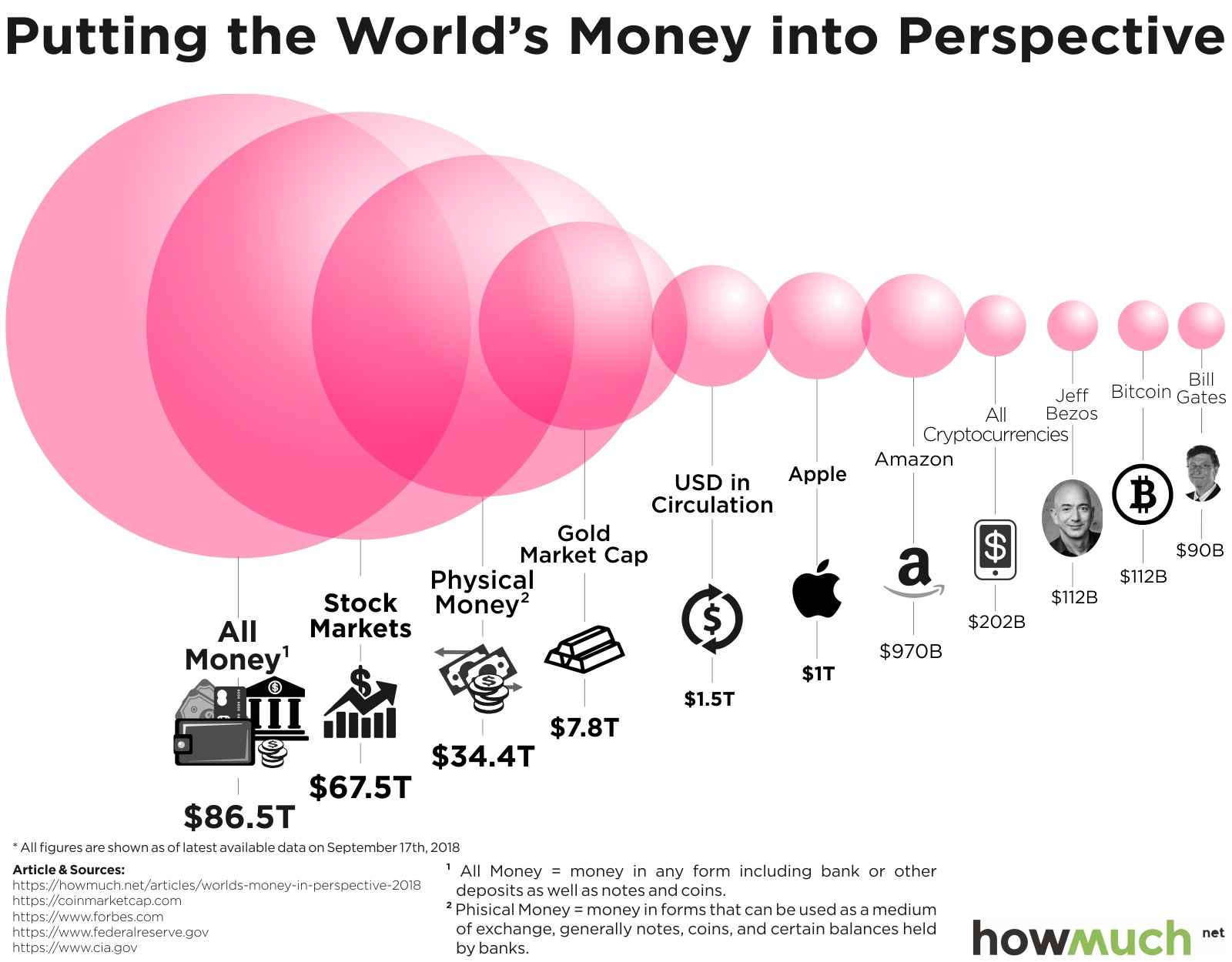

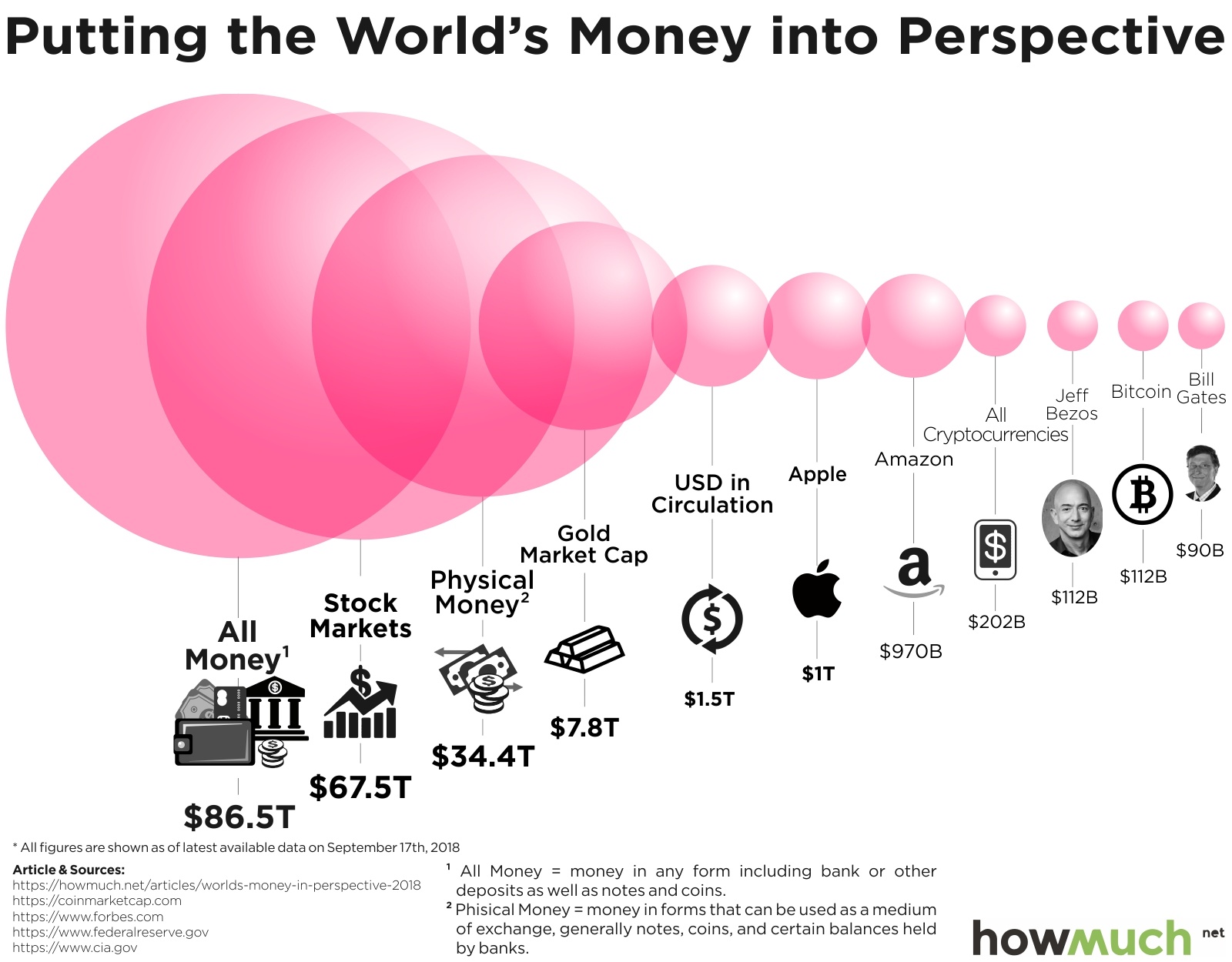

Cryptocurrency market trends

Cryptocurrency market trends

In a note dated March 12, crypto researcher Noelle Acheson pointed out the uniqueness of staking ether could lead to denial due to regulatory fog surrounding the activity. SEC Chair Gary Gensler has consistently criticized cryptocurrency and has yet to indicate whether he would approve the Ether ETF applications.

Differences Between Ether and Bitcoin

ETH can be a store of value among other functions, but its main advantage lies in powering the largest distributed computing platform in the world and supporting a range of decentralized applications. Another point of difference could arise out of the classification of ether as a security, as opposed to bitcoin, which is considered a commodity. The SEC is investigating the Ethereum Foundation, which could lead to the classification of ether as a security and far-reaching consequences for the cryptocurrency markets as a whole.

Ethereum blockchain illustration

Ethereum blockchain illustration

Insights from Industry Watchers

Bloomberg Intelligence’s James Seyffart believes that ETH ETFs will ultimately be denied in May for this round. Coinbase’s chief legal officer Paul Grewal and Grayscale’s chief legal officer Craig Salm remain optimistic, but acknowledge that the SEC may come up with new grounds for denial that weren’t tested in court. Salm hopes that the SEC’s engagement with issuers will be less extensive this time around, as the only difference is that the ETF holds ether instead of bitcoin.

Cryptocurrency regulation landscape

Cryptocurrency regulation landscape

The uncertainty surrounding the approval of spot ether ETFs is a reminder that the cryptocurrency market is still in its early stages of development. As the SEC continues to grapple with the complexities of cryptocurrency regulation, one thing is clear: the road to approval for spot ether ETFs will be long and arduous.