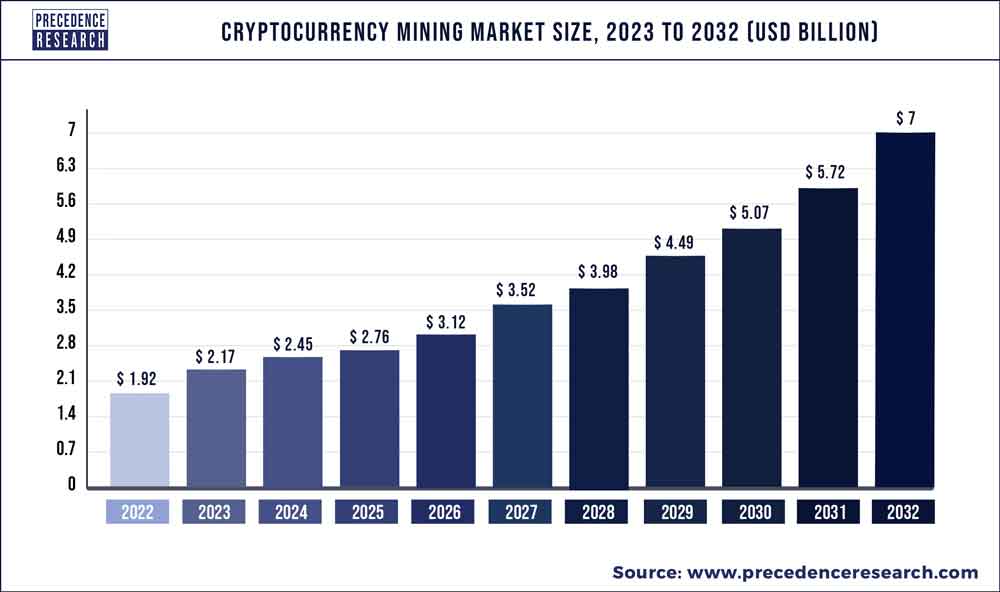

The Bitcoin Mining Industry Faces Uncertainty Amid Proposed Tax on Electricity Consumption

The Biden administration’s proposed 30% tax on electricity used by bitcoin miners has sparked heated debate in the industry. The Digital Asset Mining Energy (DAME) tax aims to mitigate the environmental and economic impacts of cryptocurrency mining by taxing their electricity consumption. However, industry experts argue that this tax could have unintended consequences, stifling energy development and distorting market dynamics.

Bitcoin mining facility in Texas, a state that has made it easy to integrate mining operations into its energy market.

Bitcoin mining facility in Texas, a state that has made it easy to integrate mining operations into its energy market.

According to Harry Sudock, Chief Strategy Officer at GRIID, the DAME tax lacks nuance in addressing the complexities of energy usage. Sudock points out that the proposal fails to differentiate between peak and average electricity usage, potentially deterring efficient energy consumption and investment in new power generation.

“This one-size-fits-all approach could discourage rational energy consumption and investment in new power generation.” - Harry Sudock

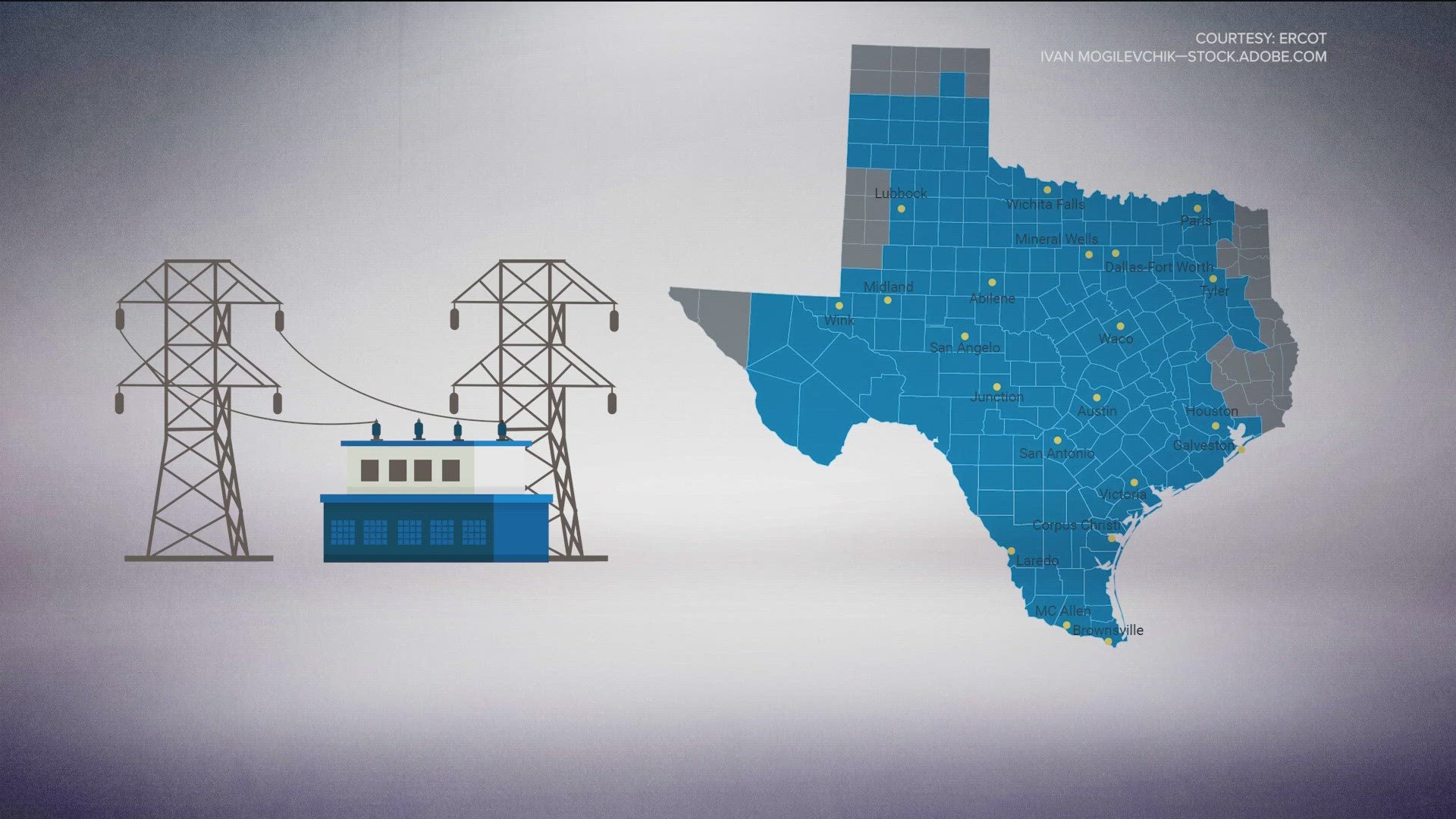

Texas: A Model for Integrating Bitcoin Mining into the Energy Market

Texas offers a successful model of integrating bitcoin mining into its energy market. The state’s approach has made it easy to build mining operations and fetch competitive prices on the open market. The distinction in the Texas market compared to other ICOs is that Texas only has a market for power, while others have markets for both power and capacity. Texas’ power grid, ERCOT, allows energy prices to float throughout the day, reflecting the duck curve, and offers credits to companies that adjust their power consumption, such as bitcoin miners.

Texas’ power grid, ERCOT, allows energy prices to float throughout the day.

Texas’ power grid, ERCOT, allows energy prices to float throughout the day.

The Future of Energy Demand and the Role of Bitcoin Miners

The future of energy demand is a growing concern, with increasing electricity consumption driven by the re-shoring of industrial capacity, the growing needs of large data centers, and the expansion of AI and bitcoin mining. Sudock warns that bitcoin miners could be scapegoated for these issues, despite their contributions to stabilizing energy markets. Bitcoin miners often purchase electricity that is not in high demand, effectively reducing ‘breakage’—unused electricity that could otherwise go to waste.

The Proposed Tax and Its Consequences

The proposed tax could force businesses out of the U.S., pushing them to relocate to regions with non-discriminatory tax treatment. This would reduce potential revenue and hinder the development of robust, reliable, environmentally friendly energy infrastructure, such as nuclear energy and hydroelectric power.

“The tax is bad public policy. It won’t generate the intended revenue and will force bitcoin miners to relocate overseas where the electric grid isn’t as clean as it is in the U.S. Instead, grid authorities should work with miners to develop pricing structures that take advantage of their unique operational flexibility to turn on and off as the price of electricity naturally fluctuates.” - Harry Sudock

Bitcoin ETFs: A Sign of Growing Adoption

Despite the uncertainty surrounding the proposed tax, investors have continued to add money to bitcoin ETFs, even as prices slipped 7% in June. BlackRock’s iShares Bitcoin Trust led the way, with inflows topping $1 billion. This suggests that investors are optimistic about the future of bitcoin and its potential for growth.

BlackRock’s iShares Bitcoin Trust saw inflows of over $1 billion in June.

Bull Run on the Horizon?

Some analysts believe that a renewed bull run may be incoming, citing reduced selling pressure and investor sentiment as signs of a potential buying opportunity. The Fear and Greed Index has entered ‘fear’ and neutral territory, and exchange net flow suggests a shift from centralized platforms to self-custody methods.

Exchange net flow suggests a shift from centralized platforms to self-custody methods.

With the proposed tax hanging over the industry, it remains to be seen how bitcoin miners will adapt to the changing regulatory landscape. One thing is clear, however: the future of energy demand is a pressing concern that requires careful consideration and cooperation from industry stakeholders and policymakers alike.