Bitcoin’s Uncertain Future: A New Gold Standard or a Flash in the Pan?

The world of cryptocurrency is abuzz with speculation about the future of bitcoin. With its value fluctuating wildly, investors are left wondering if it’s a smart investment or a fleeting fad. Hedge fund billionaire and New York Mets owner Steve Cohen recently weighed in on the topic, revealing that he owns “very little” bitcoin, but is intrigued by its potential.

“Maybe it’s the new gold,” Cohen said in an interview with CNBC’s “Squawk Box.” “It’s a new instrument, that’s the argument … [it’s] really hard to know.”

Cohen’s comments come at a time when investors are increasingly looking to bitcoin as a potential safe-haven asset. With Treasury yields spiking to their highest level since November, bitcoin’s value took a hit, sliding 5% on Monday. Austin Alexander, co-founder of LayerTwo Labs, attributes the decline to the uncertainty surrounding the cryptocurrency.

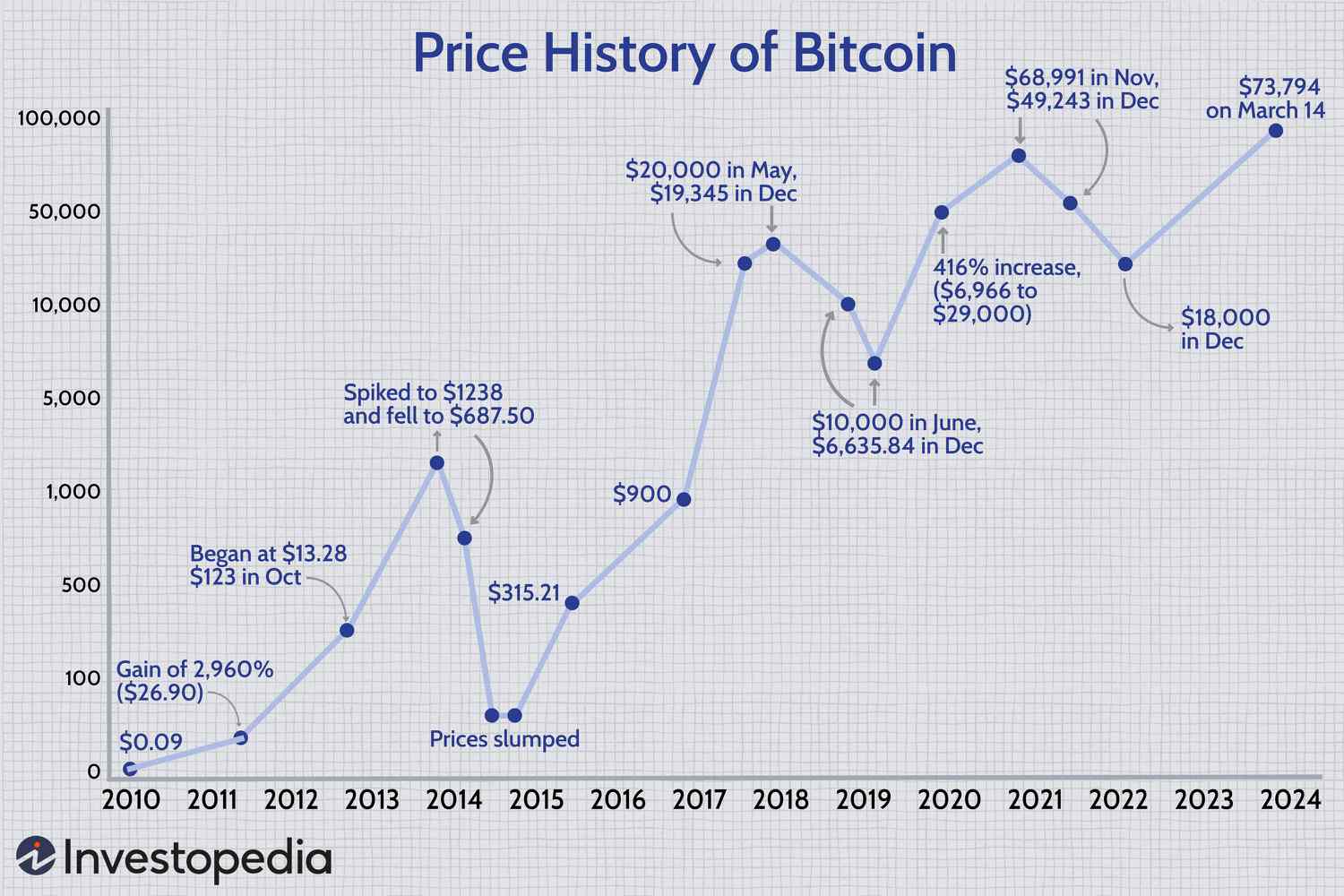

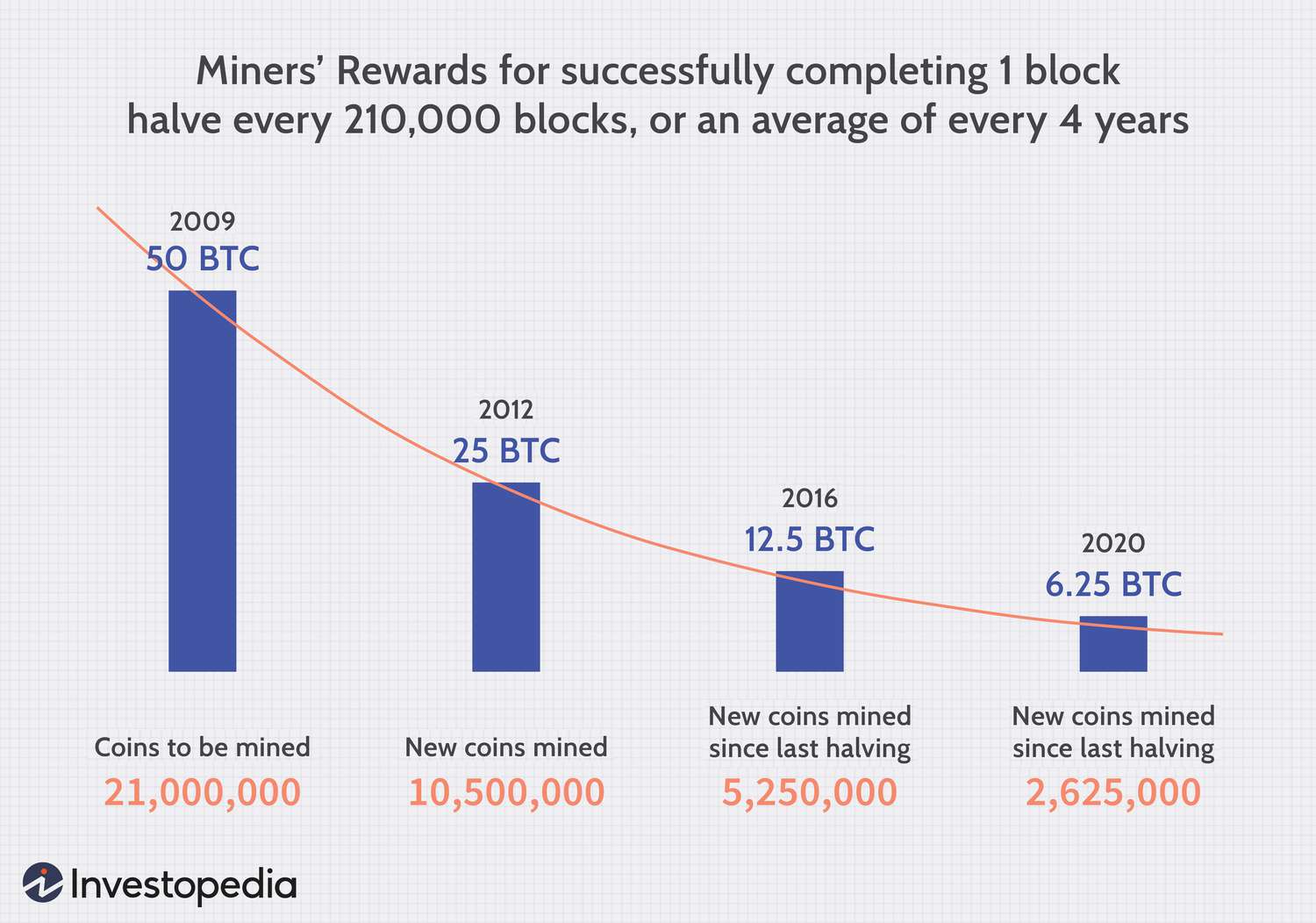

Bitcoin’s value has been on a rollercoaster ride in recent months.

Bitcoin’s value has been on a rollercoaster ride in recent months.

Despite the volatility, many investors remain bullish on bitcoin’s potential. With its decentralized nature and limited supply, some argue that it could become a new gold standard for investors. However, others are more skeptical, citing the lack of regulation and uncertainty surrounding its long-term viability.

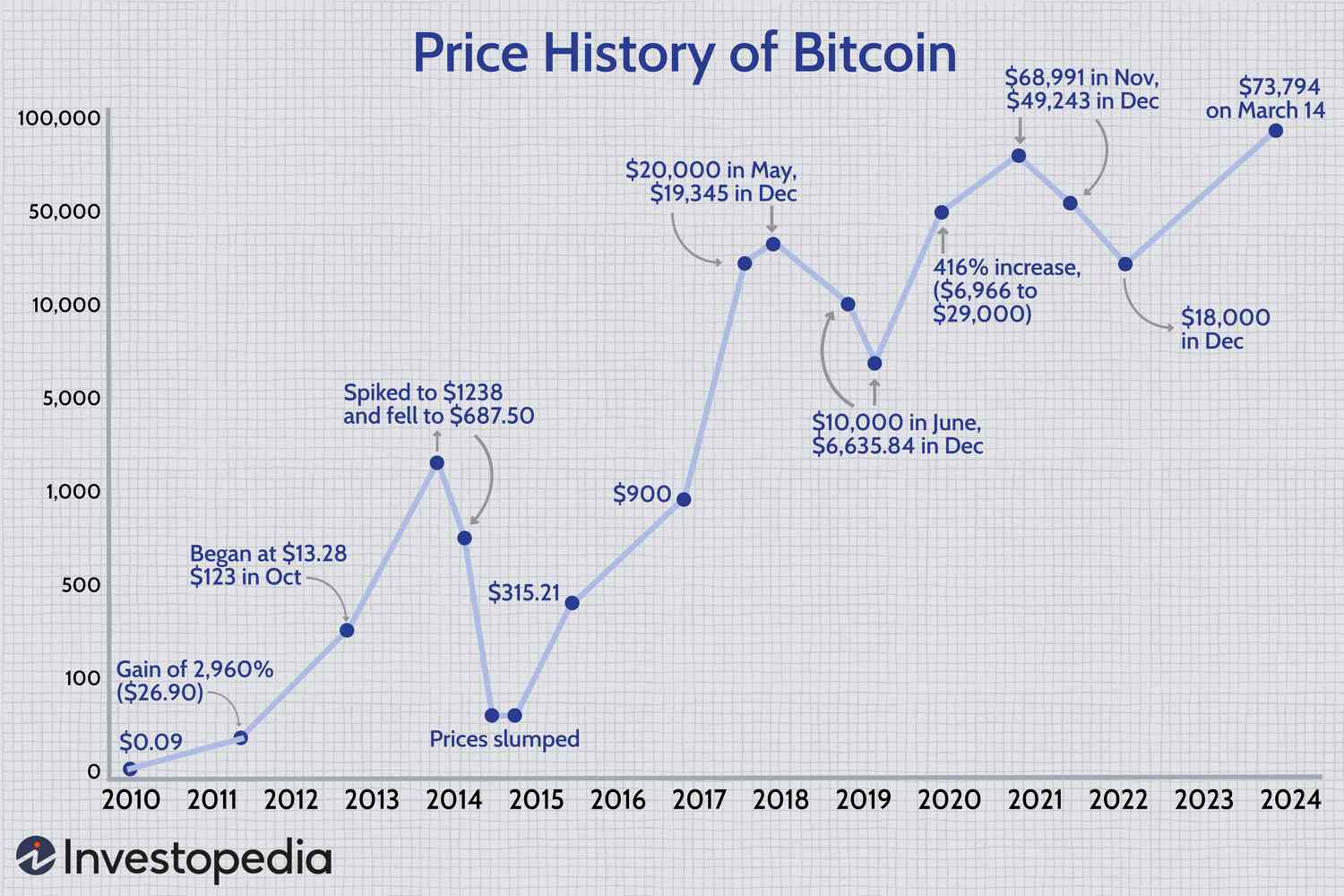

Bitcoin mining operations are becoming increasingly complex and energy-intensive.

Bitcoin mining operations are becoming increasingly complex and energy-intensive.

As the world of cryptocurrency continues to evolve, one thing is certain: bitcoin is here to stay. Whether it will become a mainstream investment vehicle or a niche player remains to be seen. One thing is certain, however: the future of bitcoin is uncertain, and investors would do well to approach with caution.

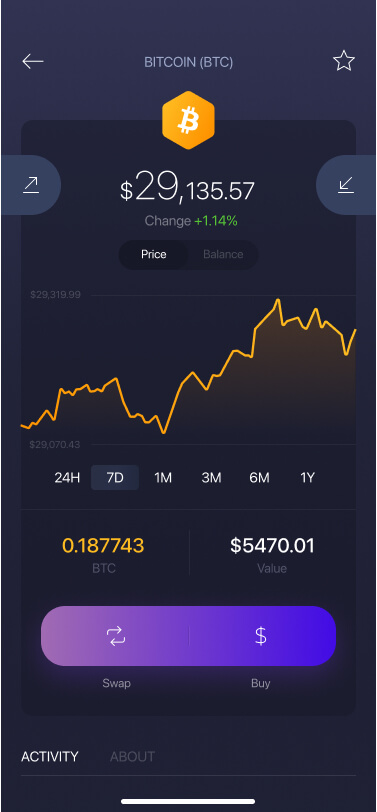

Bitcoin wallets are becoming increasingly sophisticated, but security remains a major concern.

Bitcoin wallets are becoming increasingly sophisticated, but security remains a major concern.