The Trump Effect: How a Political Comeback is Reshaping the Crypto Landscape

On a historic election night, Donald Trump has proclaimed victory, marking what he describes as the greatest political comeback in American history. This declaration comes amidst a remarkable surge in Bitcoin prices, now hitting an impressive record of $75,397, surpassing its previous peak established earlier this year. In a stunning reversal from his past critiques labeling cryptocurrency a scam, Trump has now committed to making America the crypto capital of the planet.

Trump’s victory could involve significant shifts in crypto policy.

Trump’s victory could involve significant shifts in crypto policy.

Key Highlights from the Election Results

- Even as Trump celebrates, the financial markets are reacting positively, with global stock futures up, signaling renewed optimism within alternative investments like Bitcoin.

- The former president’s earlier attempt at launching a cryptocurrency venture under the name World Liberty Financial faced challenges, yet his recent political maneuvers suggest a shift towards embracing digital currencies.

As investors eagerly watch the unfolding scenario, uncertainty remains over how a Trump presidency would actually impact regulation and innovation in the crypto sector.

Assessing Trump’s Position on Cryptocurrency

Trump’s campaign exhibits a clear push for a more welcoming climate for cryptocurrencies, contrasting with his opponents, particularly Vice President Kamala Harris, who has shown a more cautious stance towards digital currencies. This divergence underscores not just a political battle but a foundational decision point for investors and enthusiasts alike.

One of the fundamental questions centers around whether Trump’s administration will push for less regulation, appealing directly to investors. Trump’s promises to lower taxes and cut bureaucratic red tape could incentivize a thriving crypto economy in America.

“Investors are looking for cues on how legislation might alter the trajectory of Bitcoin and Ethereum,” says a financial analyst. “A Trump victory could mean significant benefits for these digital assets.”

The Crypto Landscape Post-Election

The dynamics of cryptocurrency trading and investment are already responding to Trump’s victory. Analysts predict a bullish market for Bitcoin and Ethereum in the coming months if the incoming administration supports blockchain technology and innovation.

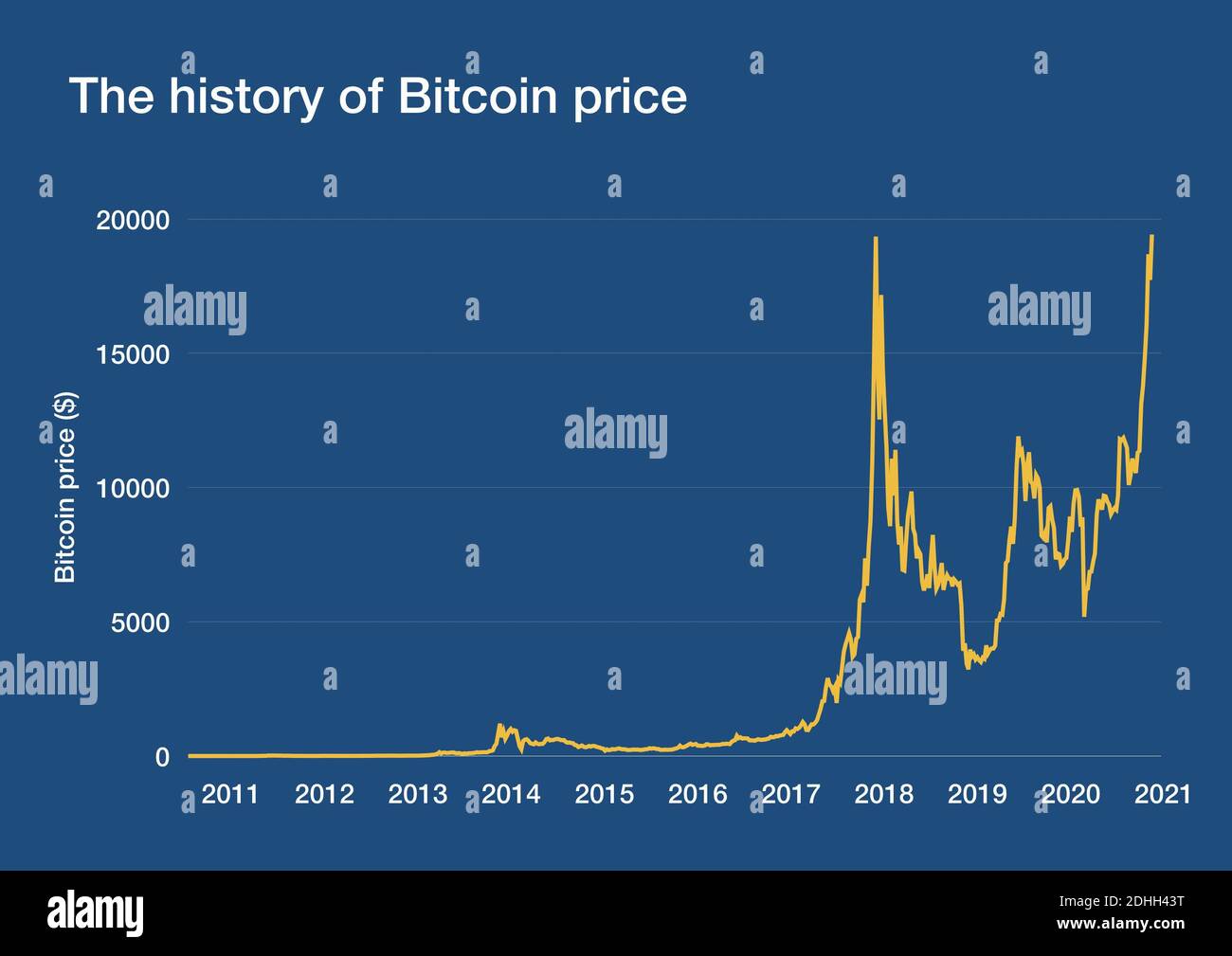

Investment in cryptocurrencies has grown significantly.

Reports indicate that Krypto investments have skyrocketed, amassing $2.18 billion in net inflows over just one week. This rush suggests that the recent electoral outcome may serve as a bellwether for the health of the crypto market, paving the way for a bullish outlook as Trump outlines his vision for alternative finance.

Implications of Trump’s Crypto Strategy

With Trump actively courting the crypto community, his presidency may usher in an era of less stringent regulations and more favorable policies for Bitcoin and its peers. Discussions around potential blockchain innovations are already gaining momentum, positioning cryptocurrency companies for unprecedented growth.

In stark contrast, the approach championed by Harris and current administration officials remains far more cautious. This could create a tangible rift in policy that would influence investor confidence and market stability. As a result, one must closely examine whether Trump’s promises can convert to actionable policies that effectively catalyze growth in the cryptocurrency ecosystem.

What Lies Ahead: Bitcoin at $80,000?

As the crypto community digests these developments, some industry experts suggest that Bitcoin’s market price could surge towards $80,000 in light of favorable policies. The conversation around the crypto-friendly environment Trump is advocating has sparked fresh enthusiasm among investors keen on capitalizing on the potential of digital currencies.

Bitcoin’s price could continue to soar.

Bitcoin’s price could continue to soar.

Whether Trump can deliver on his promises remains to be seen, and the new administration’s approach towards regulation will be critical in enabling—or stifling—the burgeoning crypto market.

In conclusion, as the political landscape evolves, so too does the cryptocurrency market. Investors must stay alert and informed as Trump’s presidency unfolds, particularly regarding how it might reshape the regulatory framework surrounding digital assets and its implications for future investments.