The Rise of Cryptocurrency: A Contrarian View

In a world where traditional investments have long reigned supreme, the recent surge in cryptocurrency prices has left many investors questioning their strategies. As Bitcoin trades near $68,500 and altcoins like Avalanche and Shiba Inu see significant gains, the financial landscape is evolving rapidly.

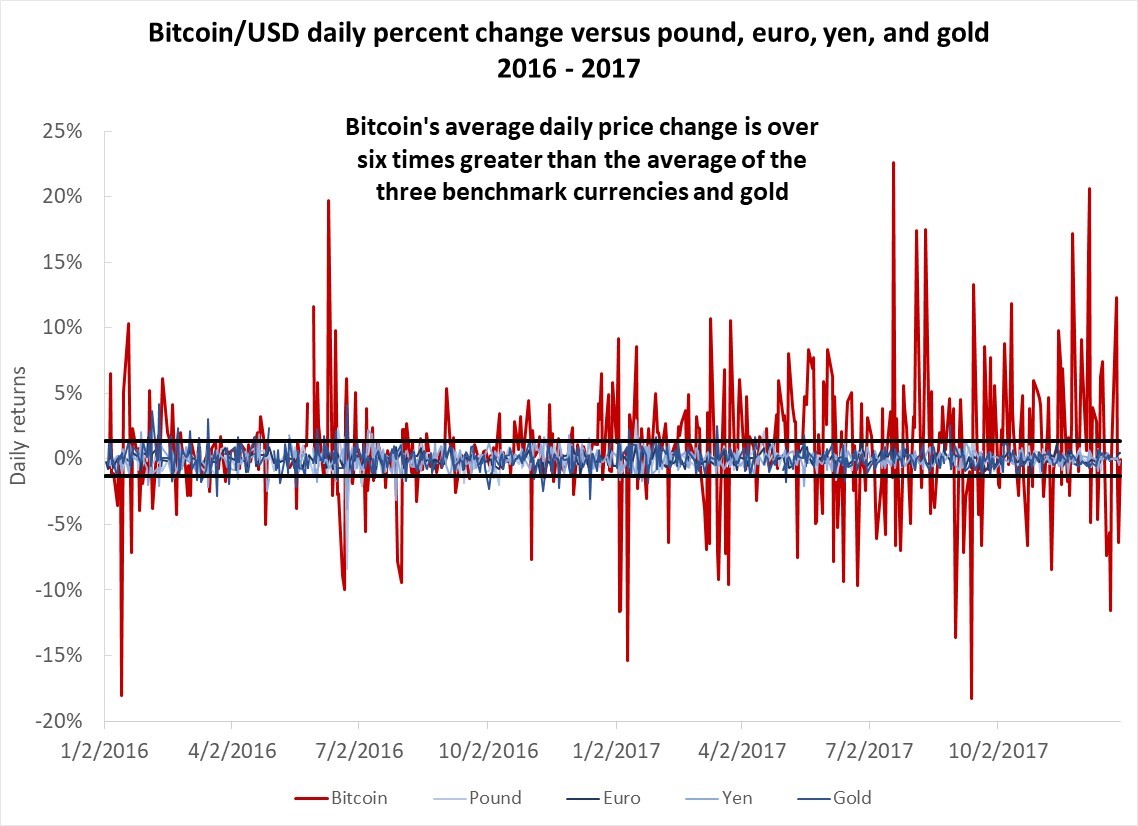

Bitcoin’s Volatile Journey

Bitcoin’s recent jump to an intraday peak of $68,897 highlights the extreme volatility in the cryptocurrency market. Despite this, the digital asset remains a favorite among investors seeking high-risk, high-reward opportunities.

Bitcoin cryptocurrency

Bitcoin cryptocurrency

The Altcoin Surge

While Bitcoin dominates the headlines, other cryptocurrencies like Ethereum, Solana, and Avalanche have also experienced notable price increases. Ethereum, the second-largest crypto token, saw a gain of over 2.6% to reach $3,633. Altcoins such as Solana, XRP, Cardano, and Dogecoin have also surged, contributing to the overall growth of the global cryptocurrency market.

Expert Insights

According to industry experts, the recent market movements are influenced by various factors, including the upcoming US fed funds rate and FOMC economic projections. Analysts suggest that Bitcoin needs to reclaim key levels for a bullish trend confirmation, while Ethereum must continue its uptrend to maintain momentum.

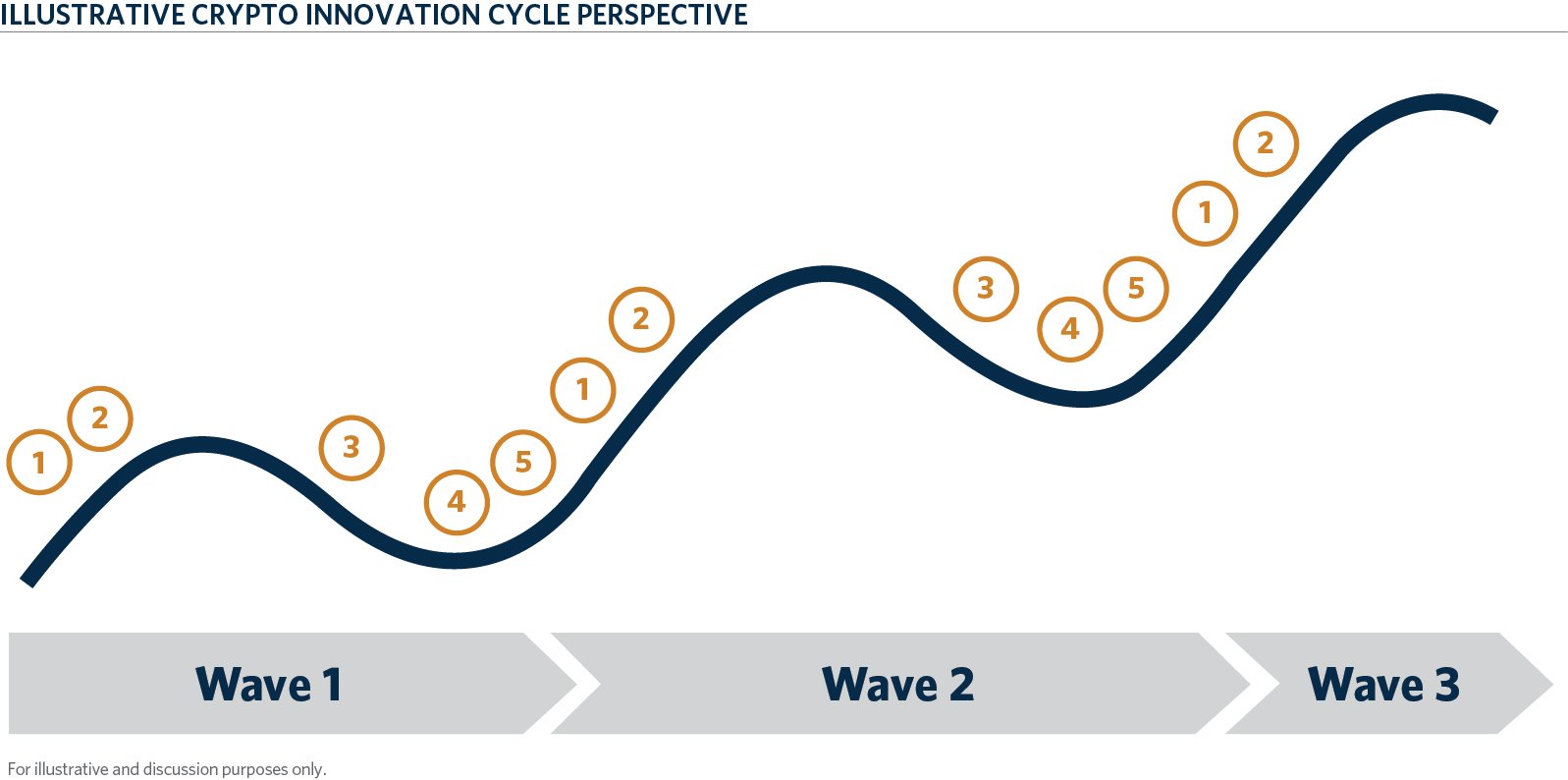

The Future of Cryptocurrency

As the cryptocurrency market continues to evolve, investors are advised to stay informed and cautious. With the potential for significant gains and losses, navigating this new financial frontier requires a blend of research, risk management, and a long-term perspective.

Conclusion

While the mainstream view may tout caution in the face of cryptocurrency volatility, embracing the potential of digital assets could lead to new investment opportunities and financial growth. As the world of finance adapts to the rise of cryptocurrency, staying informed and open-minded is key to success.