The Rise of Crypto Trading: How State Street and Galaxy Digital Are Revolutionizing the Industry

In recent years, the world of cryptocurrency has experienced exponential growth, with more and more investors looking to get in on the action. As the market continues to evolve, it’s becoming increasingly clear that traditional financial institutions are taking notice. One such institution, State Street, has recently partnered with Galaxy Digital to develop active crypto trading products. But what does this mean for the industry, and how will it impact investors?

A New Era of Crypto Trading

The partnership between State Street and Galaxy Digital is a significant development in the world of cryptocurrency. By working together, the two companies aim to provide investors with access to the $2.4 trillion digital asset ecosystem through manager-directed strategies. This move is a clear indication that traditional financial institutions are starting to take cryptocurrency seriously, and are looking for ways to get involved.

But what exactly does this mean for investors? In short, it means that they will have access to a wider range of investment options, including crypto-based funds and exchange-traded funds (ETFs). This is a significant development, as it will allow investors to diversify their portfolios and potentially increase their returns.

The Benefits of Crypto Trading

So, why are investors so interested in cryptocurrency? There are a number of reasons, but one of the main benefits is the potential for high returns. Cryptocurrency is a highly volatile market, which means that prices can fluctuate rapidly. This can be a good thing for investors, as it means that they have the potential to make significant profits if they buy and sell at the right time.

Another benefit of cryptocurrency is the fact that it is a decentralized market. This means that it is not controlled by any one government or institution, which can make it more difficult for investors to get involved. However, it also means that investors have more freedom to buy and sell as they please, without having to worry about government regulations or interference.

The Risks of Crypto Trading

Of course, as with any investment, there are risks involved with cryptocurrency. One of the main risks is the potential for significant losses if the market declines. This is because cryptocurrency is a highly volatile market, and prices can fluctuate rapidly. If an investor buys a cryptocurrency at the wrong time, they could potentially lose a significant amount of money.

Another risk is the fact that cryptocurrency is not regulated in the same way as traditional investments. This means that investors may not have the same level of protection if something goes wrong. For example, if an investor buys a cryptocurrency from a company that goes bankrupt, they may not be able to get their money back.

Conclusion

In conclusion, the partnership between State Street and Galaxy Digital is a significant development in the world of cryptocurrency. It marks a new era of crypto trading, and provides investors with access to a wider range of investment options. While there are risks involved with cryptocurrency, the potential benefits are significant. As the market continues to evolve, it will be interesting to see how traditional financial institutions become more involved.

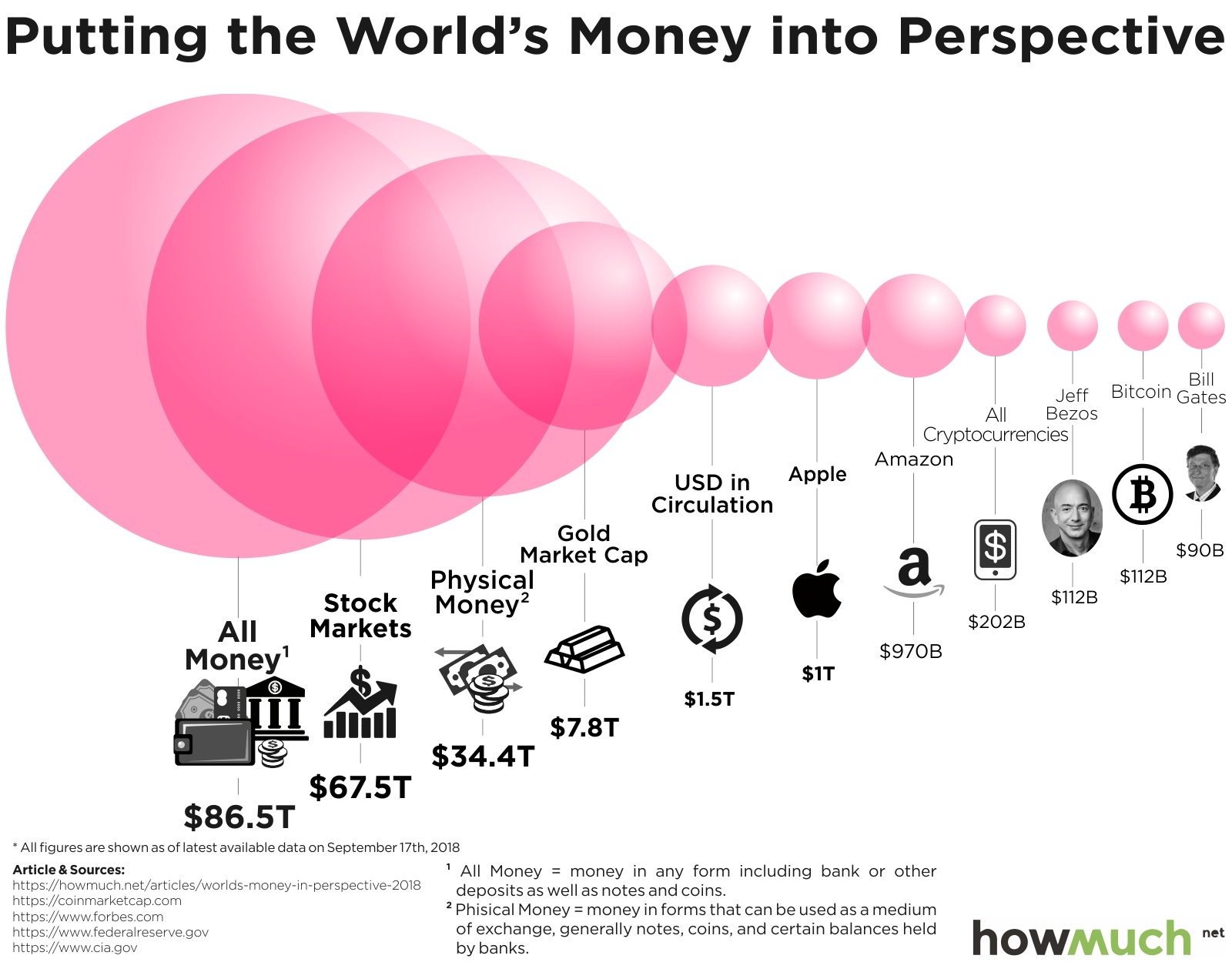

Image: A graph showing the growth of the cryptocurrency market

What is Bitcoin Margin Trading?

Bitcoin margin trading is a type of trading that allows investors to buy and sell cryptocurrencies using borrowed funds. This can be a good way for investors to increase their potential returns, but it also increases the risk of significant losses if the market declines.

How Does Bitcoin Margin Trading Work?

Bitcoin margin trading works by allowing investors to borrow funds from a third party, usually an exchange. The investor can then use these funds to buy and sell cryptocurrencies, with the goal of making a profit. However, if the market declines, the investor may be required to repay the borrowed funds, plus interest.

The Benefits of Bitcoin Margin Trading

One of the main benefits of Bitcoin margin trading is the potential for high returns. By using borrowed funds, investors can increase their potential profits, but they also increase the risk of significant losses if the market declines.

The Risks of Bitcoin Margin Trading

As with any investment, there are risks involved with Bitcoin margin trading. One of the main risks is the potential for significant losses if the market declines. This is because investors are using borrowed funds, which means that they may be required to repay the funds, plus interest, if the market declines.

Conclusion

In conclusion, Bitcoin margin trading is a type of trading that allows investors to buy and sell cryptocurrencies using borrowed funds. While it can be a good way for investors to increase their potential returns, it also increases the risk of significant losses if the market declines. As with any investment, it’s essential for investors to do their research and understand the risks involved before getting started.

Image: A graph showing the growth of the Bitcoin margin trading market

Kaspa: A New Cryptocurrency on the Block

Kaspa is a new cryptocurrency that has been making waves in the market. With a current price of $0.17129498, it’s clear that investors are taking notice. But what exactly is Kaspa, and how does it work?

What is Kaspa?

Kaspa is a type of cryptocurrency that uses a unique consensus algorithm to secure its network. This algorithm is designed to be more energy-efficient than traditional proof-of-work algorithms, which makes it more environmentally friendly.

How Does Kaspa Work?

Kaspa works by using a network of computers to validate transactions and secure the network. This network is decentralized, which means that it’s not controlled by any one government or institution. Instead, it’s maintained by a community of users who work together to validate transactions and secure the network.

The Benefits of Kaspa

One of the main benefits of Kaspa is its energy efficiency. By using a unique consensus algorithm, Kaspa is able to reduce its energy consumption, which makes it more environmentally friendly. This is a significant benefit, as many investors are looking for ways to reduce their carbon footprint.

The Risks of Kaspa

As with any investment, there are risks involved with Kaspa. One of the main risks is the potential for significant losses if the market declines. This is because Kaspa is a highly volatile market, and prices can fluctuate rapidly.

Conclusion

In conclusion, Kaspa is a new cryptocurrency that is making waves in the market. With its unique consensus algorithm and energy efficiency, it’s clear that investors are taking notice. However, as with any investment, there are risks involved, and investors should do their research before getting started.

Image: A graph showing the growth of the Kaspa market

Photo by

Photo by