The Rise of Crypto ETFs: A New Era for Investors

The world of cryptocurrency is rapidly evolving, and one of the most significant developments in recent times is the emergence of crypto ETFs (Exchange-Traded Funds). These investment vehicles have opened up new avenues for investors to tap into the potential of cryptocurrencies like Bitcoin, providing a convenient and diversified way to gain exposure to the crypto market.

The rise of crypto ETFs

In this article, we’ll delve into the world of crypto ETFs, exploring their benefits, types, and what they mean for investors.

The Benefits of Crypto ETFs

Crypto ETFs offer a range of benefits for investors, including:

- Diversification: By investing in a crypto ETF, you can gain exposure to a diversified portfolio of cryptocurrencies, reducing your risk and increasing potential returns.

- Convenience: Crypto ETFs provide a convenient way to invest in cryptocurrencies, eliminating the need to set up a digital wallet or navigate complex trading platforms.

- Regulatory Compliance: Crypto ETFs are regulated by government agencies, providing an added layer of security and protection for investors.

Types of Crypto ETFs

There are several types of crypto ETFs available, each with its own unique characteristics and benefits. Some of the most popular include:

- Spot Bitcoin ETFs: These ETFs track the price of Bitcoin, providing investors with direct exposure to the cryptocurrency.

- Crypto Stock ETFs: These ETFs invest in companies that are involved in the crypto industry, such as miners, exchanges, and blockchain developers.

The Best Crypto ETFs to Buy

With so many crypto ETFs available, it can be challenging to know which ones to invest in. Here are a few of the top-performing crypto ETFs:

- iShares Bitcoin Trust (IBIT): This ETF tracks the price of Bitcoin, providing investors with direct exposure to the cryptocurrency.

- Amplify Transformational Data Sharing ETF (BLOK): This ETF invests in a diversified portfolio of crypto stocks, including miners, exchanges, and blockchain developers.

- First Trust SkyBridge Crypto Industry and Digital Economy ETF (CRPT): This ETF provides exposure to a broad range of crypto companies, including miners, exchanges, and blockchain developers.

The Future of Crypto ETFs

The future of crypto ETFs looks bright, with more and more investors turning to these investment vehicles as a way to tap into the potential of cryptocurrencies. As the crypto market continues to evolve, we can expect to see even more innovative ETFs emerge, providing investors with new and exciting opportunities to invest in the crypto space.

The future of crypto ETFs

In conclusion, crypto ETFs offer a convenient and diversified way for investors to gain exposure to the crypto market. With their benefits, types, and top-performing funds, it’s no wonder that crypto ETFs are becoming increasingly popular among investors.

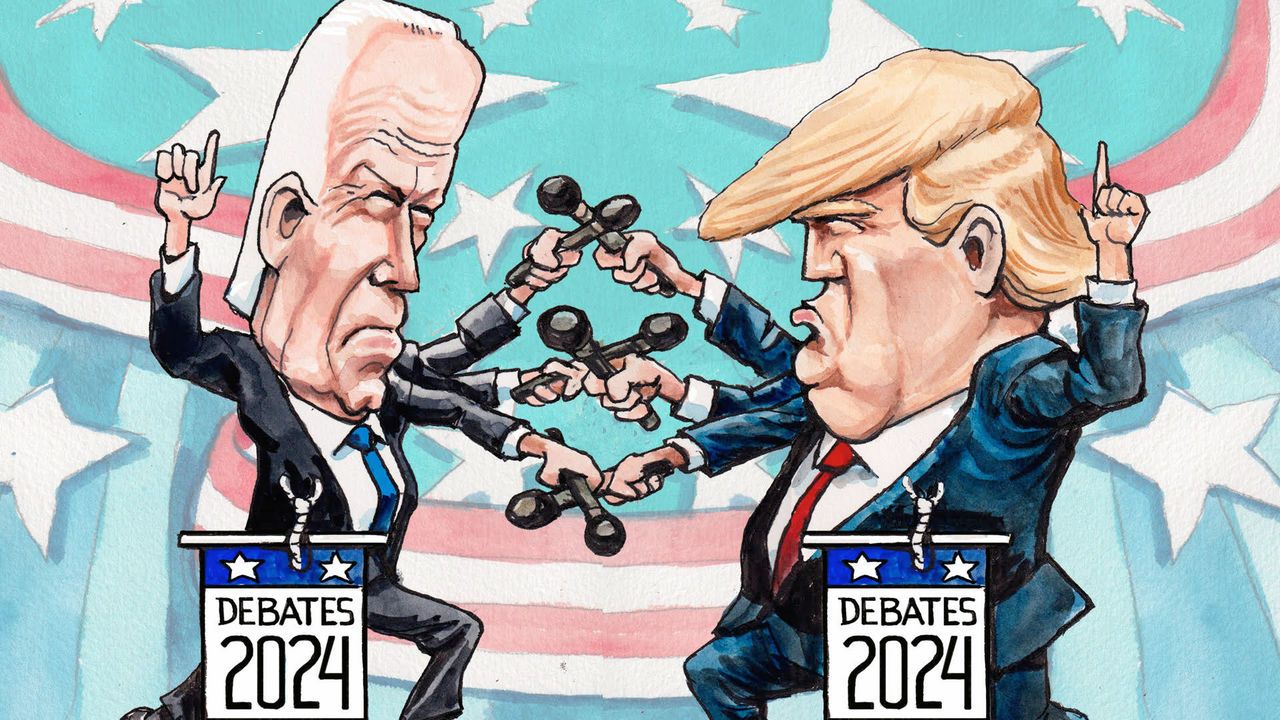

Crypto Insiders Hope for Possible Mention in Biden-Trump Debate

As the US presidential election heats up, crypto insiders are hoping that digital assets will be mentioned in the upcoming debate between Joe Biden and Donald Trump. With the crypto industry growing in importance, it’s essential that policymakers understand the implications of digital assets on the economy.

Biden-Trump Debate

Biden-Trump Debate

Bitcoin Miner Marathon Mined $15M Worth of Kaspa Tokens

In a significant development, Bitcoin miner Marathon has mined $15 million worth of Kaspa tokens, a layer 1 protocol that uses a proof-of-work consensus mechanism. This move marks a significant shift towards diversifying revenue streams for miners, who are looking to capitalize on the growing demand for digital assets.

Marathon Mining

In this article, we’ve explored the world of crypto ETFs, their benefits, types, and top-performing funds. We’ve also touched on the growing importance of digital assets in the US presidential election and the shift towards diversifying revenue streams for miners. As the crypto market continues to evolve, we can expect to see even more innovative developments in the world of crypto ETFs and beyond.