The Resurgence of Dogecoin: Is This a New Chapter for Meme Coins?

In an astonishing turn of events, Dogecoin has peaked at its highest level since 2021, resulting in a wave of bets reaching a staggering $2 billion. This resurgence begs an essential question: can meme coins transcend their initial novelty and become serious players in the cryptocurrency arena?

The Unexpected Surge of Dogecoin

Just when many thought Dogecoin was relegated to the annals of internet history, the cryptocurrency that started as a joke is back in the spotlight. Investors are pouring in billions, revealing an enthusiasm that many didn’t see coming. This kind of volatility can be unnerving, but it’s also a fundamental aspect of the cryptocurrency landscape. What fuels this speculative frenzy? Possibly a mix of nostalgia and a genuine belief that Dogecoin embodies something more significant than its whimsical branding.

Dogecoin’s recent price rise has caught many by surprise.

Dogecoin’s recent price rise has caught many by surprise.

As seasoned investors in the crypto market, we have witnessed many dramatic shifts; however, the recent climb feels different. Unlike previous patterns, this new price rally showcases a shift in market sentiment. With high hopes and speculative money flowing in, are we witnessing the dawn of a new trend in the crypto landscape?

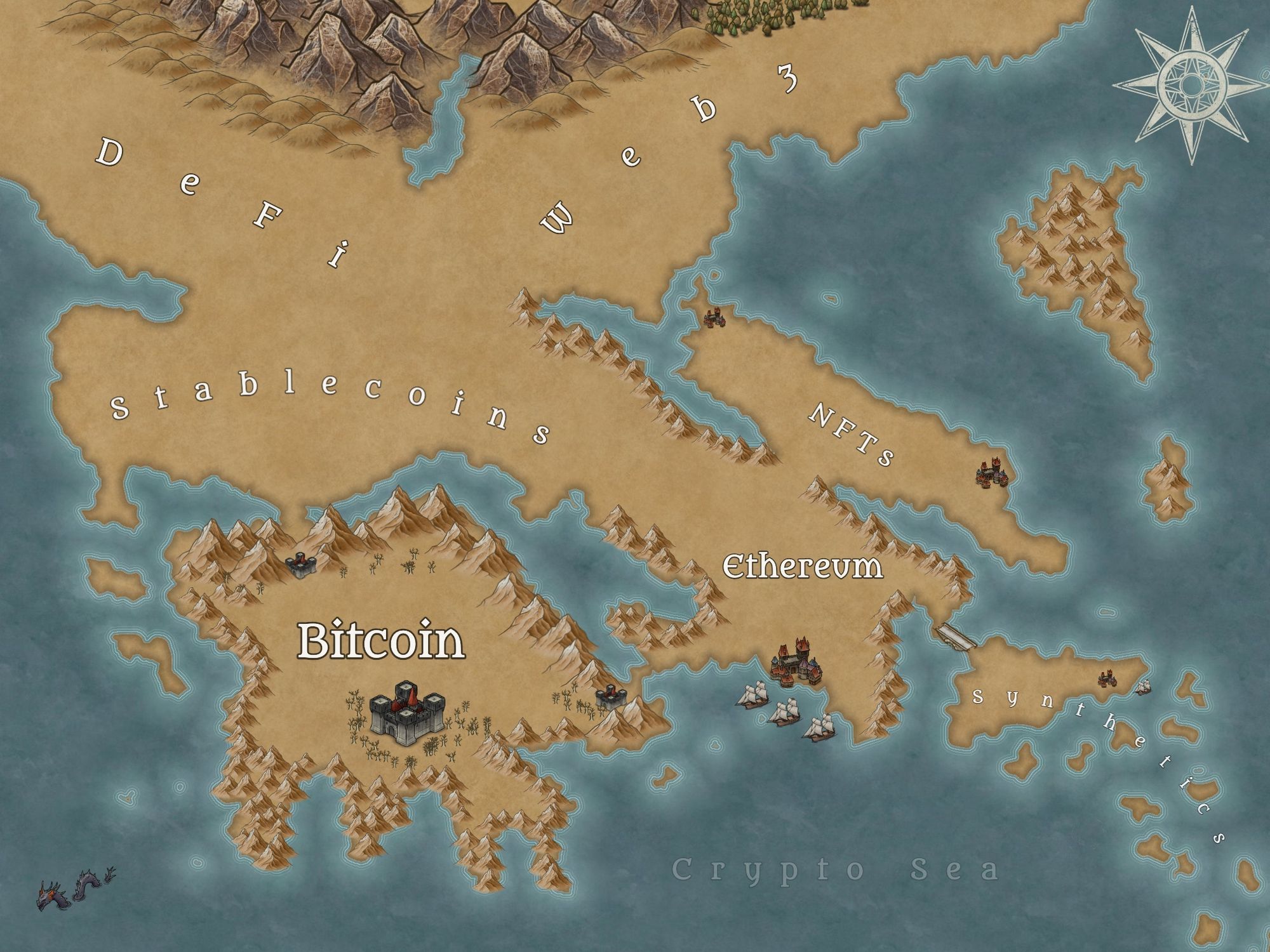

Merging of Traditions: Tokenized Treasury Notes Surpass $1B

While Dogecoin garners headlines, another trend is quietly making waves — tokenized treasury notes, which have now surpassed $1 billion in assets under management. This development signals a growing mainstream acceptance of crypto-based financial products. The trust in tokenized solutions mirrors a maturation of the crypto space, blurring the line between traditional finance and innovative blockchain technology.

Imagine a world where your cryptocurrency wallet not only holds Bitcoin or Ethereum but also represents diversified assets, including tokenized treasury notes. The accessibility and flexibility this offers could empower more investors to engage with and trust cryptocurrencies. Moreover, mainstream institutions starting to embrace these initiatives signifies a pivotal shift towards regulation and compliance that the crypto world desperately needs.

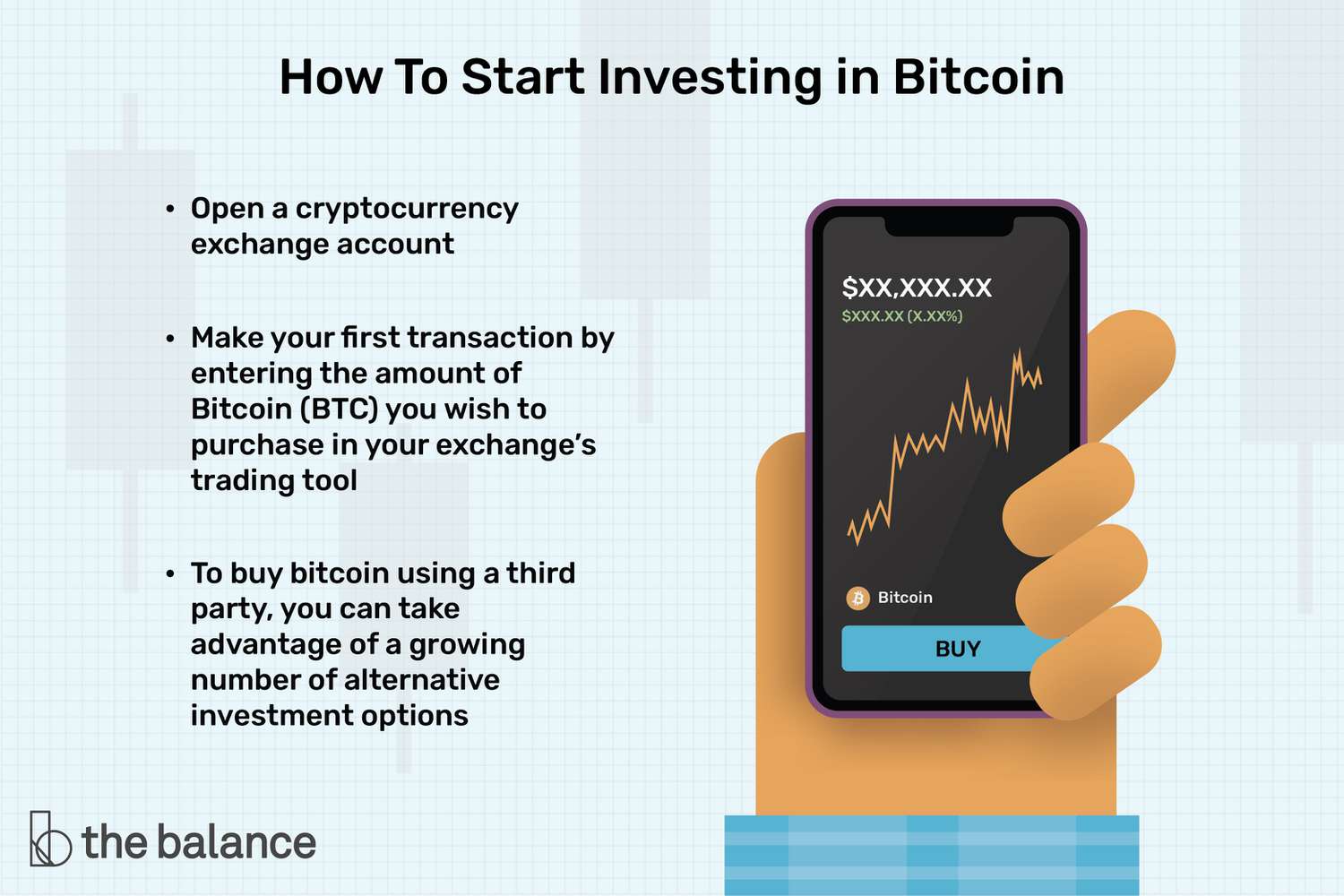

Bitcoin ETFs and Market Health

Interestingly, the buzz isn’t limited to meme coins and treasury notes. Take the recent news regarding ARK 21Shares Bitcoin ETF, which hit $200 million in daily inflows for the first time. This sort of exponential growth in investor interest is juxtaposed against the backdrop of tech-heavy index funds and ETFs showing considerable volatility. Investors are diversifying their portfolios with Bitcoin as a hedge against traditional market uncertainties, a fact that cannot be overlooked.

The fear of missing out (FOMO) can be a double-edged sword, but it certainly instills a sense of urgency in millennials and Gen Z investors, many of whom have already taken the leap into this volatile realm.

Growing interest in Bitcoin reflects a broadened investment landscape.

Growing interest in Bitcoin reflects a broadened investment landscape.

These strides in the market reinforce a significant narrative: cryptocurrency is not just a short-lived trend but rather a potentially revolutionary shift in how we view and manage money. The introduction of Bitcoin ETFs could further validate Bitcoin’s legitimacy as an asset class, appealing to both individual and institutional investors seeking stable growth avenues.

The Regulatory Landscape: A Necessary Step

However, the future of these developments hinges on a comprehensive regulatory framework. A recent statement from FATF Chief Marcus Pleyer highlighted a concerning reality: fewer than 30% of jurisdictions globally have begun regulating crypto adequately. This regulatory void presents risks but also opportunities for countries bold enough to nurture a crypto-friendly environment.

Could we be on the brink of a global shift in regulatory attitudes towards cryptocurrency? Countries identifying the potential for economic growth and innovation in the blockchain space must lead this charge. Crypto advisors play an increasingly critical role in guiding investors through the complexities of regulations while leveraging diversified strategies that extend beyond Bitcoin.

Closing Thoughts

As we stand at this intersection of cryptocurrencies’ volatile past and an uncertain yet hopeful future, it is clear that we are only beginning to uncover the potential that exists within. The harmonization of technologies, regulatory frameworks, and investor interest represents a turning point in the cryptocurrency narrative.

In wrapping up this discussion, the resurgence of Dogecoin could be seen as both a reminder and a challenge. While meme coins can rally incredible enthusiasm and investment, it is vital to understand their underlying values and the broader implications on market mechanisms. As an investor navigating through these transformative times, remaining informed and adaptable could mean the difference between thriving and merely surviving in the crumbling edifice of traditional finance.

The future of cryptocurrency is as unpredictable as it is exciting.

The future of cryptocurrency is as unpredictable as it is exciting.

Whether you believe in the power of meme coins or the stability of tokenized assets, one thing is for sure: these waves of change are just getting started, and it will be fascinating to see where this journey takes us next.