Embracing the Future: Why I Believe Asset Tokenization is Overrated

As the world buzzes with excitement over the potential of blockchain technology to revolutionize traditional assets, I find myself taking a different stance. While many herald the tokenization of assets as the next big leap in financial markets, I can’t help but question the hype surrounding this trend.

The Illusion of Accessibility

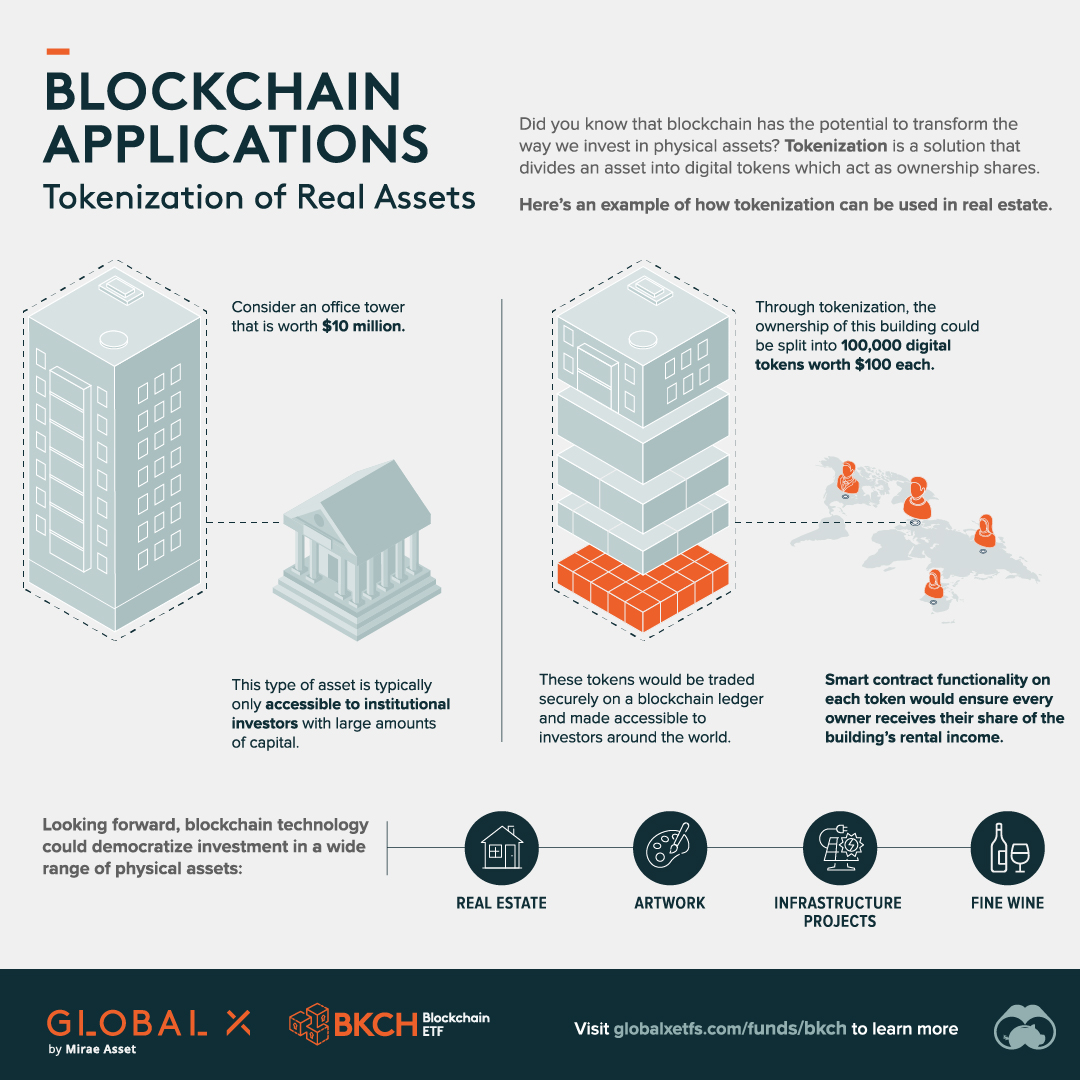

Proponents of asset tokenization often tout its ability to democratize access to a wide range of assets, from stocks to real estate. They argue that by tokenizing these assets on a public ledger, the transfer process becomes cheaper and more efficient. However, I believe this narrative oversimplifies the complexities of the financial world.

In reality, the tokenization of assets may create an illusion of accessibility without addressing the underlying barriers that prevent widespread participation in these markets. While the technology may streamline certain processes, it does not inherently solve issues of financial literacy, regulatory hurdles, or wealth inequality.

The Risks of Overreliance

Larry Fink’s vision of a future where every financial asset is tokenized raises concerns about the concentration of power in the hands of a few major players. As BlackRock, JPMorgan, and other Wall Street giants pave the way for this crypto revolution, we must consider the implications of consolidating asset ownership and control in the digital realm.

The rush towards asset tokenization may inadvertently exacerbate existing disparities by centralizing control within a select group of institutions. This shift towards digital assets could sideline smaller investors and disrupt the delicate balance of financial ecosystems.

A Cautionary Tale

While the allure of innovation is undeniable, we must proceed with caution when embracing new technologies in the financial sector. The narrative of asset tokenization as a panacea for market inefficiencies overlooks the potential risks and unintended consequences that may arise from such rapid transformation.

In conclusion, I advocate for a more nuanced approach to the adoption of asset tokenization. Rather than blindly embracing this trend as the inevitable future of finance, we should critically evaluate its implications and strive for a balanced, inclusive financial landscape.

About the Author

I am a journalist with a passion for exploring the intersection of technology and finance. Through my work, I aim to challenge conventional wisdom and spark meaningful conversations about the future of our financial systems.