Is Bitcoin a Smart Investment for Your Portfolio?

As the world of cryptocurrency continues to evolve, more and more investors are turning to Bitcoin as a way to diversify their portfolios and potentially reap big rewards. With the rise of Bitcoin ETFs, it’s now easier than ever to get in on the action. But is this cryptocurrency ETF a no-brainer buy?

Direct Exposure to Bitcoin’s Price

The iShares Bitcoin Trust, created by BlackRock, is designed to track the price of Bitcoin, offering investors a unique opportunity to capture the long-term upside of this digital currency. Unlike other ETFs, which typically hold a diversified basket of assets, the iShares Bitcoin Trust holds only one asset: Bitcoin. As a result, it does a remarkably good job of matching Bitcoin’s price. Since its launch, the iShares Bitcoin Trust has seen a significant increase, up 32.44%, while Bitcoin itself has risen 32.67%.

Easy and Cheap Portfolio Diversification

Given Bitcoin’s historical performance, it’s no wonder investors are eager to include it in their portfolios. The iShares Bitcoin Trust offers a simple and cost-effective way to do just that. With a low expense ratio of 0.25%, it’s cheaper to buy and hold Bitcoin via this ETF than it is to buy the same amount of Bitcoin through a cryptocurrency exchange. This makes it an attractive option for investors looking to diversify their portfolios without breaking the bank.

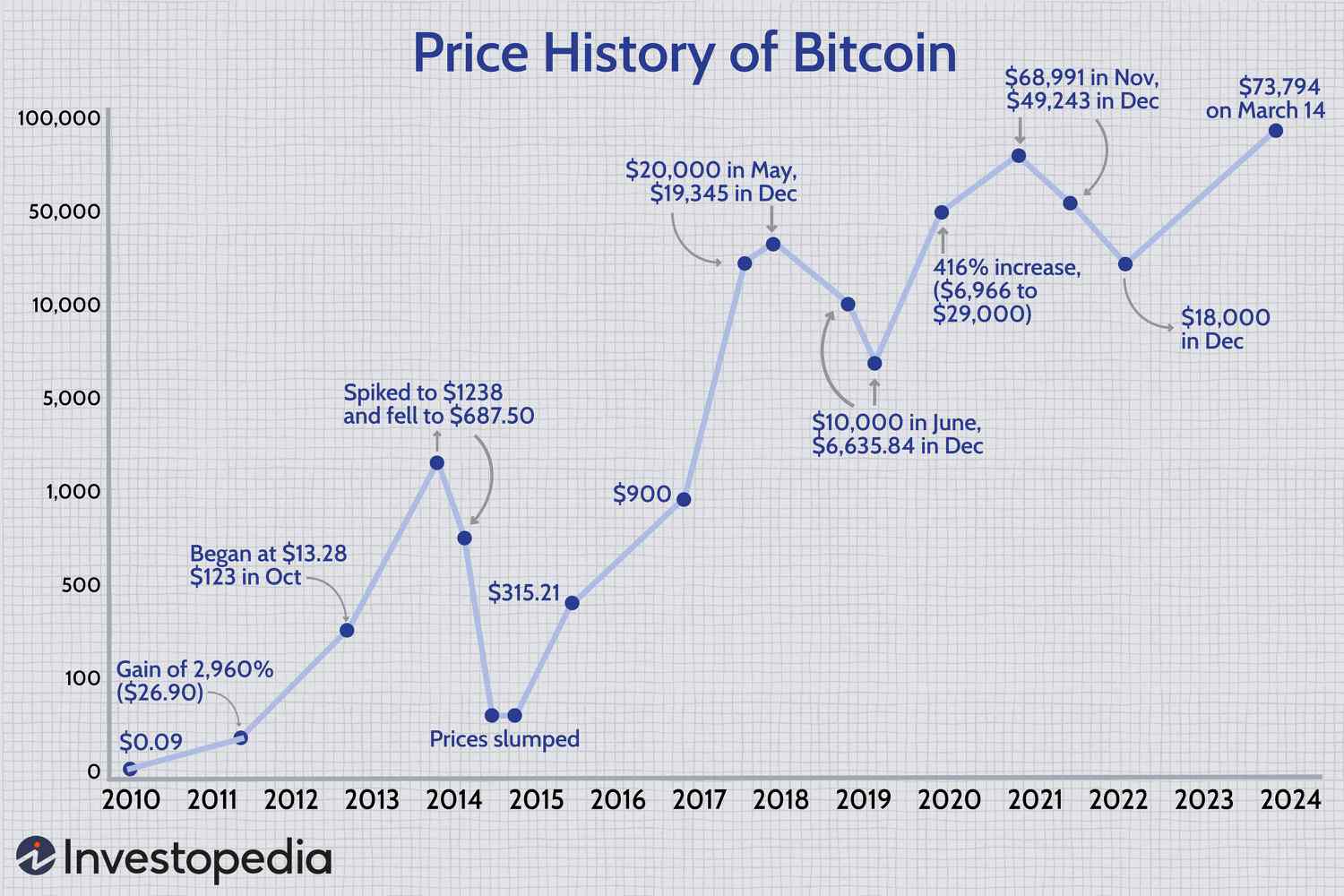

Bitcoin prices continue to rise

Bitcoin prices continue to rise

Trade-Offs

While the iShares Bitcoin Trust offers many benefits, it’s not without its trade-offs. One of the main differences between this ETF and buying Bitcoin directly is that you don’t actually own the underlying asset. You’re getting exposure to Bitcoin’s price, but you don’t have direct control over the cryptocurrency itself. This could be a problem if you plan on using Bitcoin for transactions or sending it to others.

Buy and Hold Strategy

The iShares Bitcoin Trust is best suited for investors who are looking to buy and hold for the long haul. It’s not intended for short-term directional bets on the price of Bitcoin. Instead, your investment goal should be to get exposure to Bitcoin’s price, for as cheaply as possible, for as long as possible.

A Bitcoin ETF can provide a cost-effective way to diversify your portfolio

A Bitcoin ETF can provide a cost-effective way to diversify your portfolio

In conclusion, the iShares Bitcoin Trust is an attractive option for investors looking to get in on the Bitcoin action. With its low expense ratio and ability to track the price of Bitcoin, it’s an excellent way to diversify your portfolio and potentially reap big rewards.