The Greed Factor: Are We Heading for a Cryptocurrency Crash?

28 September 2024

The cryptocurrency market is buzzing with excitement as Bitcoin and Ethereum remain relatively stable, but there’s a larger narrative unfolding that raises questions about potential risks in this cheerfully trending market. Recent data indicates a bullish atmosphere, with investor confidence skyrocketing. Could this rising tide be a precursor to a potential downfall?

Market fluctuation patterns

The Surge of Greed

The current Fear & Greed Index is flashing a rather concerning signal—greed has overtaken the cryptocurrency and stock markets. With stock indices reaching all-time highs and cryptocurrencies like Bitcoin booming by over 10% in September alone, we may indeed be in a state of euphoria. The cryptocurrency sector is clambering with investors anticipating a rally, yet historical trends suggest that this kind of overzealous optimism often invites significant price corrections.

What many investors might not realize is how emotional trading can lead us astray. I recall when Bitcoin first surged past $20,000 in late 2017, and the exuberance in the community was palpable. Many were quick to invest substantial sums, often disregarding the fundamental market indicators. The correction that followed was brutal, and many lost their investments. Today’s landscape feels eerily similar, with caution thrown to the wind as greed takes the helm.

Bitcoin’s Continued Climb

In the midst of this frenzy, Bitcoin itself has crossed the impressive $65,000 threshold, inviting waves of optimism among crypto enthusiasts. The community is abuzz with conversations about reaching new heights and solidifying Bitcoin’s position as the leading digital currency. Consolidation at these levels is typically viewed as a healthy sign for continued growth, fueling expectations of breaking past previous all-time highs.

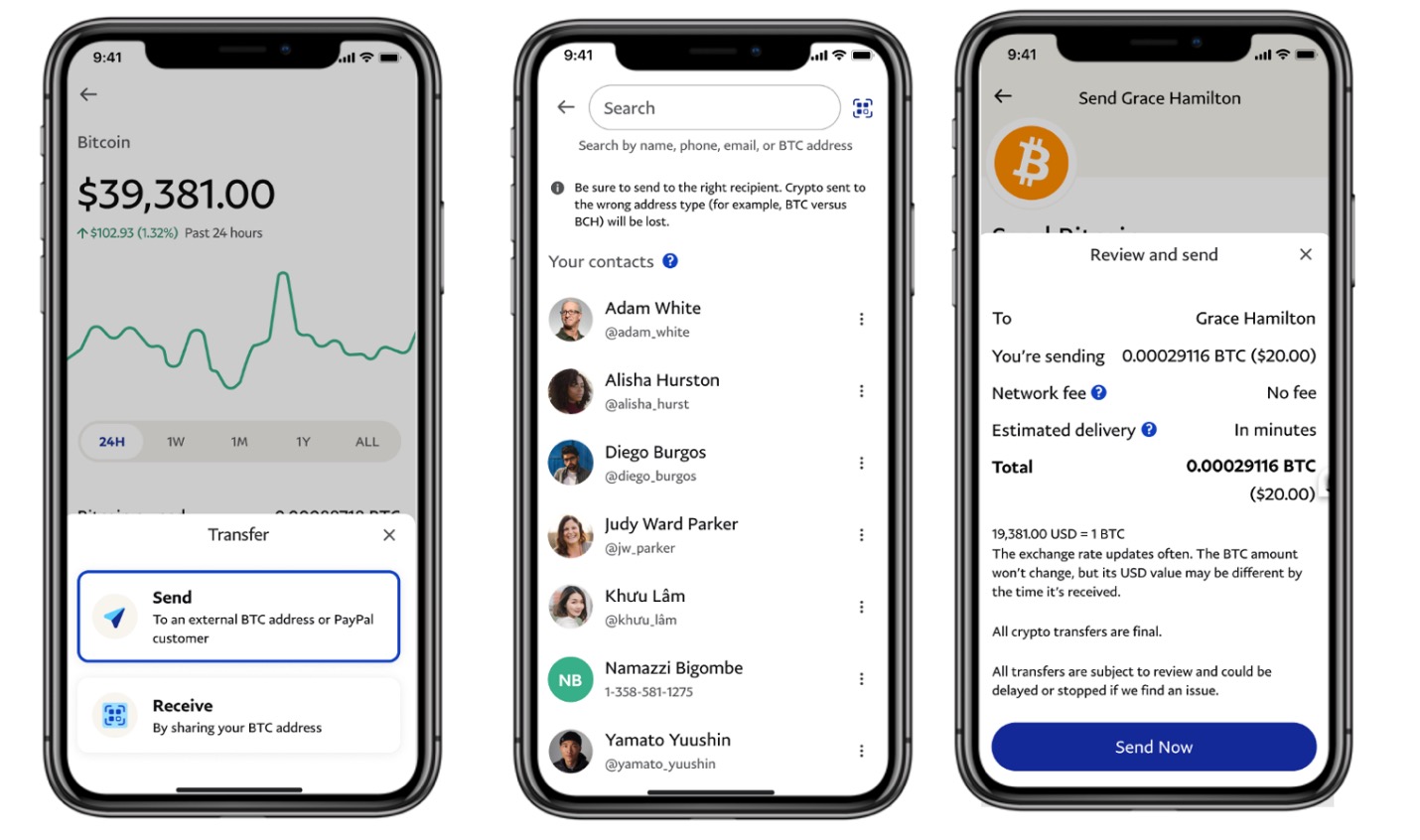

Current Bitcoin trading enthusiasm

It’s fascinating to see how the community rallies around potential milestones while glossing over the underlying sentiments that often precede a downturn. It’s a double-edged sword; while I wholeheartedly support the innovation and adoption of cryptocurrencies, the palpable disconnection from reality is concerning.

Future Prospects and Opportunities

Yet not all is bleak. There are substantial opportunities brewing within the cryptosphere that could keep the bullish momentum alive. Projects like Crypto All-Stars, embracing new tokens and staking mechanisms, offer intriguing prospects that could help sustain the current rally. With the introduction of the STARS token as a reward unit for staking, networks are emerging that specifically cater to meme coins and smaller projects, tapping into a broad spectrum of investor interests.

Innovative cryptocurrency projects on the rise

As cryptocurrencies continue to blur the lines between traditional investing and modern digital asset management, we should remain vigilant. Any significant growth in the sector needs to be approached with cautious optimism—after all, today’s best investment can just as easily transform into tomorrow’s cautionary tale.

Conclusion: Finding Balance in a Greedy Market

Investing in cryptocurrencies, just like the stock market, can be tremendously speculative. As we prepare for what might be another significant phase in the crypto markets, one thing is clear—maintaining a balanced perspective is key. I am a firm believer that informed and cautious investing can lead to prosperous outcomes, even amidst waves of greed. It is essential, therefore, to conduct thorough research, engage in solid due diligence, and above all, keep emotions in check.

As we navigate these turbulent waters, investors must remember that the thrill of potential gains must be carefully weighed against the very real risks of market corrections. Let’s embrace the opportunities while preparing to withstand the storms that may lie ahead.

Navigating the cryptocurrency market

Whether you are an experienced trader or just diving into this dynamic environment, never forget the importance of strategic planning and sticking to your investment principles.

“Investing is speculative. Your capital is at risk.”

Thus, as we delve further into the realms of cryptocurrency, we must harmonize our enthusiasm for this revolutionary asset class with the wisdom of historical market behaviors. Only then can we ride the waves without being swept away.