The Future of Crypto: How Global Liquidity and Regulation Will Shape the Industry

The world of cryptocurrency is constantly evolving, with new developments and innovations emerging every day. As the industry continues to grow and mature, it’s becoming increasingly clear that global liquidity and regulation will play a crucial role in shaping its future. In this article, we’ll explore the current state of the crypto market, the impact of global liquidity, and the regulatory landscape that’s taking shape.

The Current State of the Crypto Market

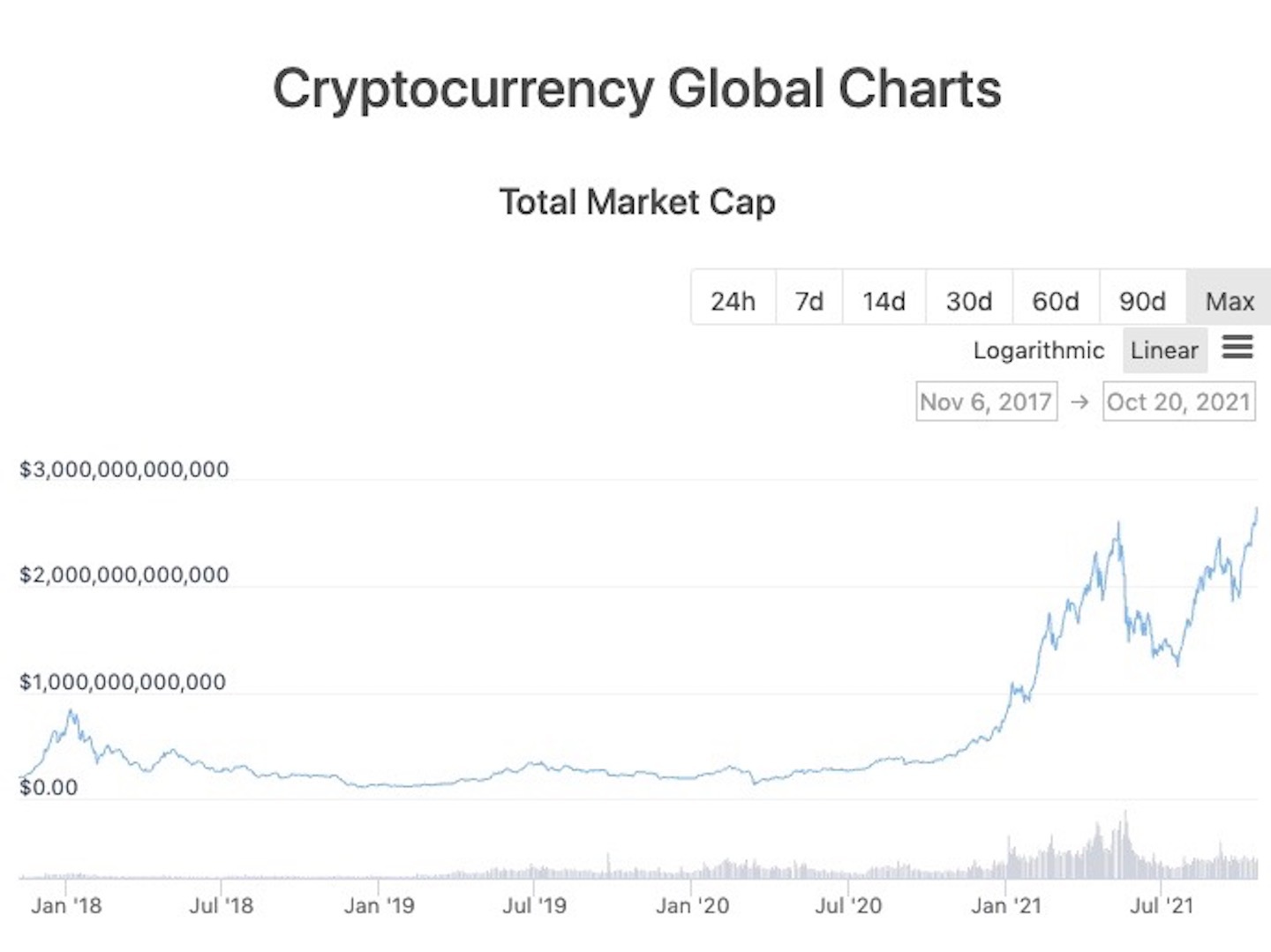

The crypto market has experienced significant growth in recent years, with the total market capitalization of all cryptocurrencies reaching over $2 trillion. However, the market has also been subject to significant volatility, with prices fluctuating wildly in response to various factors such as regulatory announcements, security breaches, and changes in global economic conditions.

Despite these challenges, the crypto market continues to attract new investors and users, with many seeing the potential for significant returns on investment. However, the market’s volatility and lack of regulation have also raised concerns among investors and regulators alike.

The Impact of Global Liquidity

Global liquidity refers to the availability of liquid assets, such as cash and other easily convertible assets, in the global economy. In the context of the crypto market, global liquidity can have a significant impact on prices and market volatility.

When global liquidity is high, it can lead to increased investment in the crypto market, driving up prices and reducing volatility. Conversely, when global liquidity is low, it can lead to decreased investment and increased volatility.

The Global Liquidity Index (GLI) is a measure of global liquidity that takes into account factors such as money supply, interest rates, and economic growth. According to the GLI, global liquidity has been increasing in recent years, which could have a positive impact on the crypto market.

The Regulatory Landscape

Regulation is playing an increasingly important role in the crypto market, with many governments and regulatory bodies around the world taking steps to establish clear guidelines and frameworks for the industry.

In the United States, for example, the Securities and Exchange Commission (SEC) has been actively engaged in regulating the crypto market, with a particular focus on initial coin offerings (ICOs) and other forms of crypto fundraising.

In Europe, the European Union’s Fifth Anti-Money Laundering Directive (AMLD5) has introduced new regulations for the crypto industry, including requirements for customer due diligence and reporting suspicious transactions.

Conclusion

The future of the crypto market will be shaped by a combination of factors, including global liquidity, regulation, and innovation. As the industry continues to evolve, it’s likely that we’ll see increased investment, adoption, and regulation.

While there are certainly challenges ahead, the potential rewards of investing in the crypto market are significant. As the industry continues to grow and mature, it’s likely that we’ll see increased mainstream adoption and recognition of the potential of cryptocurrency to transform the way we think about money and finance.

Global liquidity has been increasing in recent years, which could have a positive impact on the crypto market.

Global liquidity has been increasing in recent years, which could have a positive impact on the crypto market.

The total market capitalization of all cryptocurrencies has reached over $2 trillion.

The total market capitalization of all cryptocurrencies has reached over $2 trillion.