Bitcoin Mining Has Undergone a Significant Transformation Since the Last Halving

Every four years, we experience a bonus day in February, the United States elects a president (ideally one supportive of Bitcoin), the Olympics take place, and we witness a significant event called the Bitcoin halving. In the grand scheme of things, four years may seem relatively short. However, in the realm of Bitcoin mining, where changes in the geographical landscape, hash rate growth, and industry efficiency are big factors, a lot has occurred since the previous halving event.

The mining landscape has drastically changed since the last halving.

The mining landscape has drastically changed since the last halving.

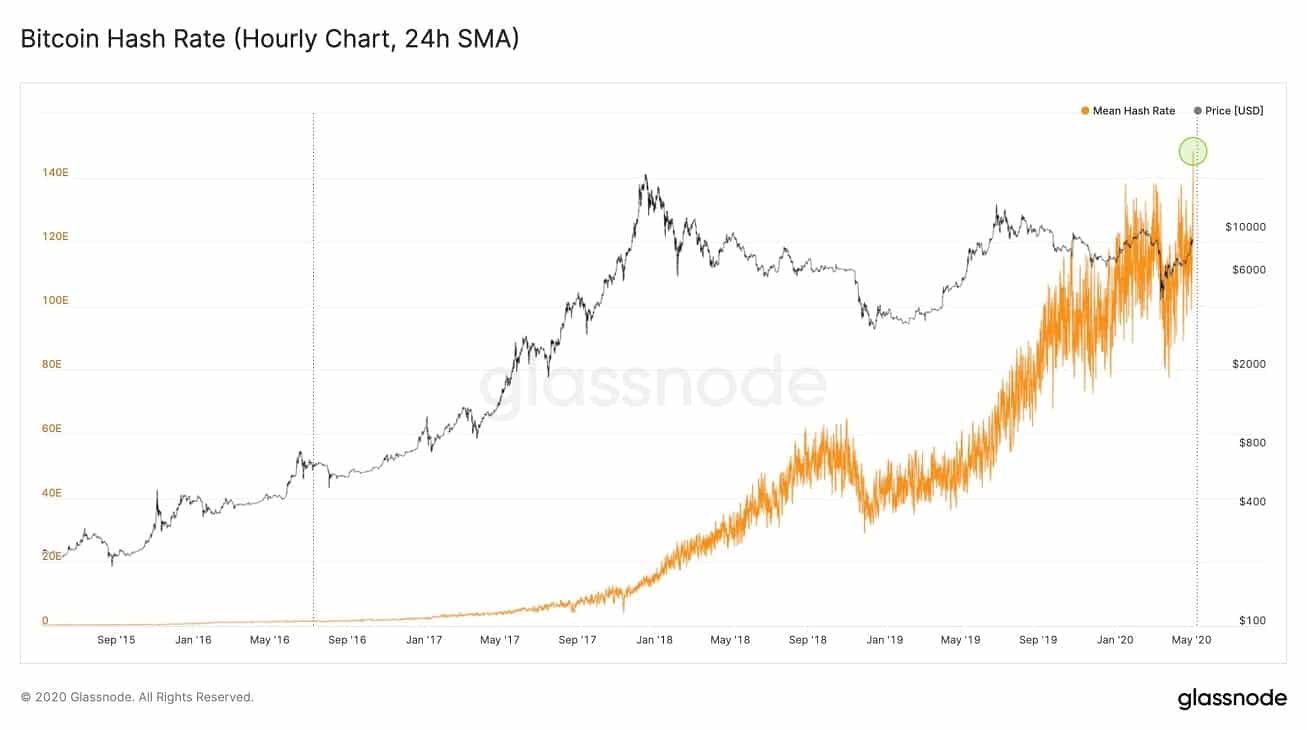

In 2020, we experienced the last halving during the height of the COVID lockdown, when many of my mining friends celebrated this epic occasion from afar, with hopes of celebrating IRL in four years. At that time, the price of Bitcoin hovered around $8,700, while the hash rate stood at approximately 120 EH/s. The majority of the hash rate was concentrated in China, and rumors regarding the possibility of a Chinese ban were merely rumors.

The price of Bitcoin and hash rate have reached unprecedented levels.

The price of Bitcoin and hash rate have reached unprecedented levels.

Today, we’re nearing the upcoming halving, with Bitcoin price and hash rate reaching unprecedented levels. It’s challenging to envision the landscape for the next halving in 2028.

Since the last halving, the exodus of China miners drastically changed the mining landscape. Miners have sought refuge in jurisdictions offering hospitality or opportunities for energy arbitrage, which became a pivotal metric for success. Several nation states, such as Bhutan, El Salvador, and even Venezuela for a short period, not only embraced miners but also devised strategies to set up mining operations themselves.

Miners have sought refuge in jurisdictions offering hospitality or opportunities for energy arbitrage.

Miners have sought refuge in jurisdictions offering hospitality or opportunities for energy arbitrage.

Texas emerged as a dominant mining hub, while Latin America and the Middle East saw growing interest and involvement in the mining sector. Going forward, the surge in hash rate across the Middle East and Africa will continue, and, based on announcements from the U.S.-listed companies, there is likely to be an increase of hash rate across North America. Miners will follow the cheapest forms of energy in jurisdictions that are economical and collaborative.

Maybe we will even experience hash rate seasonality again—this round unfolding in ERCOT markets versus rainy seasons in China.

Another major trend over the past cycle was the increase in institutional adoption. The long-awaited approval of Bitcoin ETFs in the U.S. played a significant role in legitimizing Bitcoin as an asset class within mainstream financial markets.

The long-awaited approval of Bitcoin ETFs in the U.S. played a significant role in legitimizing Bitcoin as an asset class within mainstream financial markets.

The long-awaited approval of Bitcoin ETFs in the U.S. played a significant role in legitimizing Bitcoin as an asset class within mainstream financial markets.

As we approach the next halving, it’s essential to reflect on the significant changes that have occurred in the mining landscape and the growth of institutional adoption. The future of Bitcoin mining looks promising, with miners adapting to new jurisdictions and energy sources, and institutional investors increasingly recognizing the potential of Bitcoin as a legitimate asset class.