Decoding Cryptocurrency: Your Essential Guide to Understanding Digital Currency

Cryptocurrency has moved from the fringes of finance to mainstream conversation, as its adoption skyrockets globally. With approximately 3.9% of the world owning some form of cryptocurrency, translating to over 300 million users as of 2021, it’s essential to demystify what this digital currency entails.

What is Cryptocurrency?

Cryptocurrency is fundamentally a digital form of currency that employs cryptographic security, allowing for reliable and secure transactions. Unlike traditional currencies, cryptocurrencies operate without a centralized authority governing their issuance or management. Their backbone is blockchain technology, a decentralized ledger that records all transactions transparently and securely.

An illustration of blockchain technology powering cryptocurrencies.

An illustration of blockchain technology powering cryptocurrencies.

Understanding Blockchain Technology

The term “blockchain” first gained traction with Bitcoin, the first successful implementation of this technology. Essentially, blockchain serves as a public ledger that documents all recorded transactions across numerous computers, making it virtually tamper-proof. This decentralized storage mechanism relies on consensus protocols such as proof of work to validate transactions, ensuring all participants in the network can trust the integrity of the information.

Keys to the Kingdom: Public and Private Keys

In the world of cryptocurrency, public and private keys play a crucial role in ensuring the security of transactions. Public keys act like email addresses, allowing users to receive cryptocurrency, while private keys function as passwords, granting access to one’s funds. It’s vital for users to safeguard their private keys diligently, as losing access could mean losing access to their entire crypto portfolio.

How Do Cryptocurrencies Function?

Cryptocurrencies thrive on a trifecta of mechanisms: account address, balance, and associated keys. Each cryptocurrency account is identified by a unique address, through which transactions are facilitated. Balances are recorded on the blockchain, offering visibility across the network, and keys ensure that only the rightful owner can manipulate their assets.

Buying Cryptocurrencies: A Step-by-Step Guide

For those eager to jump into the crypto market, purchasing cryptocurrencies can be done in a few straightforward steps. Popular methods include buying directly with fiat currency or utilizing cryptocurrency exchanges. Wallets, which can be either hardware or software, serve as digital spaces to store, send, and receive cryptocurrencies securely.

Different types of cryptocurrency wallets for secure transactions.

Different types of cryptocurrency wallets for secure transactions.

When buying cryptocurrencies, platforms like Coinbase or various exchanges offer users a plethora of options. They typically allow you to manage your assets through Contracts for Difference (CFDs), providing a versatile way to trade without owning the underlying asset.

“Trading these digital currencies can be incredibly rewarding, but it also involves a high degree of risk.”

Risk Awareness in Cryptocurrency Trading

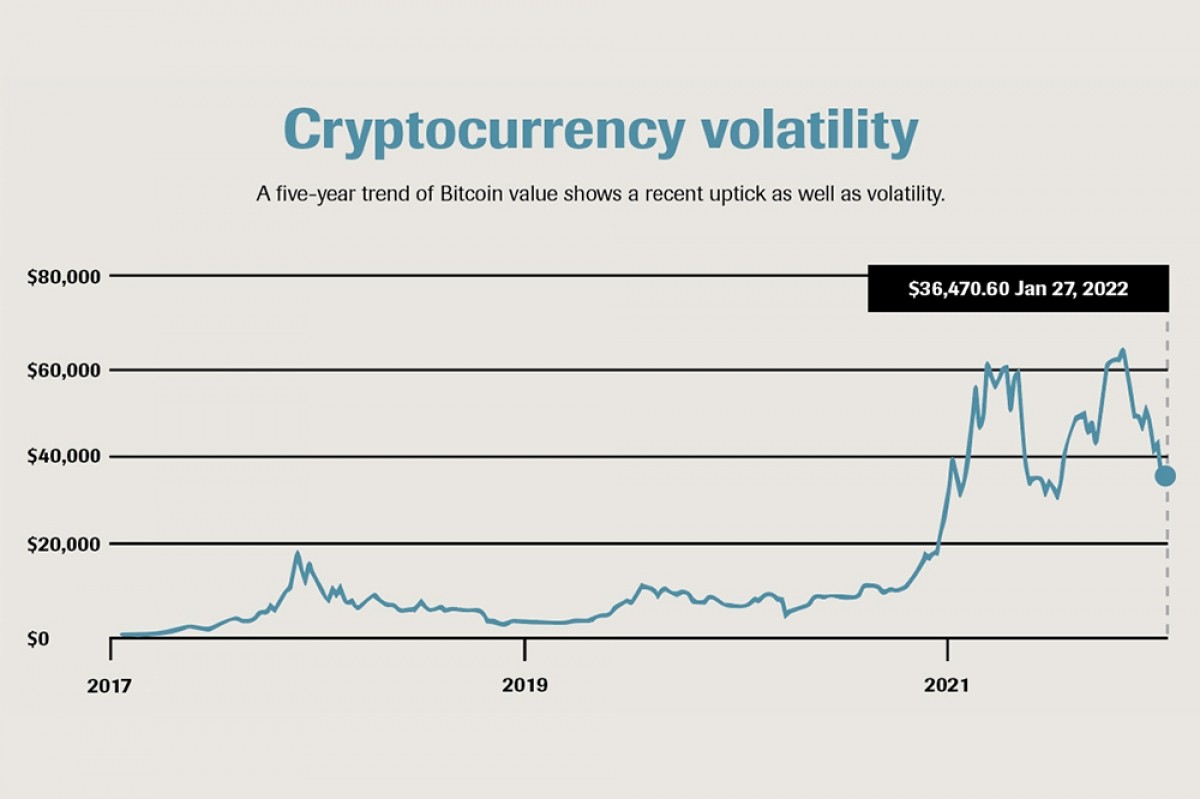

It’s important to approach crypto trading with caution, as highlighted by many experts. Investing in cryptocurrency involves high speculation and potential volatility, which can lead to substantial gains or losses. Beginners are encouraged to invest only what they can afford to lose, given the unpredictable nature of the markets.

Conclusion: The Future of Cryptocurrency

As cryptocurrency continues to gain traction, both new and experienced investors must familiarize themselves with its mechanics, benefits, and associated risks. With numerous resources available, understanding digital currencies can empower individuals to make informed decisions in an evolving financial landscape.

Stay updated with the latest trends and insights in the cryptocurrency market as this exciting realm continues to grow and innovate.

A snapshot of trending cryptocurrencies in today’s market.