The Cryptocurrency Market’s Dramatic Rebound: What’s Behind Bitcoin’s Surge Above $60,000?

The recent developments in the cryptocurrency market have been nothing short of remarkable. Bitcoin, the world’s most valuable digital currency, has surged above the $60,000 mark, leading to a significant increase in the overall market capitalization to $2.2 trillion. This impressive rebound has left investors and analysts alike wondering what’s behind this sudden surge.

A Positive Shift in Investor Sentiment

The latest trends in the cryptocurrency market indicate a positive shift in investor sentiment. Bitcoin’s price has not only surpassed the $60,000 mark but has also shown a significant increase of six percent compared to the previous day. This upward trend has been accompanied by a notable rise in the prices of other digital currencies, including Ethereum, which has seen a ten percent increase.

The Rise of Altcoins: Toncoin and Sui Take Center Stage

Among the top-performing altcoins are Toncoin and Sui, which have shown remarkable growth. Toncoin has witnessed an impressive increase of over eleven percent, while Sui has seen a staggering rise of nearly twenty-eight percent. These developments demonstrate the dynamic nature of the cryptocurrency market, where new players are emerging and making a significant impact.

Long-Term Projections and Investor Optimism

Despite a dramatic decline in the first week, experienced investors remain optimistic about the long-term prospects of the cryptocurrency market. Experts like Dr. Profit predict that Bitcoin could reach between $180,000 and $220,000 within a year. Such projections highlight the importance of taking a long-term view when investing in cryptocurrencies.

The Impact of Cryptocurrencies on Weak Fiat Currencies

The growing acceptance of cryptocurrencies like Bitcoin and stablecoins poses a significant threat to weak fiat currencies, particularly in emerging markets. According to the Crypto Valley Journal, these digital currencies could undermine the existing economic structures and lead to significant political and economic consequences.

Bitcoin Cash: Opportunities and Risks for Investors

Another interesting development is the emergence of Bitcoin Cash (BCH), which enables faster transactions through larger block sizes. Investors can generate attractive returns through trading or lending, but they must also consider the associated risks. The limited supply of coins provides a certain level of protection against market manipulation, making BCH an attractive option for investors interested in the cryptocurrency market.

Conclusion

The recent trends in the cryptocurrency market underscore the dynamic nature of digital assets and their impact on the global economy. Investors must remain cautious and keep a close eye on both the opportunities and risks associated with investing in cryptocurrencies. As the market continues to evolve, it’s essential to take a long-term view and make informed decisions.

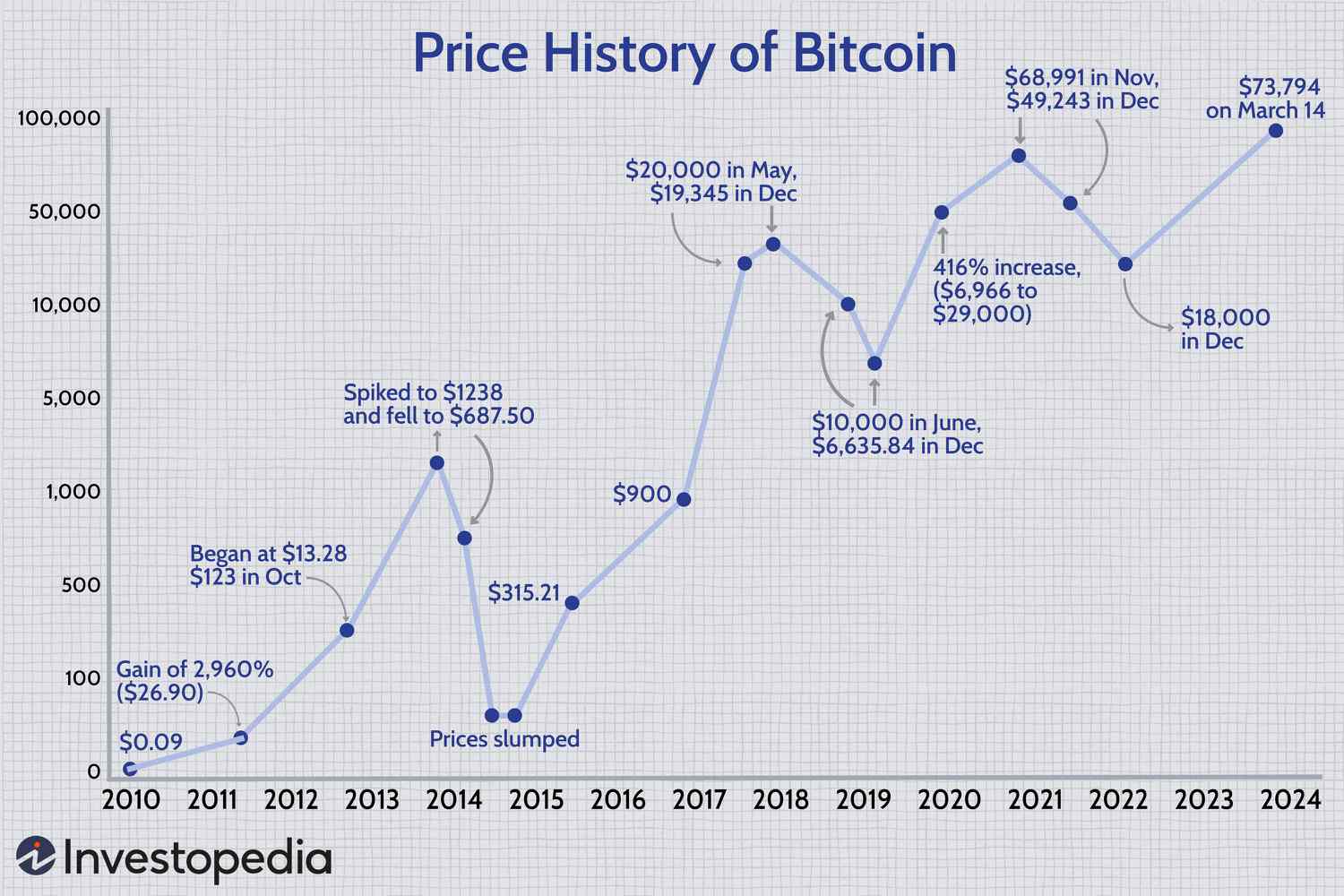

Image: Bitcoin’s price surge above $60,000

Image: Cryptocurrency market trends

Image: Investors watching market trends

Image: Bitcoin Cash logo