The Crypto Rebound: A Rocky Road Ahead?

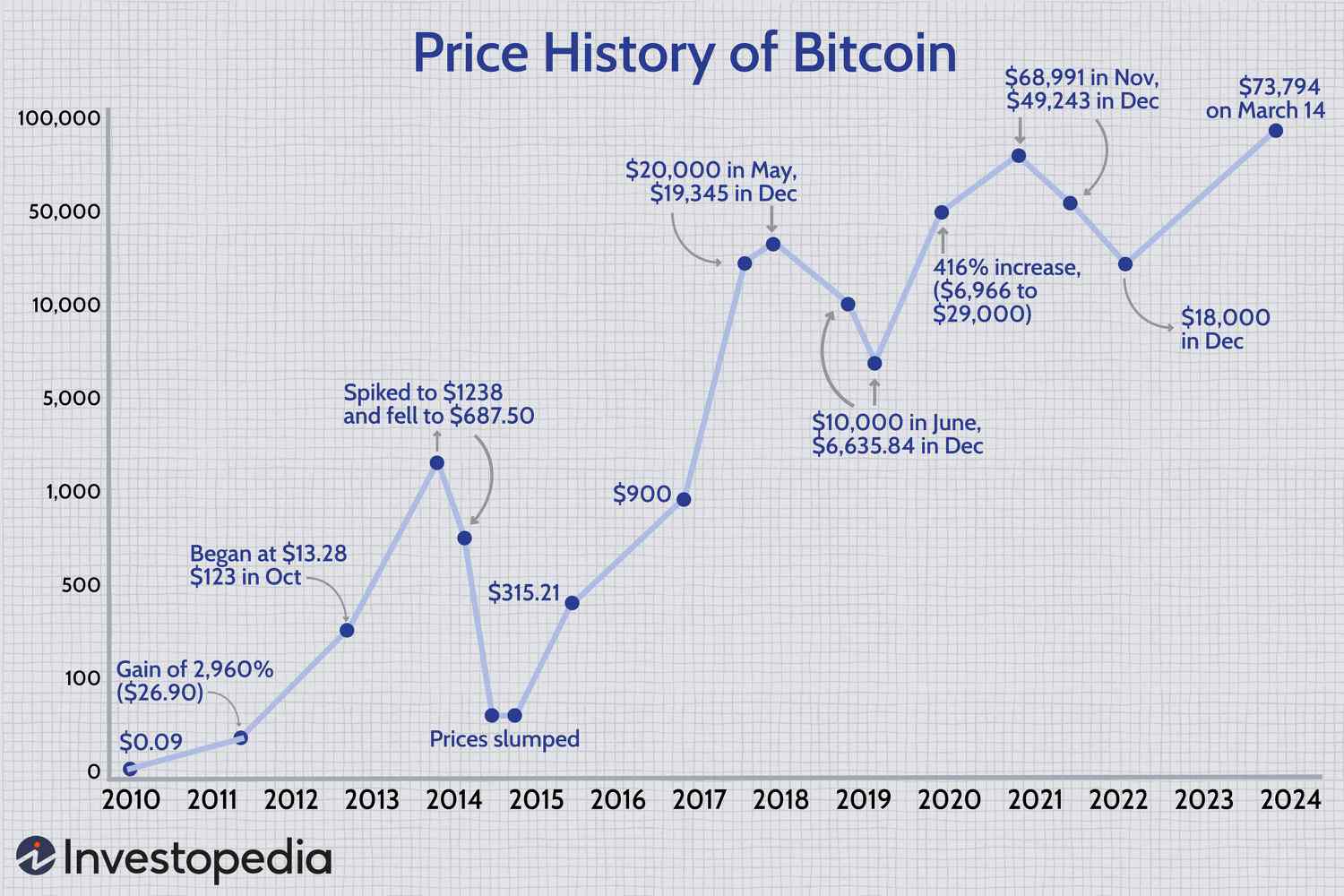

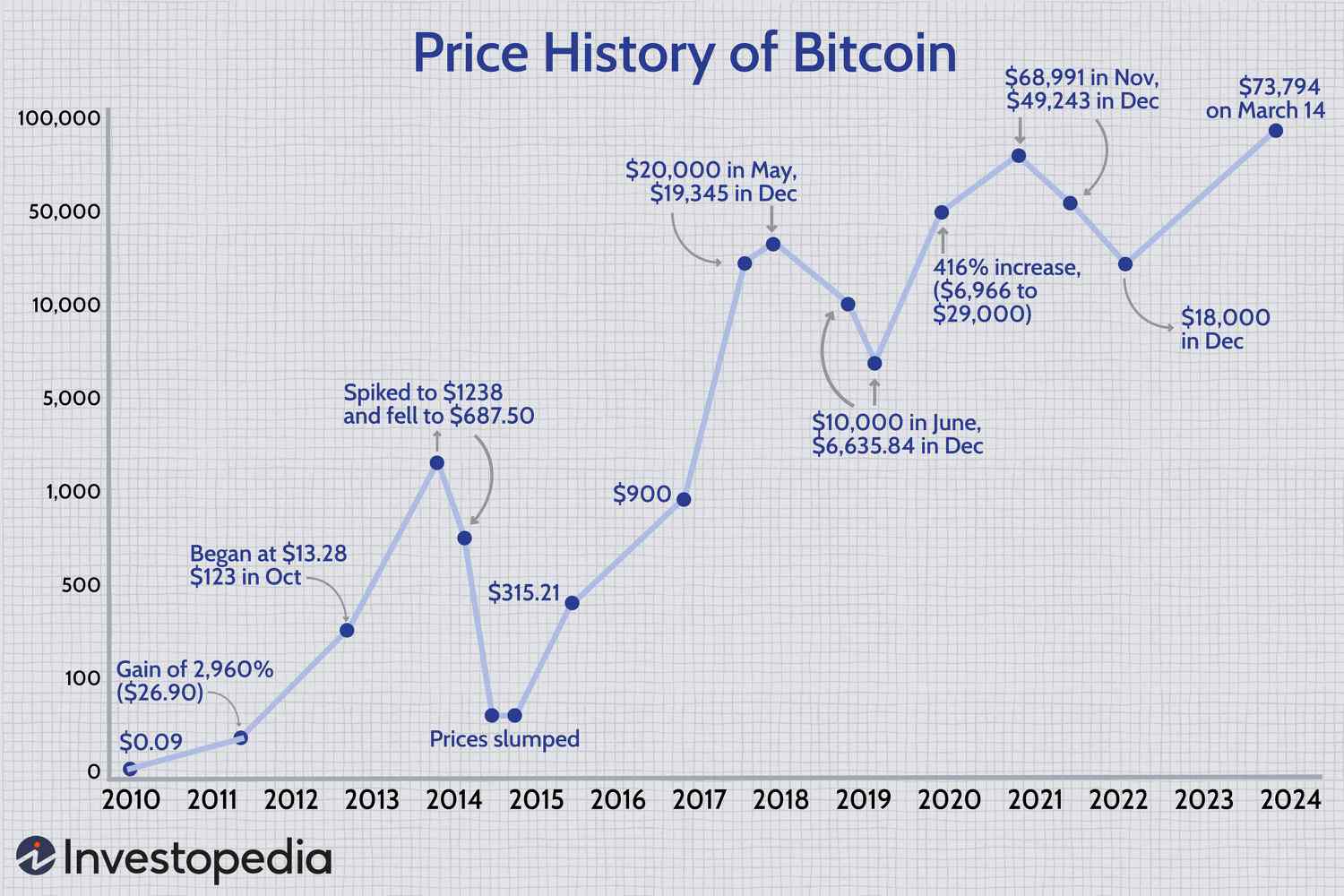

As I sit down to write this article, I can’t help but think of the rollercoaster ride that is the crypto market. One day, it’s soaring to new heights, and the next, it’s plummeting back down to earth. The latest development in this saga is the news that Bitcoin’s Mt. Gox is set to return around $8 billion of Bitcoin to creditors in stages. This has sparked concerns about a potential wall of supply hitting the market, which could further dampen the already fragile crypto rebound.

The crypto market has been on a wild ride lately.

The crypto market has been on a wild ride lately.

The crypto faithful have been predicting that Bitcoin will reach $100,000, but with the latest developments, I’m not so sure. The signs are not looking good. German government disposals of seized Bitcoin and waning inflows into dedicated US exchange-traded funds are just a few of the red flags that have me questioning the sustainability of this rebound.

The crypto mining industry has been a major contributor to the crypto market’s growth.

The crypto mining industry has been a major contributor to the crypto market’s growth.

I’m not saying that the crypto market is doomed, but I do think that we need to take a step back and reassess our expectations. The crypto market is still in its infancy, and it’s going to take time for it to mature. We need to be realistic about the challenges that lie ahead and not get caught up in the hype.

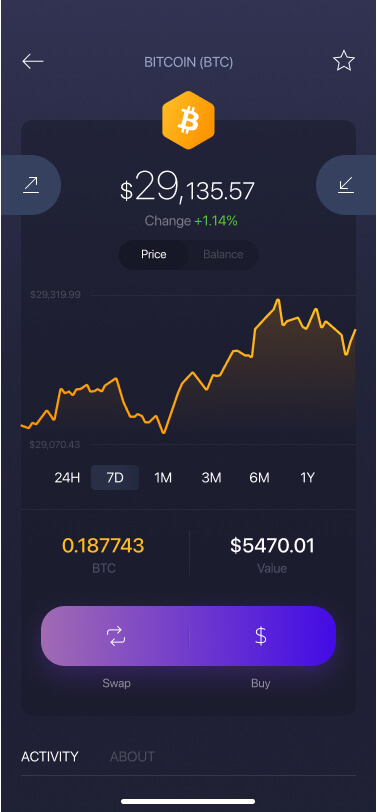

The rise of crypto wallets has made it easier for people to invest in the crypto market.

The rise of crypto wallets has made it easier for people to invest in the crypto market.

In conclusion, the crypto rebound is not going to be easy. There are going to be ups and downs, and we need to be prepared for them. But with caution and a clear head, I believe that we can navigate these choppy waters and come out stronger on the other side.