The Crypto Market Takes a Hit: What’s Behind the Sudden Slump?

The cryptocurrency market has taken a sudden downturn, with Bitcoin, Ethereum, and Dogecoin leading the decline. As of 3 p.m. ET, the entire crypto market is down 3.9% over the past 24 hours, with Bitcoin, Ethereum, and Dogecoin declining 4.5%, 5.1%, and 7%, respectively. But what’s driving this sudden slump?

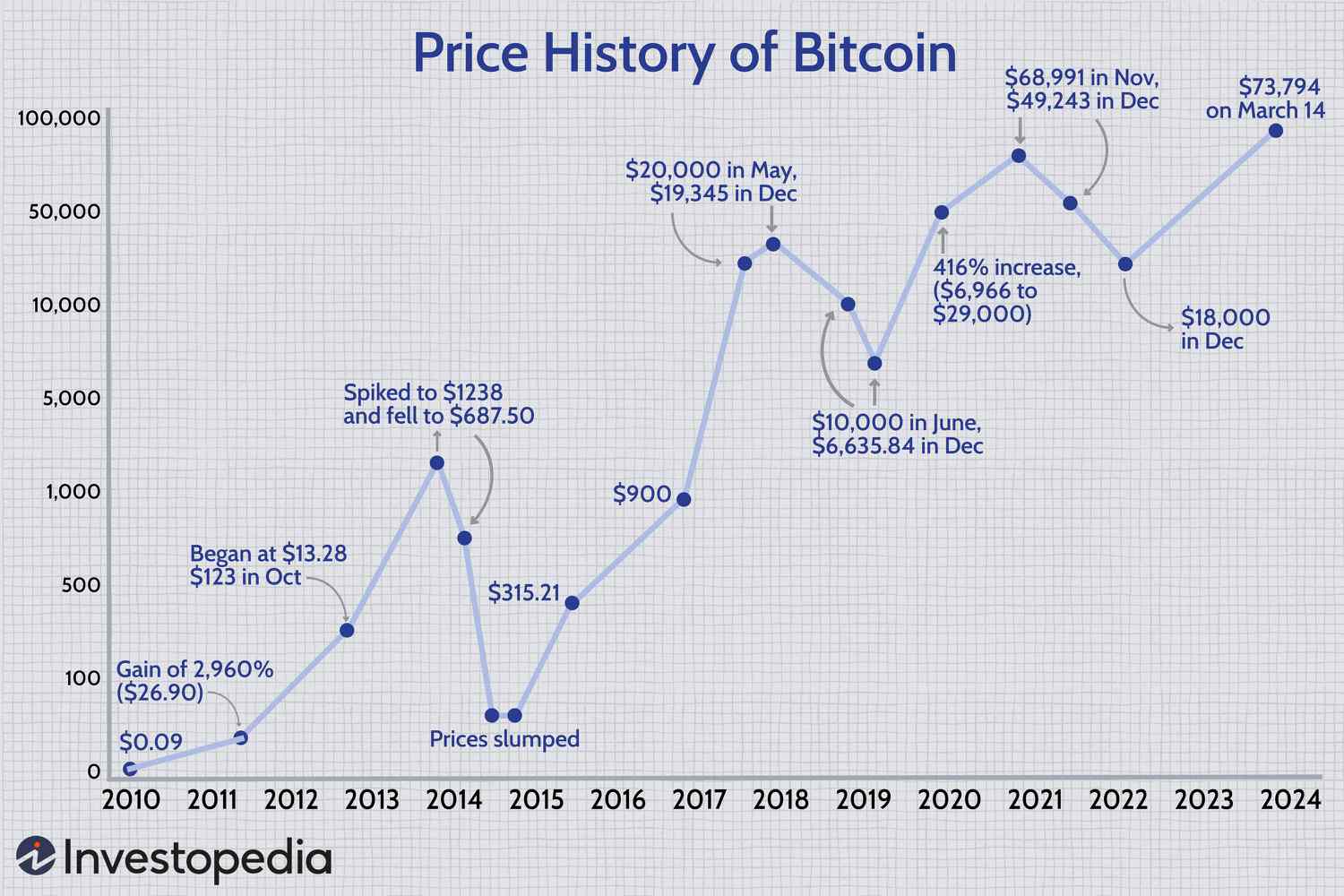

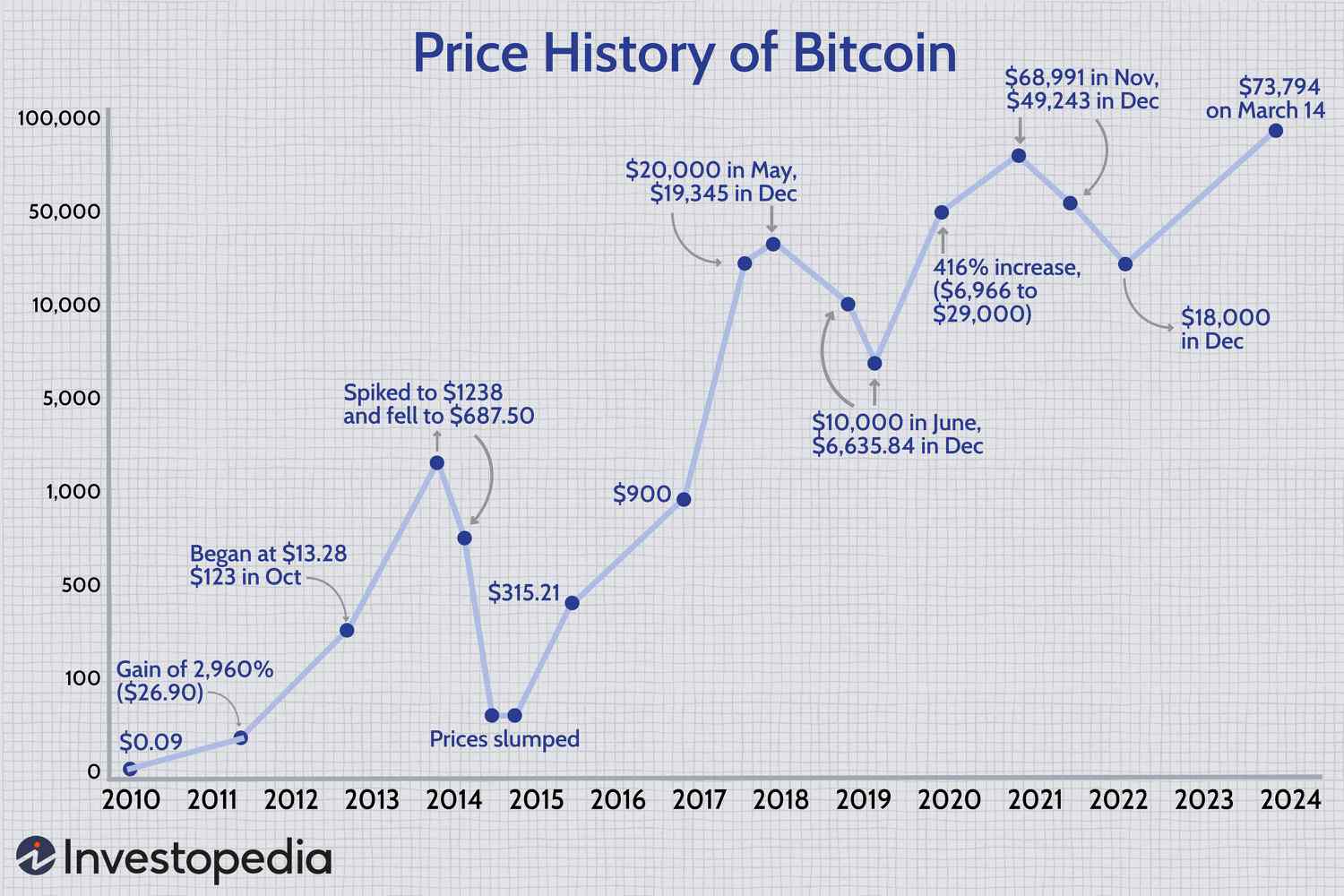

A graph showing the decline in cryptocurrency prices

A graph showing the decline in cryptocurrency prices

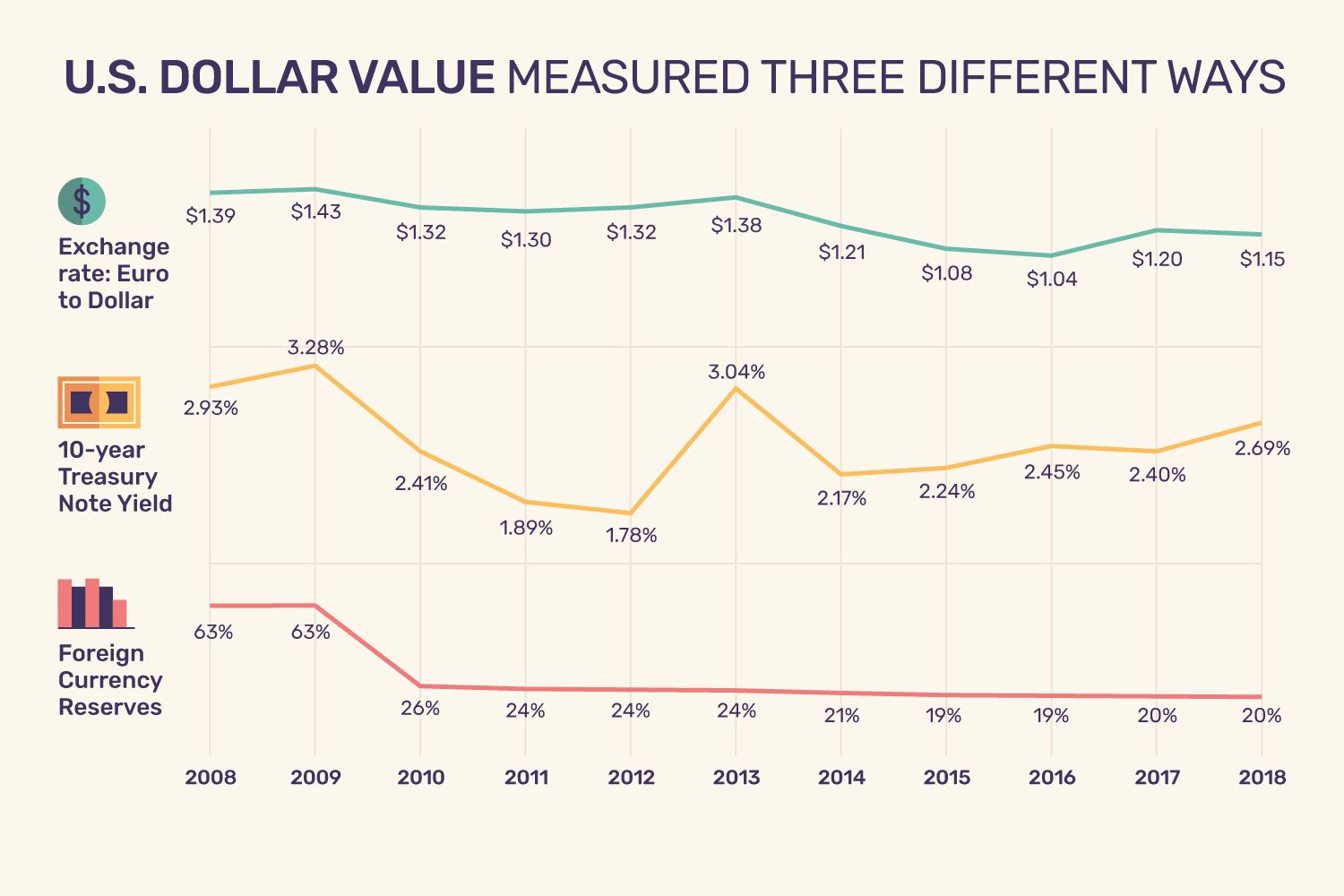

The Dollar’s Strength Weighs on Cryptocurrencies

The strengthening U.S. dollar is a major contributor to the decline in cryptocurrency prices. As the dollar strengthens, it puts downward pressure on commodities, including cryptocurrencies. This is because many cryptocurrencies, such as Bitcoin and Ethereum, are benchmarked against the dollar. When the dollar strengthens, it becomes more expensive to buy these cryptocurrencies, leading to a decline in their value.

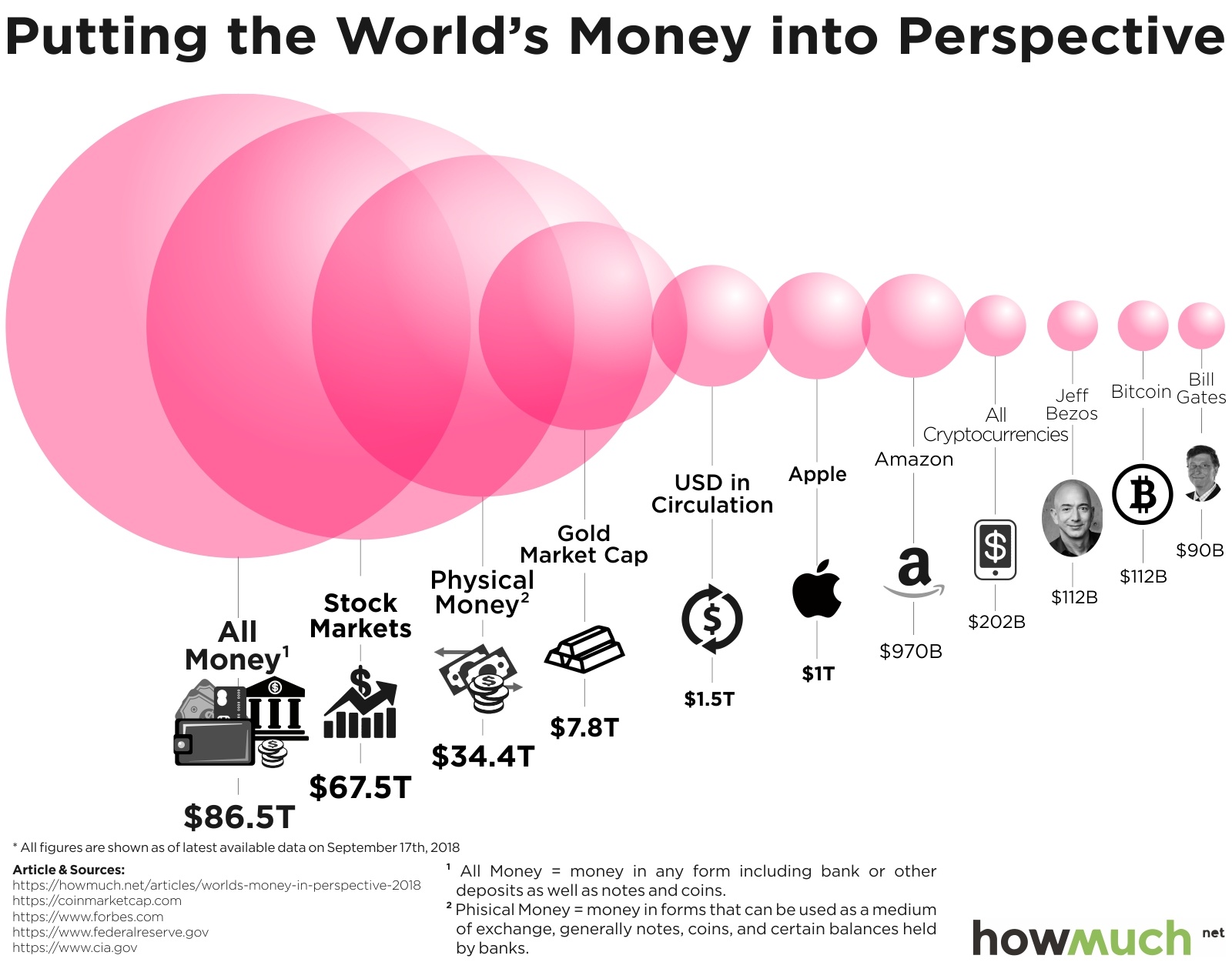

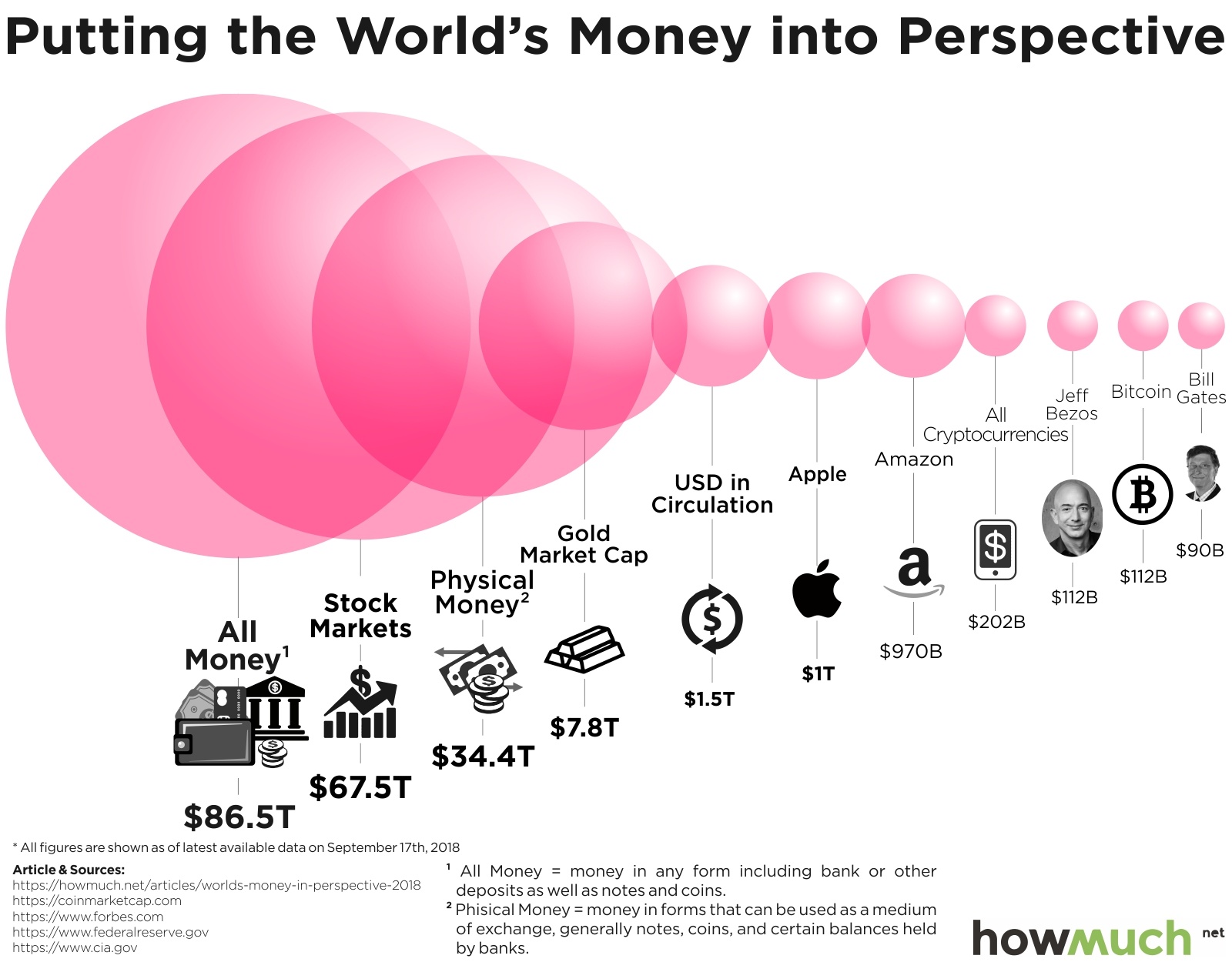

A graph showing the strengthening U.S. dollar

A graph showing the strengthening U.S. dollar

Cooling Demand for Bitcoin ETFs

Another factor contributing to the decline in cryptocurrency prices is the cooling demand for Bitcoin ETFs. According to recent data, net daily outflows from Bitcoin ETFs have reached $1.1 billion, hurting the overall thesis that strong demand and an upcoming halving event for Bitcoin could lead to price outperformance. This decline in demand is not only affecting Bitcoin but also Ethereum, as investors become cautious about the entire cryptocurrency market.

A graph showing the decline in Bitcoin ETF demand

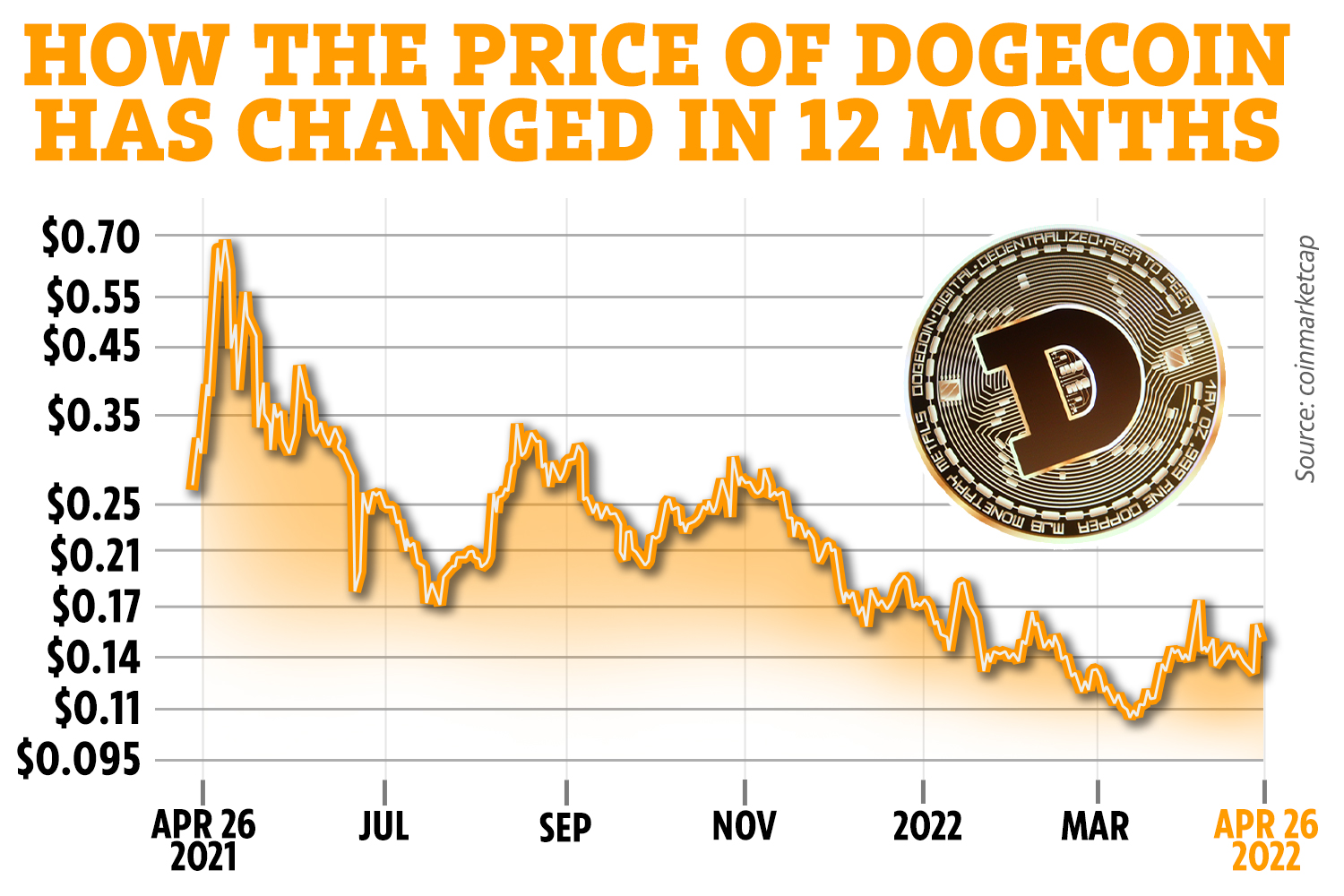

Dogecoin’s Decline: A Reality Check

Dogecoin, the world’s largest meme token, has also taken a hit, declining 7% in the past 24 hours. While this decline may seem significant, it’s essential to put it into perspective. Dogecoin recently hit a fresh two-year high, and its decline is likely due to its speculative nature. As a more speculative asset, Dogecoin is prone to larger price swings, making its decline less surprising.

A graph showing Dogecoin’s price movement

A graph showing Dogecoin’s price movement

Is the Party Over?

The recent decline in cryptocurrency prices has raised concerns about the sustainability of the current rally. However, it’s essential to consider this decline in the broader context. Cryptocurrencies are known for their volatility, and a 5% to 7% daily decline is not uncommon. While it’s essential to monitor incoming macro data and spot ETF inflows, it’s too early to say whether this decline marks the end of the current rally.

A graph showing the cryptocurrency rally

A graph showing the cryptocurrency rally

In conclusion, the recent decline in cryptocurrency prices is a reminder of the market’s volatility. While it’s essential to be cautious, it’s also important to consider the broader context and not overreact to short-term fluctuations.