The Crypto Industry: A Wild Ride of Ups and Downs

It’s been a wild two years in the crypto industry, with its fair share of ups and downs. From the final hurrah of an earlier crypto bubble to the full-blown catastrophe of industry marquee names collapsing in bankruptcy and scandal, it’s been a rollercoaster ride. The high point of this era was the trial of Sam Bankman-Fried, which marked a turning point in the industry’s fortunes.

A bleak period for the crypto industry

A bleak period for the crypto industry

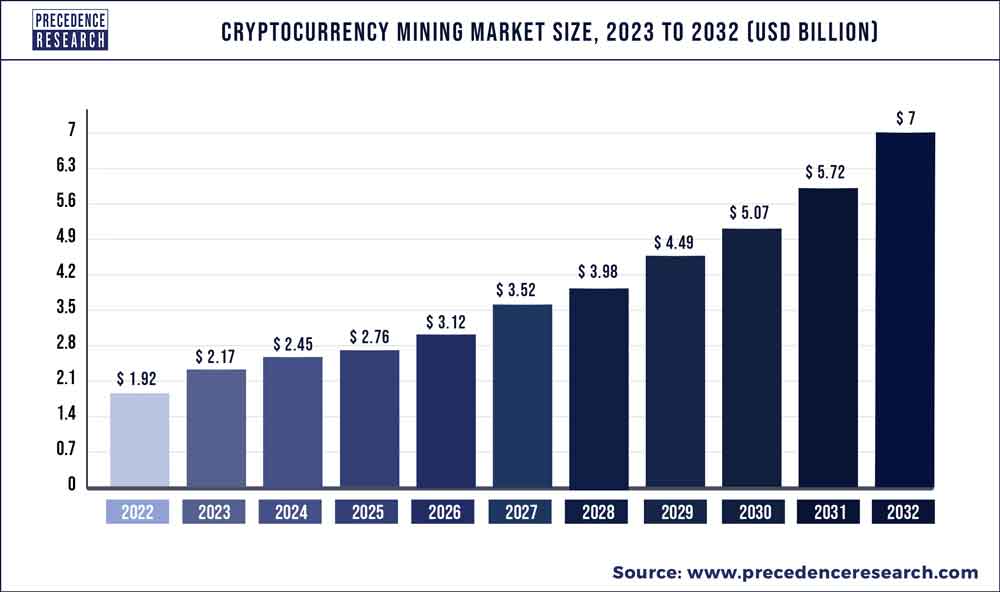

In mid-2023, the industry was in the trough of Crypto Winter, with even many longtime believers asking if it was time to pack in this blockchain thing for AI. But then, lo and behold, the industry sprang back bigger and richer than ever, turbo-charged by an influx of Wall Street capital and the launch of Bitcoin ETFs. Coinbase CEO Brian Armstrong and other crypto OGs who long eschewed the ways of Washington, D.C., learned to play its game and are now a fearsome political force.

The Crypto Industry Today

Today, the crypto industry is a far cry from its humble beginnings in open-air markets. With a market capitalization of over $2.4 trillion, it’s a force to be reckoned with. But with great power comes great responsibility, and the industry is still grappling with the implications of its newfound influence.

A critical moment for Bitcoin options

This Friday, around 107,000 Bitcoin options contracts will expire, with a notional value of $6.6 billion. The put/call ratio is 0.5, meaning that twice as many long (call) contracts are expiring as shorts (puts). The max pain point, or price at which most losses will be made, is $57,000, which is around $4,000 lower than current spot prices.

The Impact of Options Expiry

The expiry of these options contracts is likely to have a significant impact on the crypto market. With a notional value of over $10 billion, it’s a critical moment for Bitcoin and Ethereum options. The implied volatility, a measure of future volatility from expiring contracts, did not show a significant rise, with BTC below 50% IV for all major terms.

A critical moment for Ethereum ETFs

A critical moment for Ethereum ETFs

Ethereum ETF news will be clearer early next month, and the implied volatility will be under strong downward pressure for a few days after today’s delivery. The total market capitalization has recovered a little from its dip earlier this week to hover around the $2.4 trillion mark. However, sentiment remains bearish, and markets have been downtrending throughout June.

Conclusion

The crypto industry has come a long way in two years, from the depths of Crypto Winter to the heights of a $2.4 trillion market capitalization. But with great power comes great responsibility, and the industry must navigate the implications of its newfound influence. The expiry of Bitcoin and Ethereum options contracts is a critical moment for the market, and only time will tell what the future holds.