The Bitcoin Price Boom: What’s Next After Ethereum ETF Approval?

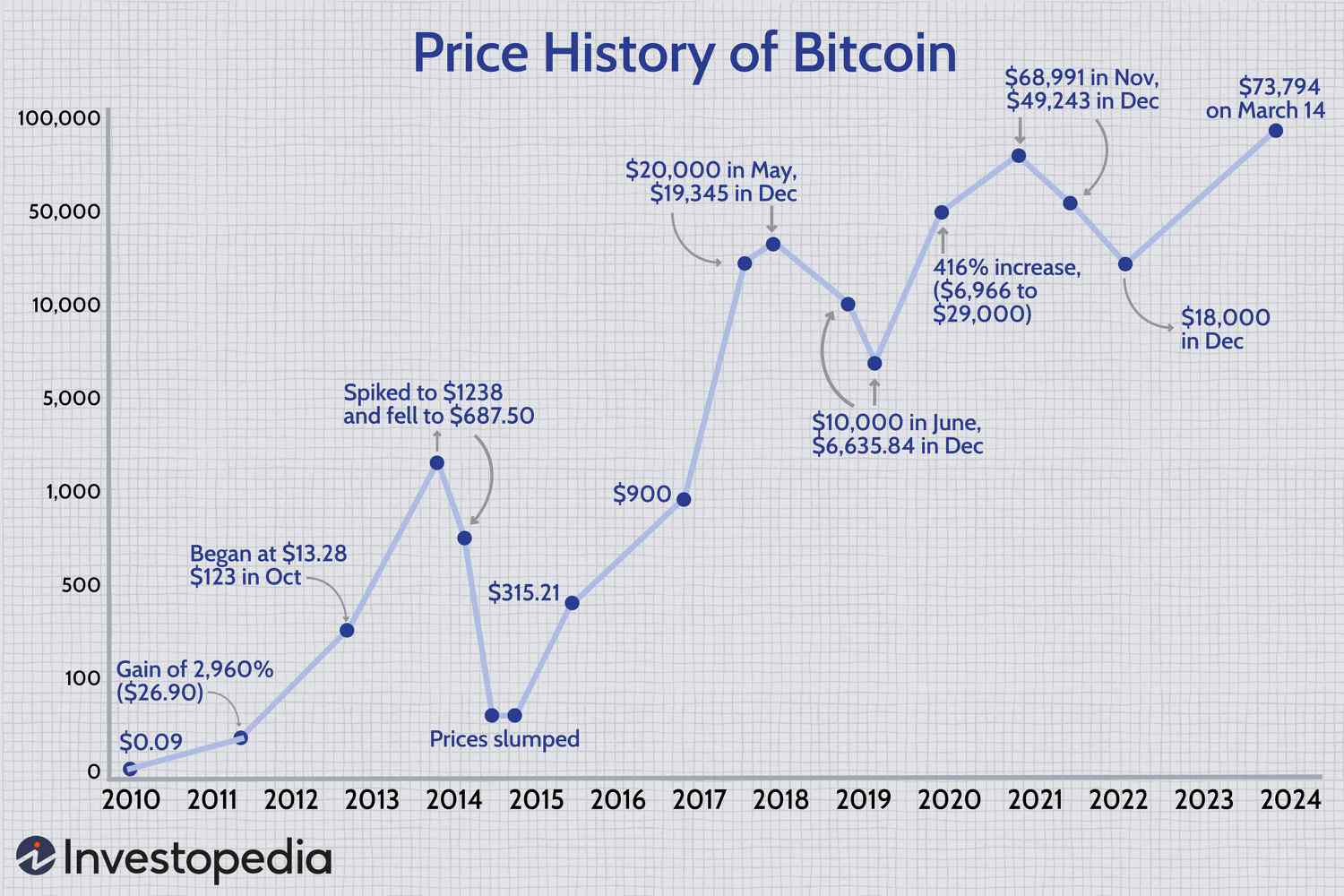

The bitcoin price has rebounded to its all-time highs of around $70,000 per bitcoin, largely due to the arrival of Wall Street spot exchange-traded funds (ETFs). The Federal Reserve could be about to turbocharge the bitcoin price even further. As China quietly lays the groundwork for a Hong Kong bitcoin and ethereum ETF boom of its own, BlackRock’s head of crypto has revealed what the world’s largest asset manager sees next for bitcoin, ethereum, and crypto.

Bitcoin price surges to all-time highs

Bitcoin price surges to all-time highs

“For our clients, their interest overwhelmingly has been in bitcoin, a little bit in ethereum, and not a whole lot in that longer tale of 10,000-plus assets,” Robert Mitchnick, head of crypto at BlackRock, told Bloomberg ahead of the Wall Street ethereum ETF being approved this week.

Ethereum ETF approval creates an “opportune moment” for bitcoin

Ethereum ETF approval creates an “opportune moment” for bitcoin

BlackRock’s IBIT spot bitcoin ETF has pulled in almost $16 billion since January, topping the other recently approved bitcoin ETFs and becoming one of the fastest-growing ETFs of all time. “I can’t overstate how powerfully attractive that is to every investor,” Mitchnick said. “I’m we’re probably going to see people come over from other countries who are big investors just to get that; it’s just hard to compete with that.”

BlackRock’s IBIT spot bitcoin ETF pulls in almost $16 billion

BlackRock’s IBIT spot bitcoin ETF pulls in almost $16 billion

Speculation has ramped up following the surprise ethereum ETF approval that Ripple’s XRP or one of the many ethereum rivals such as solana or avalanche could be next in line for a Wall Street spot ETF. “Certainly, there’s some great projects out there in that larger group of assets, but there’s also been a lot of pretty frivolous projects,” Mitchnick, who worked at XRP developer Ripple in 2017, said, adding it’s “still early.”

Ethereum rivals such as solana or avalanche could be next in line for a Wall Street spot ETF

Ethereum rivals such as solana or avalanche could be next in line for a Wall Street spot ETF

“A lot of tokens that have been flash in the pan and they’ve come and gone, and there’s been you know hype associated with them that hasn’t been backed up by real economic substance, so it’s going to be a long journey for some of the rest of crypto to really start establishing product market fit and economic use cases before they start to I think cross that chasm into what we’ve seen obviously bitcoin become,” Mitchnick said.

The crypto market is expected to continue growing

The crypto market is expected to continue growing

This week, the U.S. Securities and Exchange Commission (SEC) took traders and the crypto industry off guard when it green-lit a number of ethereum ETFs, expected to begin trading over the next few months. It’s thought the SEC’s unexpected approval could have been the result of political pressure as crypto takes center stage in the looming 2024 U.S. presidential race.

The SEC’s unexpected approval could have been the result of political pressure

The SEC’s unexpected approval could have been the result of political pressure

“For other coins [such as] solana [and] XRP) markets will look ahead to their eventual ETF status as well, albeit this is likely a 2025 story not a 2024 one,” Geoffrey Kendrick, head of crypto at Standard Chartered, said in an emailed note. “So for me, for now, bitcoin and ethereum dominance will rise with selective ’next in line’ winners as well.”

Bitcoin and ethereum dominance will rise with selective ’next in line’ winners

Bitcoin and ethereum dominance will rise with selective ’next in line’ winners

As the crypto market continues to grow, it’s clear that bitcoin and ethereum are leading the charge. But what’s next for the rest of the crypto market? Only time will tell.

The future of crypto is bright

The future of crypto is bright