The Bitcoin Halving: What’s Next for Cryptocurrencies?

The much-anticipated Bitcoin halving has come and gone, leaving many investors wondering what’s next for the cryptocurrency market. While prices have barely budged since April 19, 2024, the long-term effects of Bitcoin halvings are well-documented, often leading to substantial price increases in the following months.

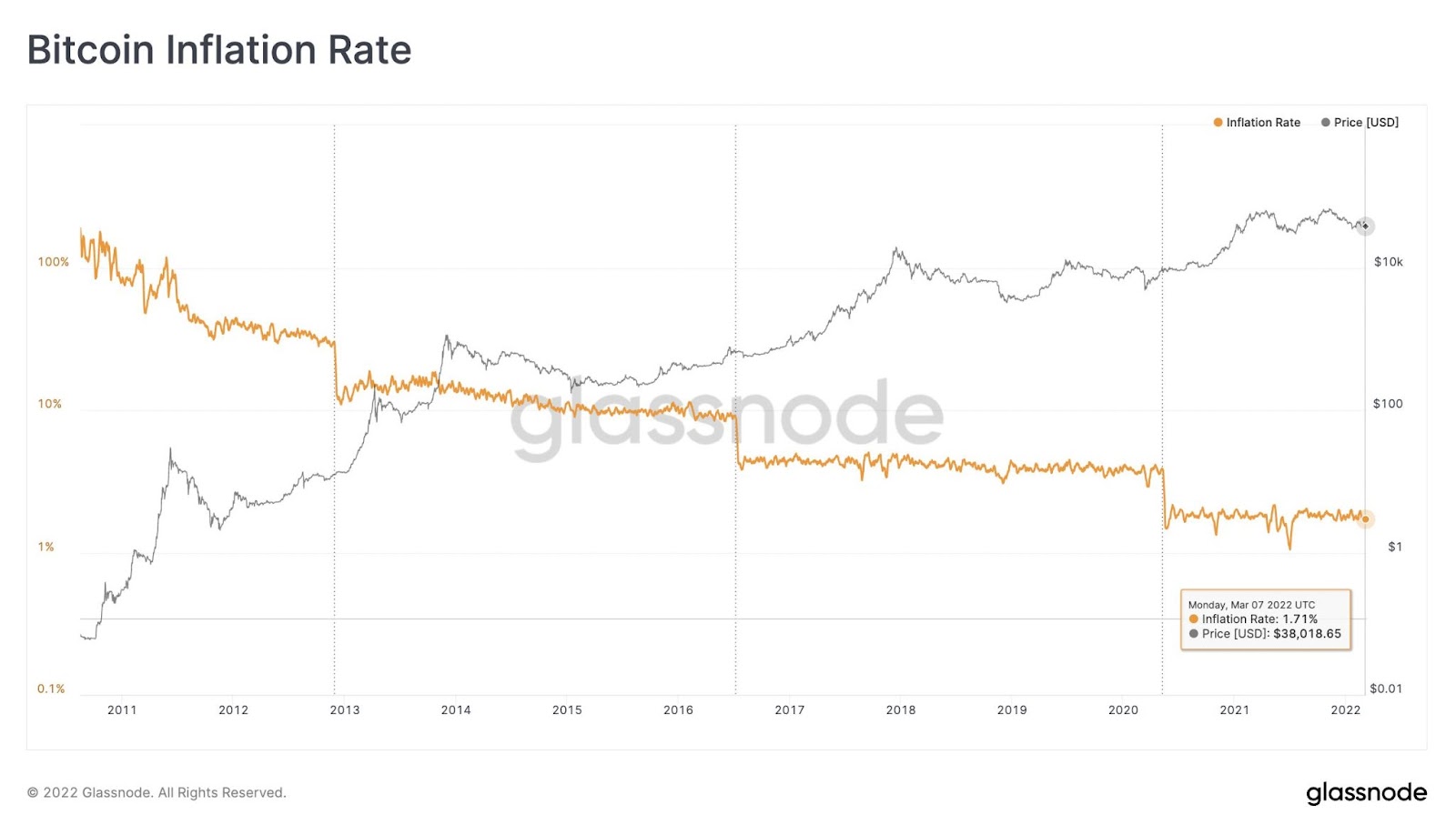

The Bitcoin halving has lowered the block reward from 6.25 to 3.125 digital coins, reducing the effective inflation rate to 0.85%.

In this article, we’ll explore the implications of the Bitcoin halving and highlight two cryptocurrencies that should be on your radar right now.

The Classic Bitcoin Play

You can’t go wrong with a classic. The leader of cryptos has just undergone its fourth halving, cutting the block reward from 6.25 to 3.125 digital coins. The lower coin-creation rate lowers Bitcoin’s effective inflation rate, which now stands at a prudent 0.85%. In comparison, the mining and recycling rates of physical gold result in a 3.1% annual supply-side inflation for the traditional value-storage leader.

Bitcoin’s inflation rate is now lower than gold’s, making it an attractive option for institutional investors.

Bitcoin’s inflation rate is now lower than gold’s, making it an attractive option for institutional investors.

Historically, Bitcoin halvings have set the stage for significant price increases, even if the effects aren’t immediate. Think of it like planting a seed. The fruits might not be visible yet, but they’re growing under the surface.

Polkadot: The Web3 Revolution

The official blockchain network and cryptocurrency of the Web3 Foundation has had a bumpy ride in 2024. Polkadot prices are blowing in the wind, swooning and soaring by turns as investors await the Web3 revolution.

Polkadot aims to be the backbone of Web3, enabling seamless blockchain interoperability.

But here’s the thing about Polkadot: It’s a project with grand ambitions. Its ability to help different blockchains interoperate seamlessly could be game-changing. Polkadot will be the digital glue that holds the Web3 architecture together, making the most of each blockchain system’s unique strengths in a single app-writing framework.

The current price dip presents a potential buying opportunity for investors who believe in Web3’s transformative power. As the ecosystem matures and adoption increases, the Polkadot token could see substantial gains.

Luck Favors the Prepared

The crypto market may look quiet after the halving, but there’s plenty of action beneath the surface. Bitcoin offers stability and proven post-halving growth, Polkadot presents a bet on future tech, and both are poised for robust price gains in the next year or two.

Keep these cryptos on your watchlist, and don’t be afraid to invest your cash in these newfangled digital assets. Remember, nobody knows exactly when they will soar again, as they did four years ago.