Bitcoin’s Upcoming Halving: What Investors Need to Know

The crypto space is no stranger to price volatility and technical evolutions. Since 2022, the sector has evolved and matured rapidly, with spot bitcoin ETFs attracting the majority of attention and investment. However, technical improvements continue to occur in rapid succession, driving operational improvements that lower costs and allow increased development over time.

Bitcoin mining operations are set to change

Bitcoin mining operations are set to change

The Ethereum blockchain and community continue to drive operational improvements that lower costs and will allow increased development over time. Specifically, the lowering of gas fees via the Dencun upgrade will allow smart contracts to expand even more rapidly than anticipated. As a result, the potential for enterprise adoption, as well as blockchain-based organizations such as DAOs, will continue to benefit.

“The halving will almost certainly have an effect on the crypto sector, both directly and indirectly, and investors would be well advised to monitor the effects both in the short and long term.”

Simultaneously, stablecoins have hit market capitalization levels not seen since 2021, while NFTs continue to make a resurgence following a catastrophic collapse during the previous bull market. One technical upgrade, however, stands apart and distinct from others in terms of the speculation and impact it might have; the bitcoin halving.

Impact on Miners and Investors

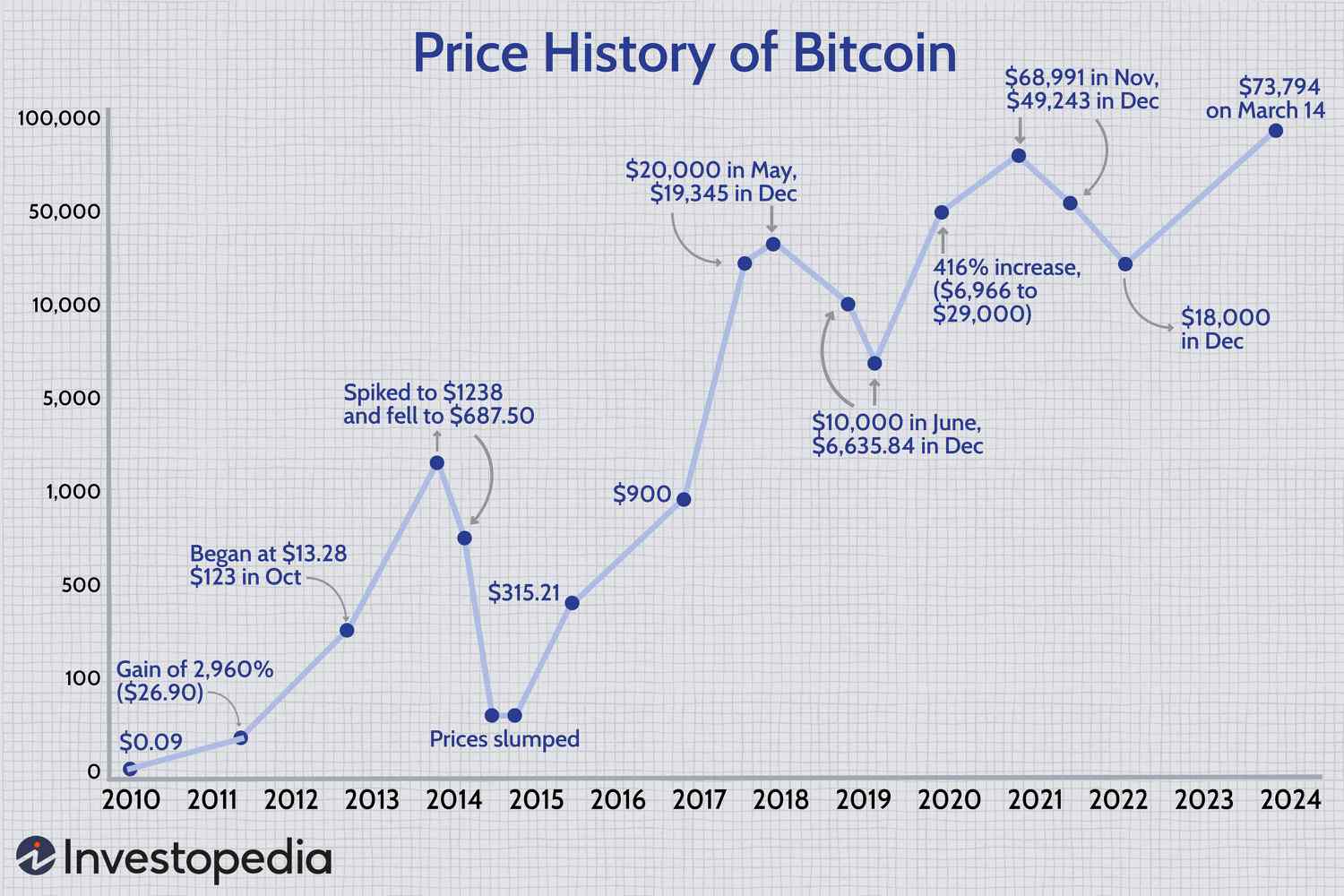

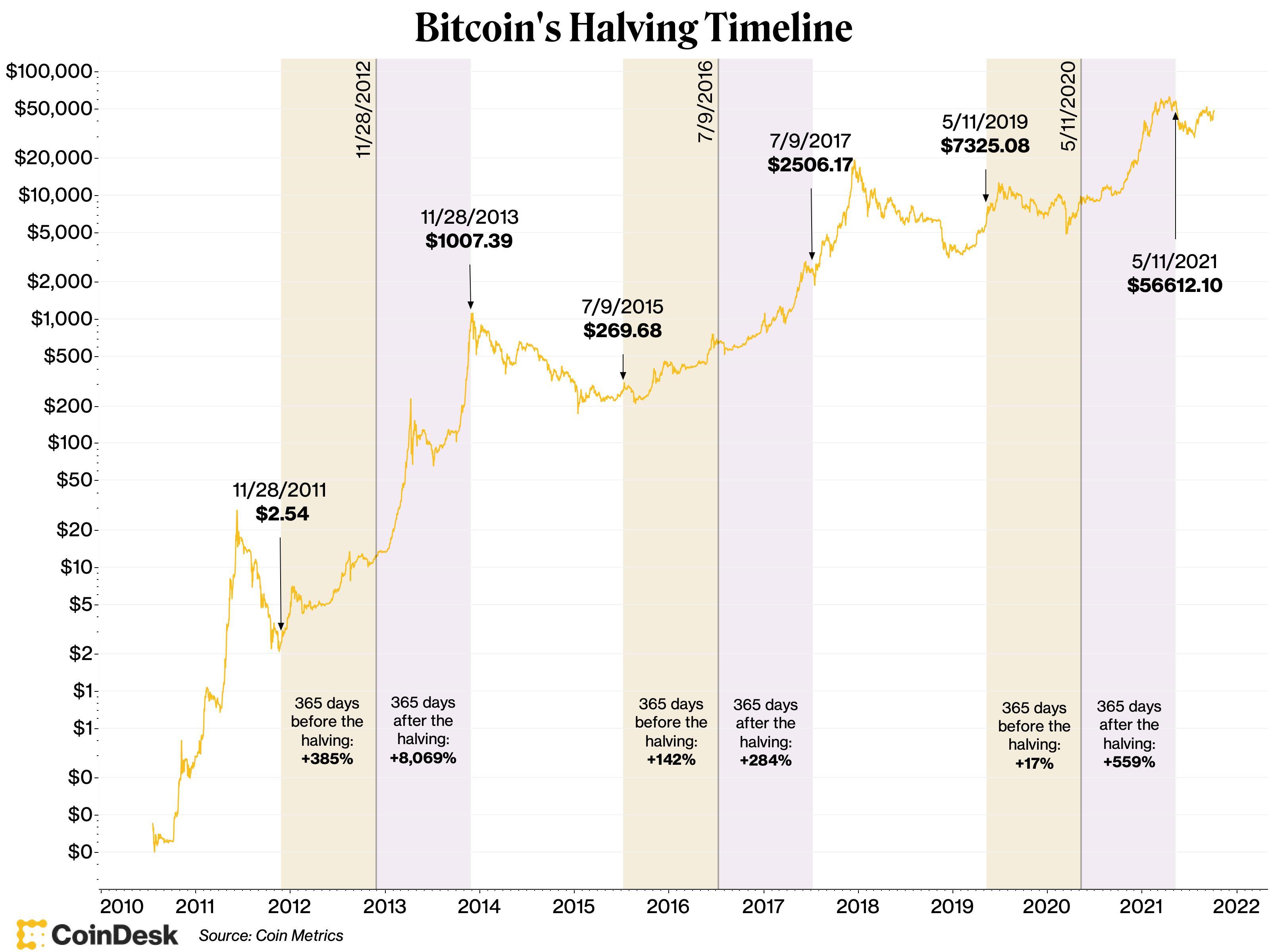

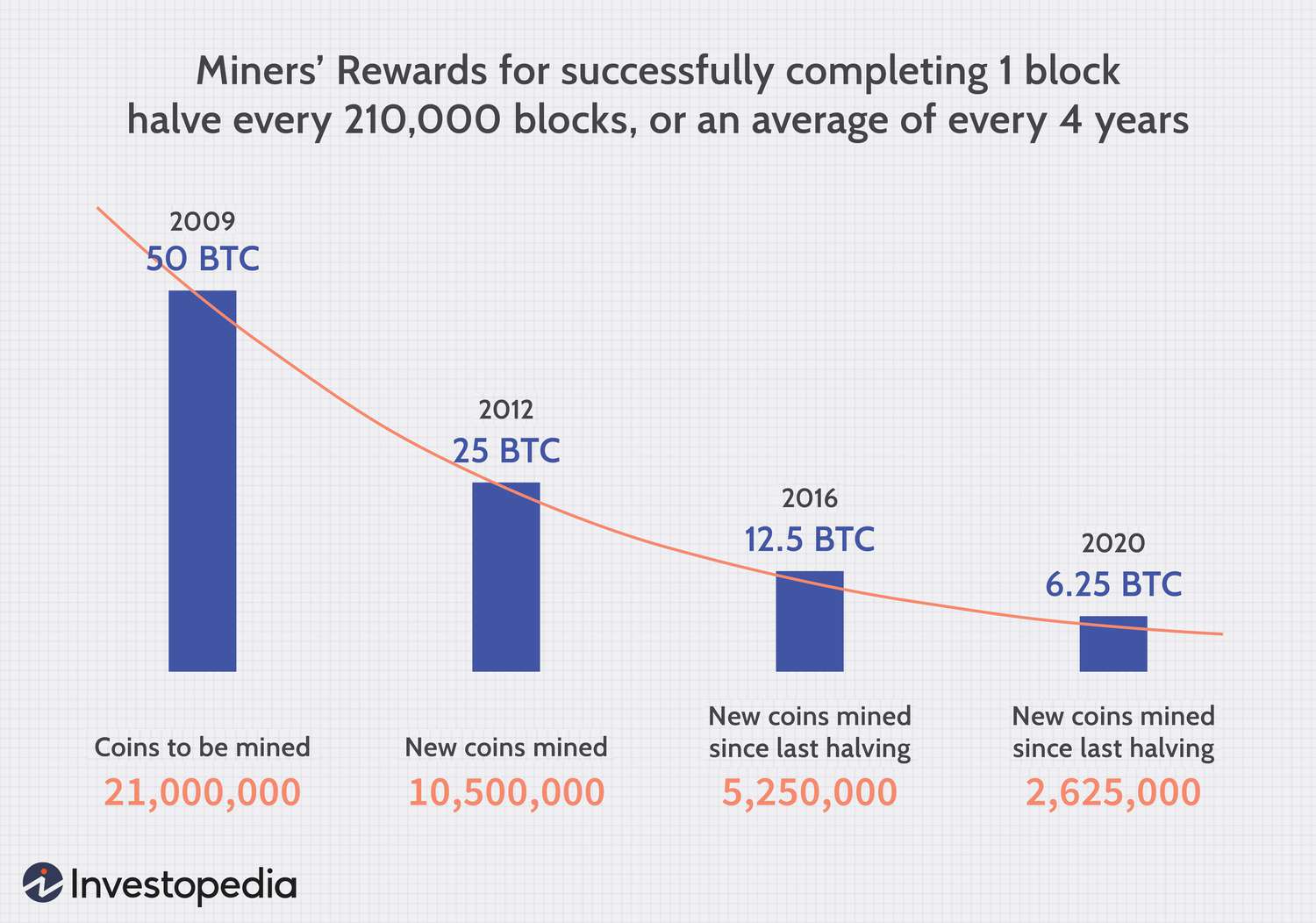

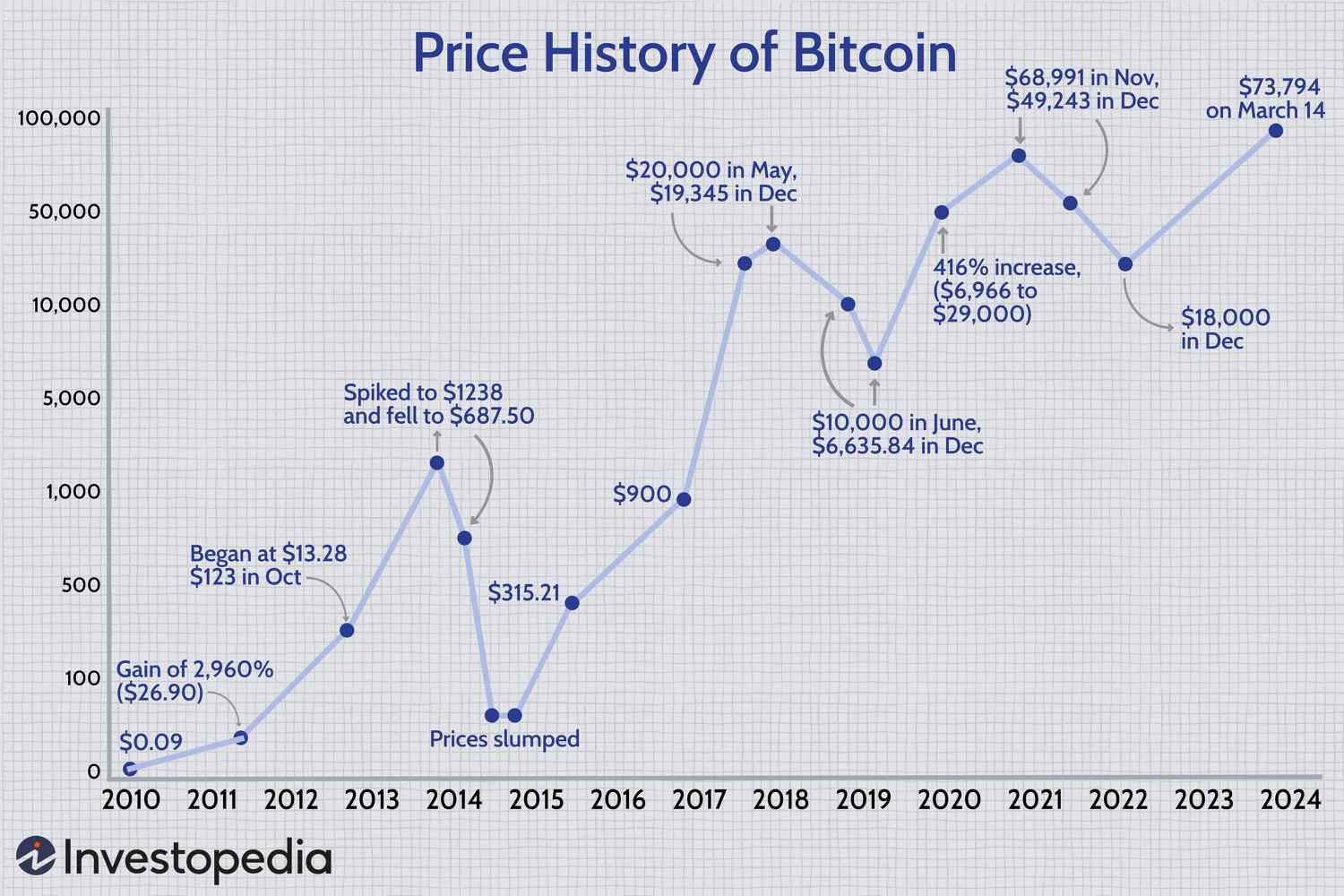

Since the bitcoin halving reduces the number of bitcoin rewarded to miners by 50%, it would make sense that analytics and market focus would center around the impact this event has on the price per bitcoin. Predicting price movements, especially for an asset class that is still as emerging and fast-moving as the crypto sector, is also difficult. However, investors do have evidence that might prove useful. In each of the three previous halving events, the price at the end of the year in which the halving occurred exceeded the price at the occurrence of the halving, including the halving event that happened during the most recent bull market during 2020-2021.

Bitcoin price movements following previous halving events

Bitcoin price movements following previous halving events

The investor impact of the halving would seem relatively straightforward to understand, especially with bitcoin ETFs still attracting billions of inflows. However, the effect of miners should also be examined. With fewer bitcoins rewarded, this might lead to miners investing more in capital equipment to increase the likelihood of earning these rewards, which in turn could lead to more centralization in the space.

Energy Consumption and Demand

As a result of the halving, which in turn might lead to growing investment and consolidation amongst bitcoin miners, there is also the potential for even more political scrutiny over operators in this space. Given that multiple hearings have been held around the amount of electricity used by miners, and that a punitive 30% tax is still being floated, the reality is that the U.S. bitcoin mining industry should be prepared for more scrutiny moving forward.

Bitcoin mining energy consumption is under scrutiny

Bitcoin mining energy consumption is under scrutiny

One item that should be kept in mind is that as bitcoin becomes an established role of the investing landscape, even on a geo-political scale (see El Salvador), that developing and retaining a competitive mining industry could very well become part of national policy discussions.

Impact on Other Crypto

Even as the crypto market continues to grow, expand, and mature, bitcoin remains a dominant force. Whether it is measured by price-per-token, market capitalization, social media mentions, investment products, or investment dollars, bitcoin remains the unchallenged leader of the crypto market. Any significant change around bitcoin will invariably influence the sentiment and fund flows for other cryptoassets, and this halving event will be no different.

The crypto market is set to be impacted by the bitcoin halving

The crypto market is set to be impacted by the bitcoin halving

For example, the approval of the spot bitcoin ETFs kick-started a bull market for bitcoin and almost every other cryptoasset. The halving will almost certainly have an effect on the crypto sector, both directly and indirectly, and investors would be well advised to monitor the effects both in the short and long term.