The Aura of Cryptocurrencies (and the Death of NFTs)

The world of cryptocurrencies is a tumultuous one, marked by significant price fluctuations and intense debates. As the market continues to evolve, it’s essential to examine the underlying forces driving these changes. In this article, we’ll delve into the current state of cryptocurrencies, exploring the factors influencing their prices and the implications for investors.

The Death of NFTs?

Non-Fungible Tokens (NFTs) were once hailed as the future of digital ownership. However, their prices have been plummeting, leaving many to wonder if they’re nothing more than a fleeting fad. According to Tarek Abou Zeid, Partner and Senior Client Portfolio Manager at Man AHL, NFTs have followed a similar price path to historical bubbles, such as tulips, railroads, and South Sea stocks. They spiral upwards as excitement builds, only to crash spectacularly when the bubble bursts.

Bored Ape

Bored Ape

Cryptocurrencies, on the other hand, have behaved differently. While they’ve experienced significant drawdowns, they’ve always recovered. This resilience has led some to argue that they’re a nascent asset class moving through the initial stages of maturity.

The Aura of Cryptocurrencies

Walter Benjamin’s 1935 essay, “The Work of Art in the Age of Mechanical Reproduction,” provides a useful framework for understanding the divide between NFTs and cryptocurrencies. Benjamin argues that the aura of an original work of art is connected to its place in time and space, its unimpeachable authenticity. In contrast, NFTs attempt to create a virtual aura, which is inherently fragile and susceptible to replication.

Cryptocurrencies, by removing any physical manifestation of their unique status, have concentrated on the concept of scarcity and its link to value. This fundamental difference in approach has significant implications for investors.

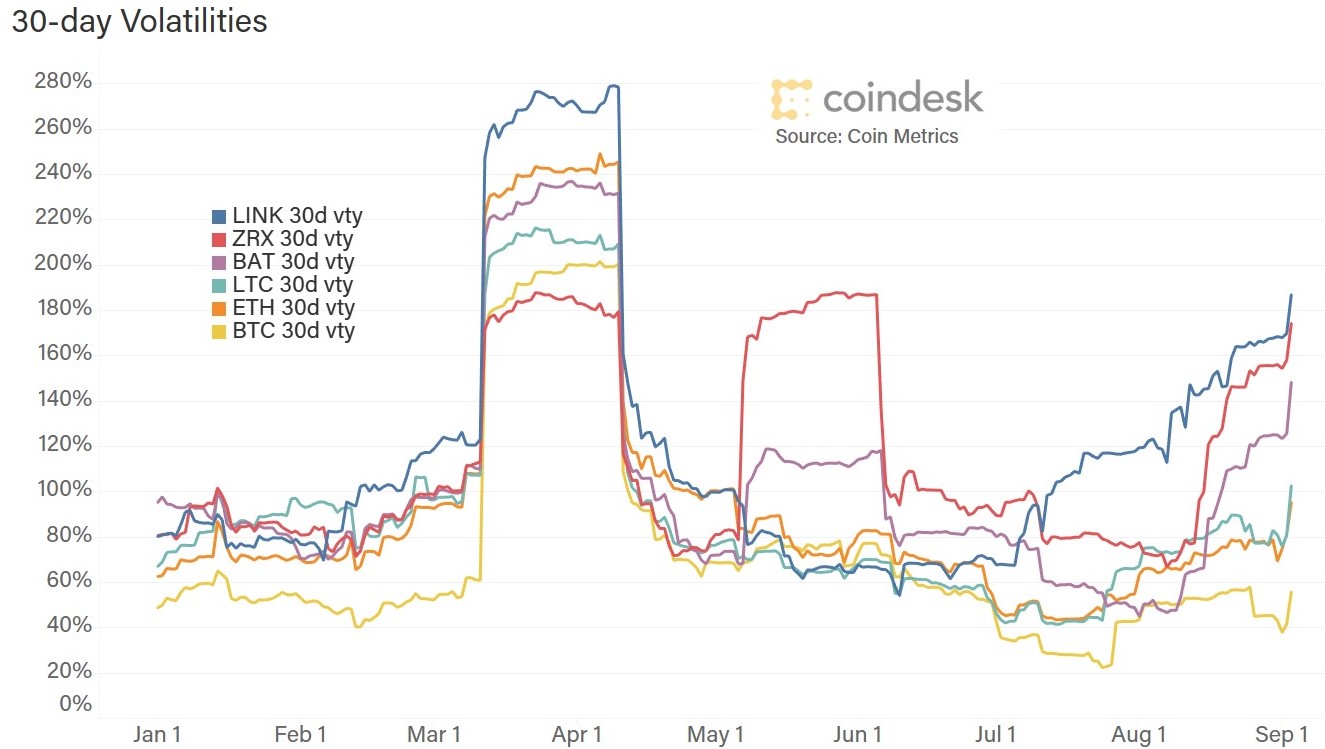

Market Volatility and the Fed

The recent decline in cryptocurrency prices has been exacerbated by market volatility and uncertainty surrounding the Federal Reserve’s interest rate decisions. The Fed’s stance on inflation has a direct impact on the dollar index, which in turn affects the price of cryptocurrencies.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/3OIUAKMBIFHQFDBTDBWDMCRDEI.jpg) Dollar Index

Dollar Index

As the Fed navigates the complex landscape of inflation and interest rates, investors must remain vigilant and adapt to changing market conditions.

Conclusion

The world of cryptocurrencies is a complex and ever-changing landscape. As investors, it’s essential to stay informed and adapt to shifting market conditions. While NFTs may be struggling, cryptocurrencies continue to evolve and mature as an asset class. By understanding the underlying forces driving these changes, we can make more informed investment decisions and navigate the tumultuous world of cryptocurrencies.