Bitcoin’s Bull Run: Why the April 2024 Halving Could Send Prices Soaring

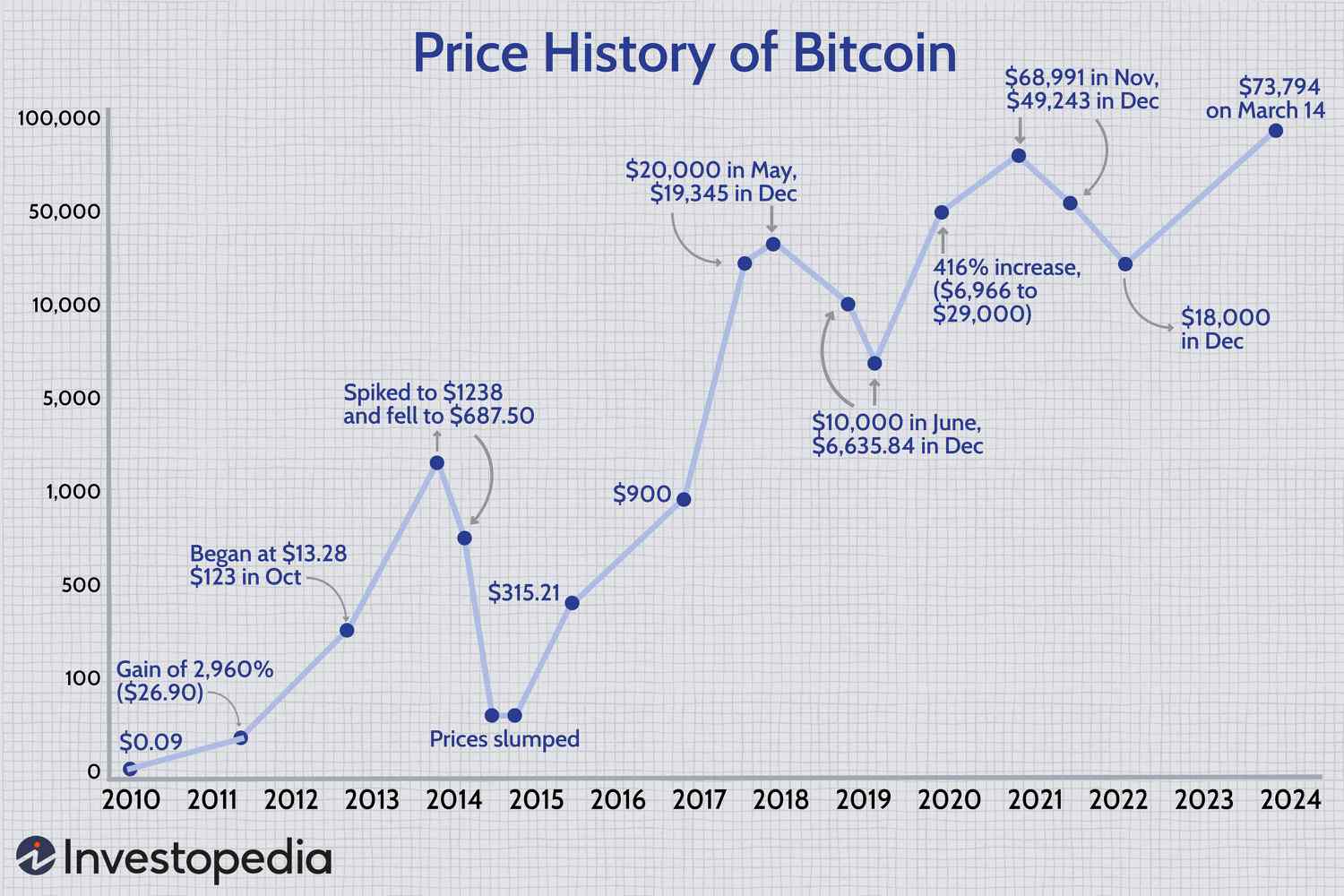

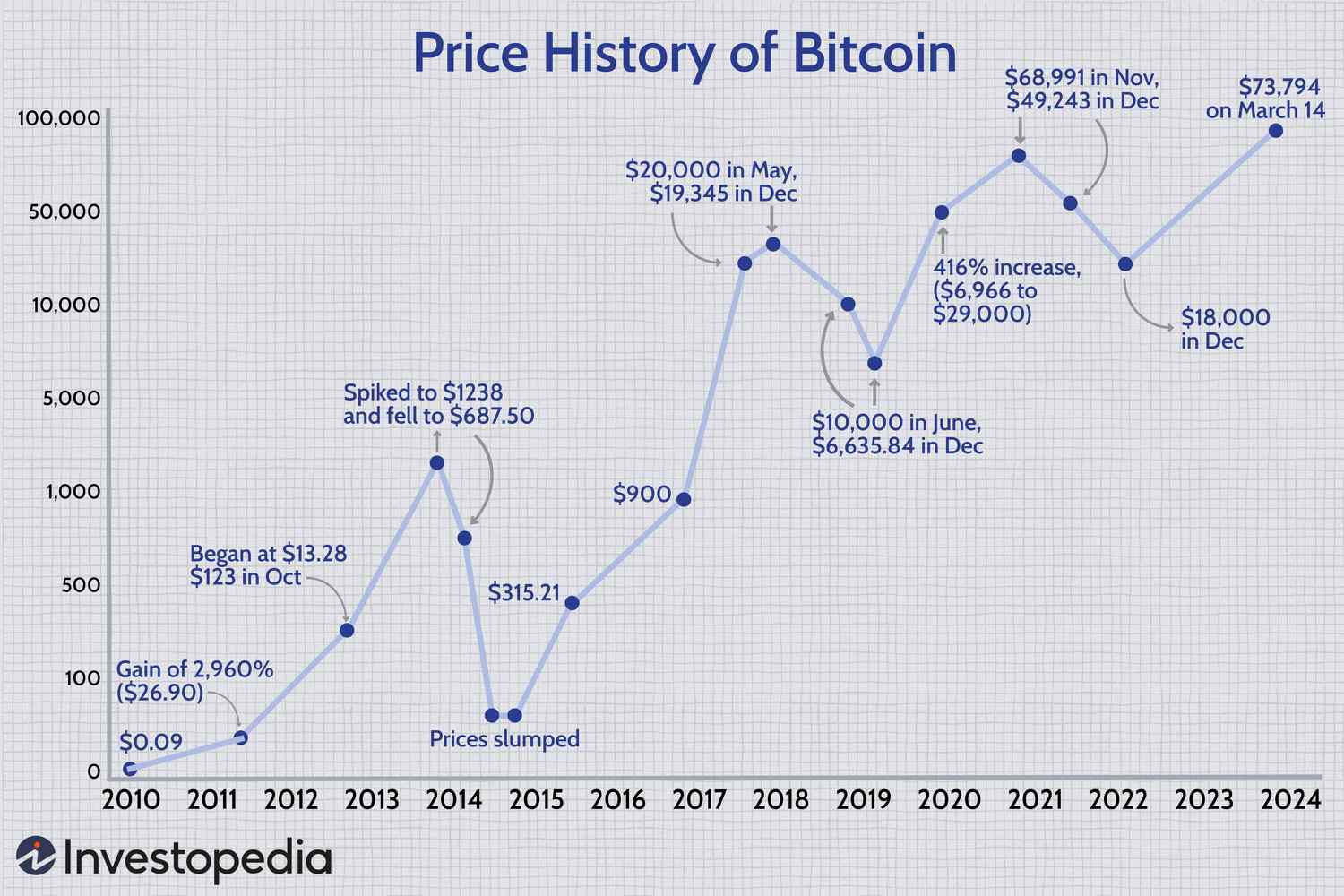

The cryptocurrency market is abuzz with excitement as the April 2024 Bitcoin halving event approaches. The halving, which occurs every four years, reduces the block reward for miners, effectively cutting the supply of new bitcoins in half. Historically, this event has led to significant price increases, and many experts believe this year will be no exception.

The Perfect Storm: ETFs and Halving Converge

The upcoming halving event coincides with the recent approval of 11 spot bitcoin exchange-traded funds (ETFs) by the U.S. Securities and Exchange Commission (SEC). This influx of institutional investment has already driven bitcoin’s price to new all-time highs, and many believe the best is yet to come.

“The bitcoin halving event is widely regarded as a significant catalyst for positive price action in the bitcoin market,” says Alissa Ostrove, Chief of Staff at CCData. “The reduction in supply, assuming demand remains constant or increases, can lead to a rise in the price of bitcoin.”

The Road to $100,000

Blockstream CEO, Adam Back, believes that bitcoin is undervalued at $72,000 and predicts the asset will cross the $100,000 mark before the halving. This may seem ambitious, but with the ETF-led demand and the upcoming supply shock, it’s not impossible.

WIZZ (@CryptoWizardd) agrees, stating, “ETFs are positive news because they bring mainstream attention to crypto. More attention means more growth. And that’s why BTC will continue its rally post-halving. There’ll be some volatility, but my target is $110,000, with an ATH of around $120,000.”

Miners: The Unsung Heroes

While the halving event is a key risk factor for miners, Constantin Kogan, partner at TDX, notes that bigger operations must have already prepared for the event. Smaller firms, however, may struggle to adapt. Despite this, the subsequent price increase makes up for the reduction in block rewards from 6.25 to 3.125 BTC per block.

“The halving makes bitcoin scarcer, so it attracts new investors, traders, and drives the price. While reduced rewards could increase selling pressure for miners, the rising price incentivizes holding,” Kogan adds.

Conclusion

The April 2024 Bitcoin halving event is poised to be a pivotal moment in the cryptocurrency’s history. With the convergence of ETFs and the halving, the stage is set for a potential price explosion. Whether you’re a seasoned investor or a newcomer to the world of crypto, one thing is certain – the next few months will be an exciting ride.

The Bitcoin halving event: a key catalyst for price growth

The Bitcoin halving event: a key catalyst for price growth

ETFs bring mainstream attention to crypto

ETFs bring mainstream attention to crypto

The road to $100,000?

The road to $100,000?