How 2024 Reshaped Digital Assets

Dec 24, 2024

The cryptocurrency landscape underwent a significant transformation in 2024, driven by unprecedented institutional engagement and progressive regulatory frameworks. This article delves into the pivotal moments and trends that defined this year in crypto, exploring the newfound legitimacy and opportunities for digital assets within traditional finance.

An overview of the evolving landscape of cryptocurrencies.

An overview of the evolving landscape of cryptocurrencies.

ETFs and the Rise of Digital Assets in Traditional Portfolios

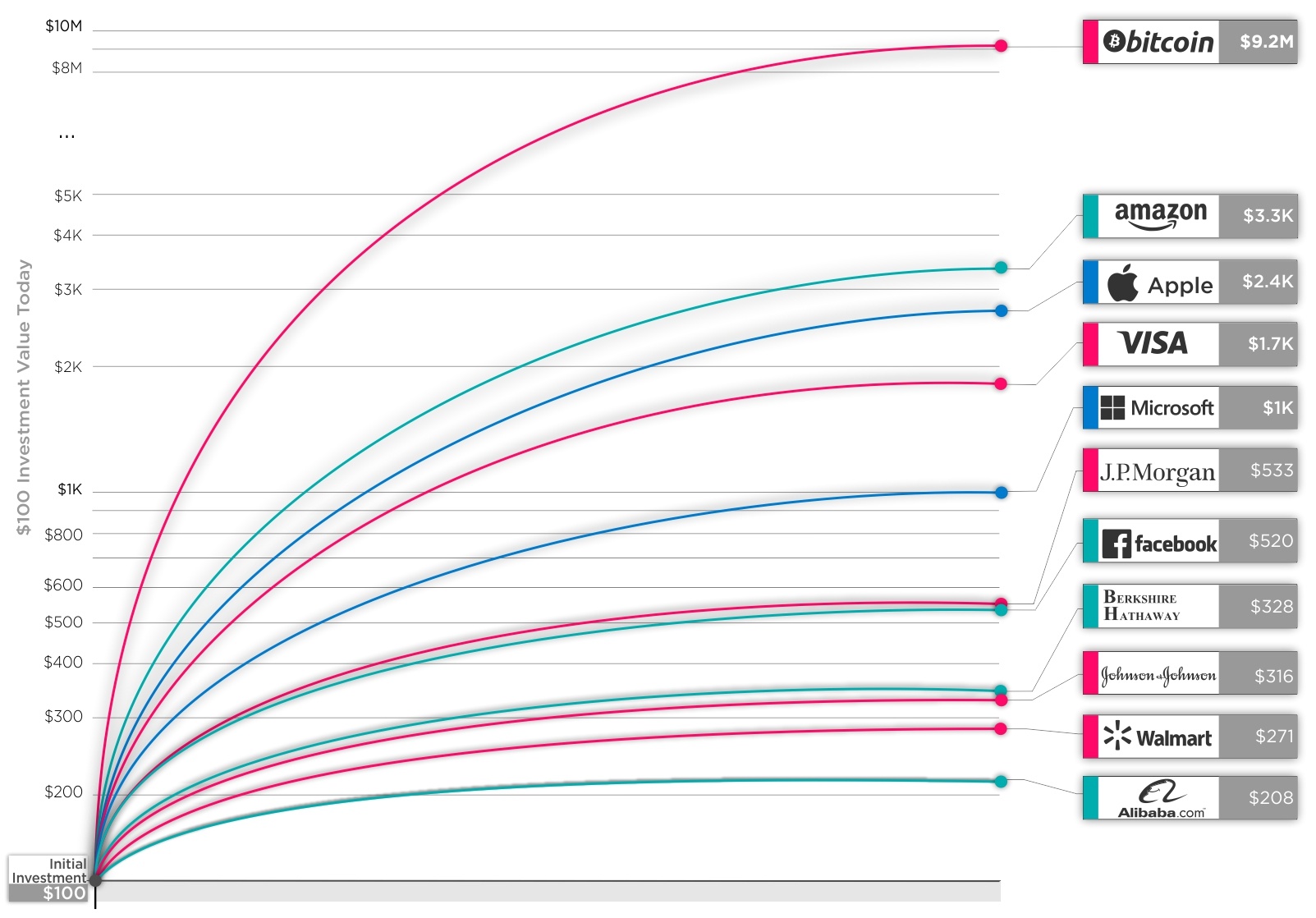

2024 marked a watershed moment for institutional adoption of cryptocurrencies. Major financial institutions, including giants like JPMorgan Chase and Goldman Sachs, shifted from skepticism to active participation in the crypto space, integrating digital assets into mainstream portfolios. The approval of Bitcoin exchange-traded funds (ETFs) was a game changer, with multiple ETFs receiving green lights from the US Securities and Exchange Commission (SEC) in January. This momentous decision made it easier for funds to diversify into cryptocurrency investments, with Bitcoin ETFs collectively amassing approximately $113 billion in assets.

The increasing acceptance of crypto-focused investment products within traditional asset management signifies a paradigm shift. Institutional investors, who once regarded cryptocurrency as a speculative asset, now view digital tokens as essential components of diversified portfolios.

Bitcoin Halving: A New Narrative

Traditionally, the Bitcoin halving has been the catalyst for explosive price surges, with past occurrences propelling Bitcoin’s value well beyond previous all-time highs. However, 2024 presented a novel narrative; Bitcoin defied historical patterns by reaching new peaks as early as March, buoyed by the optimism surrounding ETF approvals.

Analyzing Bitcoin’s historical price patterns.

Analyzing Bitcoin’s historical price patterns.

The halving event, which reduces miners’ rewards approximately every four years, is typically associated with bullish momentum due to its anti-inflationary effects. Yet, 2024 showed a more complex behavior: following an initial spike, Bitcoin’s price plateaued for much of the year, only to soar again in November. This fluctuation underscores the intricate interplay of market sentiment, regulatory developments, and institutional adoption shaping Bitcoin’s trajectory this year.

Regulatory Advances: Creating a Safe Harbor

The global regulatory landscape also witnessed remarkable progress, as authorities sought to establish policies that foster responsible growth within the crypto industry. One notable achievement was the official recognition of crypto asset service providers (CASPs) like Luno in South Africa as legitimate financial service providers, enhancing their credibility and operational scope.

Regulators worldwide are increasingly adopting diligent frameworks aimed at safeguarding investors while ensuring innovation continues to flourish. As regulatory clarity improves, both investors and institutions are likely to find greater confidence in participating in the digital economy.

The Trump Effect: A Strategic Pivot Towards Crypto

The political climate significantly influenced the crypto sphere in 2024, particularly following the election of President Donald Trump. Crypto became a cornerstone of his campaign strategy, with promises to develop a “strategic Bitcoin reserve” and label the United States as the “crypto capital of the planet.”

Exploring political influences on cryptocurrency policies.

Exploring political influences on cryptocurrency policies.

Trump’s administration has placed a strong emphasis on appointing pro-crypto individuals to key positions within federal agencies. His nomination of Paul Atkins to chair the SEC, a figure known for supporting cryptocurrency initiatives, has invigorated optimism among crypto advocates. This strategic pivot towards fostering an environment conducive to digital assets is likely to have a lasting impact on the regulatory landscape and institutional participation in the sector.

Conclusion

The year 2024 has undeniably reshaped the cryptocurrency landscape, setting the stage for a new era of institutional integration, regulatory advancements, and innovative financial products. As digital assets gain traction in traditional portfolios and regulatory frameworks evolve to support this transformation, the future of cryptocurrency looks promising.

For those eager to stay ahead, continually exploring the advancements and shifts in this dynamic industry will be essential.

Visions for the future of digital finance.

Visions for the future of digital finance.