Bitcoin’s Price Surge: The Game Theory Phenomenon

The recent approval of spot Bitcoin ETFs is set to revolutionize the way institutional investors interact with the cryptocurrency market. With the ability to add Bitcoin exposure to their portfolios through a simple ETF purchase, institutions are poised to inject a massive influx of capital into the market. But what does this mean for the future of Bitcoin’s price?

Understanding the Current Landscape

Institutional investors are known for their thorough due diligence, and their entry into the Bitcoin market will likely be gradual. However, as they begin to understand the benefits of Bitcoin, they will inevitably arrive at the same conclusion: Bitcoin is a necessity in their portfolios. This widespread adoption will lead to a tsunami of capital flowing into the market, driving up the price of Bitcoin.

The Potential Impact of Institutional Investment

Studies suggest that a 5% allocation of institutional assets to Bitcoin could propel the cryptocurrency’s market cap to over $7 trillion, with prices soaring beyond $400,000. However, some analysts argue that a 5% allocation may be too conservative. A recent ARK Invest study suggests that the ideal exposure level could be closer to 19%, which would propel Bitcoin’s price to over $1.3 million.

The Game Theory Phenomenon

The influx of institutional investors marks the beginning of a fascinating phenomenon: game theory. As institutions observe their peers reaping the benefits of Bitcoin investments, they will face pressure to join the fray or risk being left behind in the race for returns. This dynamic, driven by the desire to outperform peers and secure maximum returns, will fuel a surge in Bitcoin adoption and investment unlike any we have seen before.

Institutional investors are poised to inject a massive influx of capital into the Bitcoin market.

Institutional investors are poised to inject a massive influx of capital into the Bitcoin market.

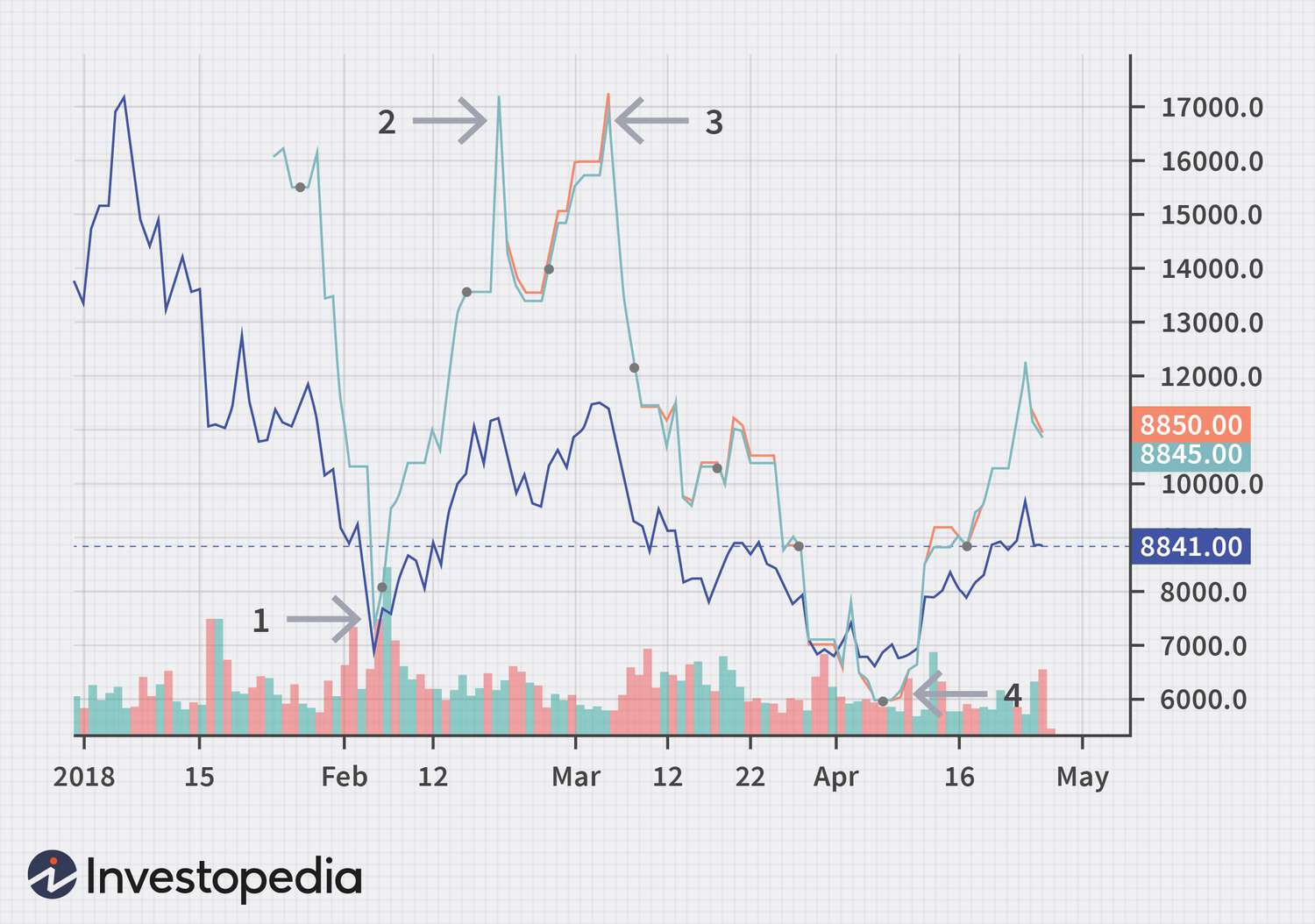

The potential impact of institutional investment on Bitcoin’s price.

The potential impact of institutional investment on Bitcoin’s price.

The game theory phenomenon driving Bitcoin adoption and investment.

The game theory phenomenon driving Bitcoin adoption and investment.

Conclusion

The approval of spot Bitcoin ETFs marks the beginning of a new era for Bitcoin. As institutional investors enter the market, the cryptocurrency’s price is poised to surge to unprecedented heights. With the game theory phenomenon driving adoption and investment, it’s clear that Bitcoin is on the cusp of a major breakthrough. Will Bitcoin reach $1 million? Only time will tell, but one thing is certain: the future of Bitcoin has never looked brighter.

The future of Bitcoin has never looked brighter.

The future of Bitcoin has never looked brighter.