Spot Ethereum ETF Approval: A Boon for Bitcoin?

The recent approval of spot Ether ETFs by the United States Securities and Exchange Commission (SEC) has sparked a heated debate in the cryptocurrency community. While some have expressed concerns over the potential implications of this move, MicroStrategy founder Michael Saylor believes that this development could ultimately benefit Bitcoin.

“Is this good for Bitcoin or not? Yeah, I think it’s good for Bitcoin, in fact, I think it may be better for Bitcoin because I think that we are politically much more powerful supported by the entire crypto industry,” Saylor told Bitcoin podcaster Peter McCormack on the May 25 episode of What Bitcoin Did podcast.

Saylor’s argument is that the approval of spot Ether ETFs serves as “another line of defense for Bitcoin.” This move is expected to accelerate institutional adoption, as previously wary investors will now recognize crypto as a legitimate asset class.

Institutional investors are increasingly turning to cryptocurrencies.

Institutional investors are increasingly turning to cryptocurrencies.

Saylor predicts that mainstream investors will allocate a significant portion of their capital to the crypto asset class, with Bitcoin likely to receive the majority of the allocated capital. “I think mainstream investors will say oh there is a crypto asset class now, maybe we’ll allocate 5% or 10% to the crypto asset class, but Bitcoin will be 60% or 70% of that,” he claimed.

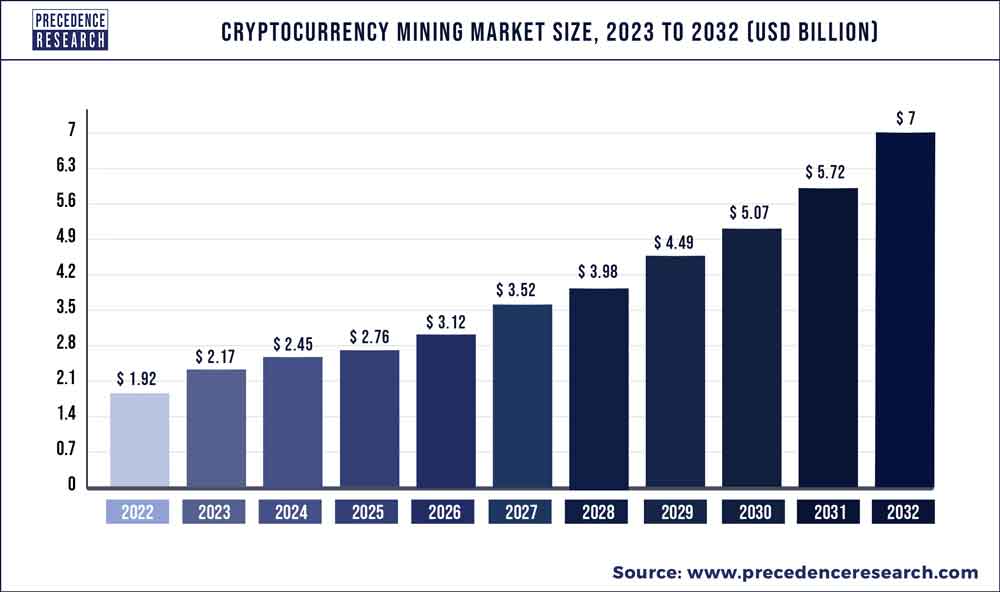

Institutional investors are driving the growth of the cryptocurrency market.

Institutional investors are driving the growth of the cryptocurrency market.

The approval of spot Ether ETFs is a significant milestone in the development of the cryptocurrency market. As the industry continues to mature, it is likely that we will see increased adoption and growth. With Bitcoin at the forefront of this movement, the future looks bright for the world’s largest cryptocurrency.

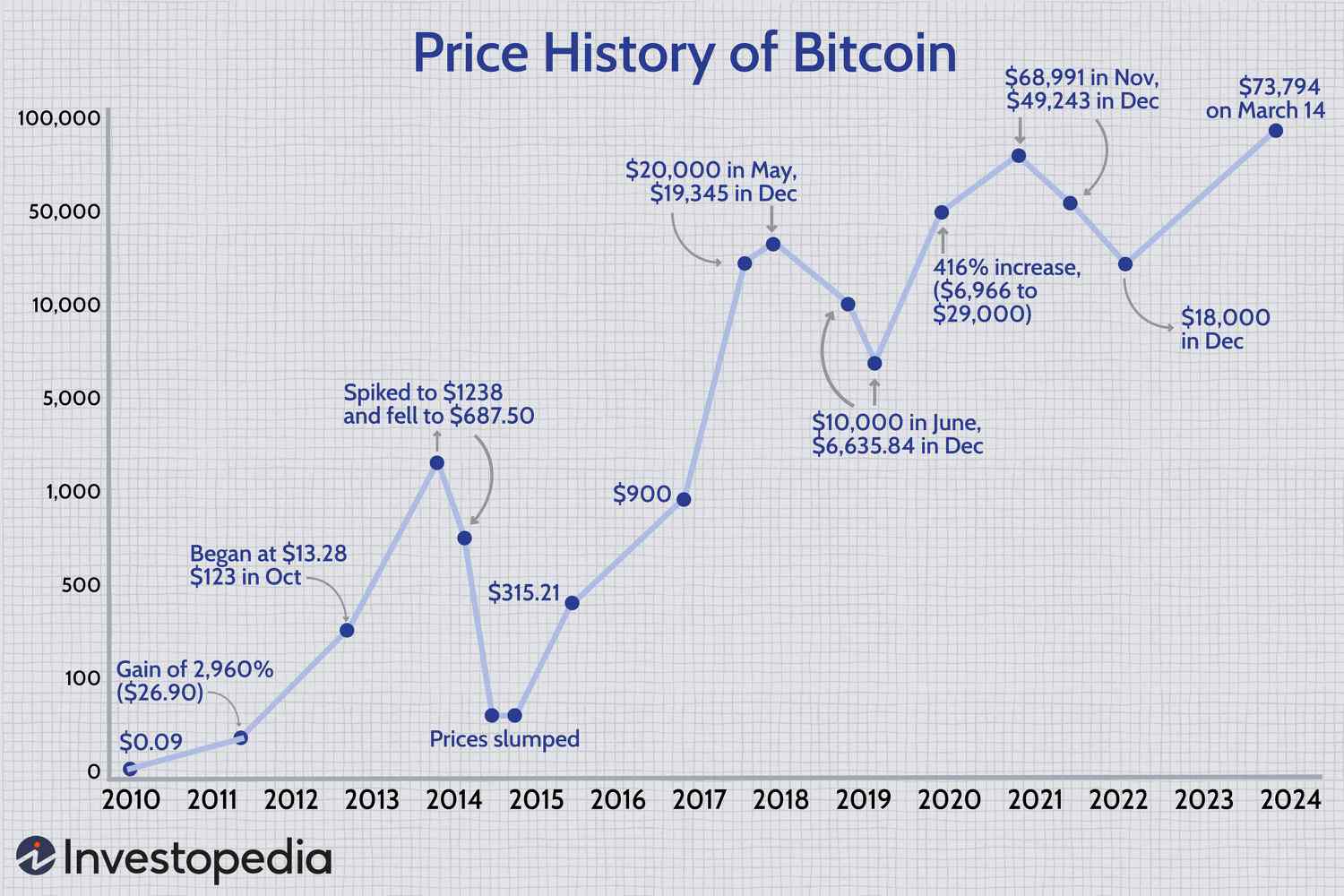

Bitcoin is poised for further growth as institutional adoption increases.

Bitcoin is poised for further growth as institutional adoption increases.