Solana: The Next Big Cryptocurrency to Hit the ETF Market?

As the cryptocurrency landscape continues to evolve, investors are constantly on the lookout for the next big thing. With the recent approval of Bitcoin and Ethereum ETFs in the U.S., many are speculating about which cryptocurrency will be the next to make its debut in the ETF market. One cryptocurrency that has been generating significant buzz is Solana.

What is Solana?

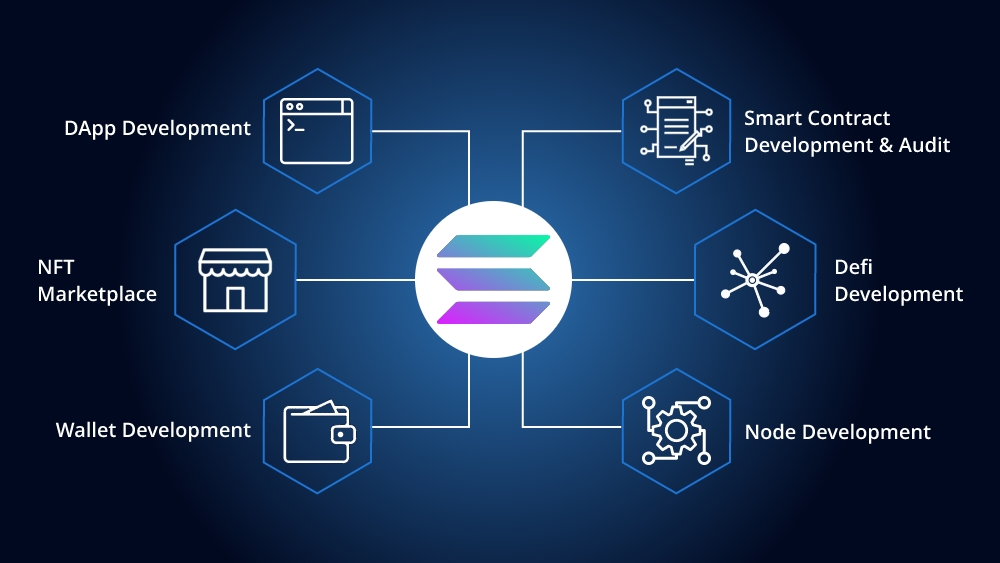

Solana is a high-performance blockchain platform that provides fast, secure, and scalable decentralized applications (dApps) and cryptocurrencies. Unlike Bitcoin, which was designed as a payment system, Solana is built for high-performance blockchain applications. Its focus on fast transaction speeds and low costs makes it attractive for developers.

Solana’s high-performance blockchain platform

Solana’s high-performance blockchain platform

Solana’s Value Proposition

The core value propositions of Solana are its high-speed and low-cost attributes. As a blockchain platform, it is scalable, processing up to 65,000 transactions per second (TPS), significantly higher than Bitcoin (around 7 TPS) and Ethereum (about 15-30 TPS). This makes it suitable for high-frequency trading, decentralized finance (DeFi) applications, and other use cases requiring fast transaction processing. Furthermore, it is highly cost-efficient, with the cost per transaction on Solana being very low, often less than $0.01.

“Solana’s high performance and low costs make it an attractive option for developers and investors alike.”

Solana’s Operational Framework

Solana uses a novel consensus mechanism called Proof of History (PoH) in conjunction with Proof of Stake (PoS), enhancing security and decentralization while maintaining high performance. PoH is a cryptographic clock that provides a historical record proving that an event has occurred at a specific moment in time. This helps to order transactions and blocks efficiently, allowing nodes to agree on the time and order of events without having to communicate directly. Whereas PoS utilizes validators to produce new blocks based on the number of Solana tokens they hold and are willing to “stake” as collateral. Validators process transactions and secure the network, and they are rewarded with Solana tokens for their efforts.

Solana’s innovative consensus mechanism

Solana’s innovative consensus mechanism

Investing in Solana through an ETF

In the U.S., no Solana-specific ETF is currently available. However, as reported by Reuters, Cboe Global Markets has filed a request with the U.S. Securities and Exchange Commission (SEC) to list ETFs tied to the Solana cryptocurrency. Under SEC rules, the agency has 240 calendar days to decide whether to approve or deny Cboe’s application.

In Canada, 3iQ, a digital asset investment fund manager, has recently announced that it has filed a preliminary prospectus with the securities regulatory authorities to launch North America’s first Solana exchange-traded product, the Solana Fund (Ticker: QSOL).

“Solana is entering the forefront and will become the latest digital asset offering that investors can integrate into their portfolio.”

Conclusion

As the cryptocurrency landscape continues to evolve, investors are constantly on the lookout for the next big thing. With its high-performance blockchain platform, fast transaction speeds, and low costs, Solana is definitely worth keeping an eye on. Whether you’re a seasoned investor or just starting to explore the world of cryptocurrencies, Solana is definitely a name to watch in the coming months.