Solana: The Next Big Cryptocurrency to Hit the ETF Market?

The world of cryptocurrency is ever-evolving, and with the recent approval of Bitcoin and Ethereum ETFs in the U.S., the question on everyone’s mind is: what’s next? The growing consensus among asset managers seems to be that Solana is top-of-mind for many investors. But what is Solana, and how does it differ from other cryptocurrencies like Bitcoin and Ethereum?

What is Solana?

Solana is a high-performance blockchain platform that provides fast, secure, and scalable decentralized applications (dApps) and cryptocurrencies. Unlike Bitcoin, which was designed as a payment system, Solana is built for high-performance blockchain applications. Its focus on fast transaction speeds and low costs makes it attractive for developers. As of July 31, 2024, Solana’s market capitalization is USD 84.15B.

Solana’s Value Proposition

The core value propositions of Solana are its high-speed and low-cost attributes. As a blockchain platform, it is scalable, processing up to 65,000 transactions per second (TPS), significantly higher than Bitcoin (around 7 TPS) and Ethereum (about 15-30 TPS). This makes it suitable for high-frequency trading, decentralized finance (DeFi) applications, and other use cases requiring fast transaction processing. Furthermore, it is highly cost-efficient, with the cost per transaction on Solana being very low, often less than $0.01.

Solana’s Operational Framework

Solana uses a novel consensus mechanism called Proof of History (PoH) in conjunction with Proof of Stake (PoS), enhancing security and decentralization while maintaining high performance. PoH is a cryptographic clock that provides a historical record proving that an event has occurred at a specific moment in time. This helps to order transactions and blocks efficiently, allowing nodes to agree on the time and order of events without having to communicate directly. Validators process transactions and secure the network, and they are rewarded with Solana tokens for their efforts.

Investing in Solana through an ETF

While there is currently no Solana-specific ETF available in the U.S., two issuers have filed for a spot Solana ETF: VanEck on June 27 and 21Shares on June 28. Meanwhile, in Canada, 3iQ has announced that it has filed a preliminary prospectus with the securities regulatory authorities to launch North America’s first Solana exchange-traded product, the Solana Fund (Ticker: QSOL). This fund will allow investors to gain exposure to SOL in a simplified manner, in a fund structure that is eligible for registered accounts in Canada, making it a tax-efficient, long-term investment option.

But what does this mean for the future of cryptocurrency and the stock market? Will Solana be the next big thing, or will it flop like so many other altcoins before it? Only time will tell, but one thing is certain: the world of finance is changing fast, and investors need to stay ahead of the curve to stay ahead of the game.

The Stock Market and Cryptocurrency: A Perfect Storm?

As the stock market continues to slide, many investors are turning to cryptocurrency as a safe haven. But is this a wise move, or are investors simply jumping from the frying pan into the fire?

The Yen Carry Trade Reversal

One of the key factors driving the current market volatility is the yen carry trade reversal. With higher interest rates in Japan, investors who had borrowed yen to purchase assets such as stocks, gold, and commodities are now reversing these transactions, leading to a massive unwinding of positions. This has led to a sharp decline in the value of the yen, which in turn has put upward pressure on the USD Index.

The Impact on Cryptocurrency

So what does this mean for cryptocurrency? In the short term, the decline in the value of the yen and the resulting increase in the USD Index may lead to a decline in the value of cryptocurrency. However, in the long term, the fundamentals of cryptocurrency remain strong, and many investors believe that it will continue to be a store of value and a hedge against inflation.

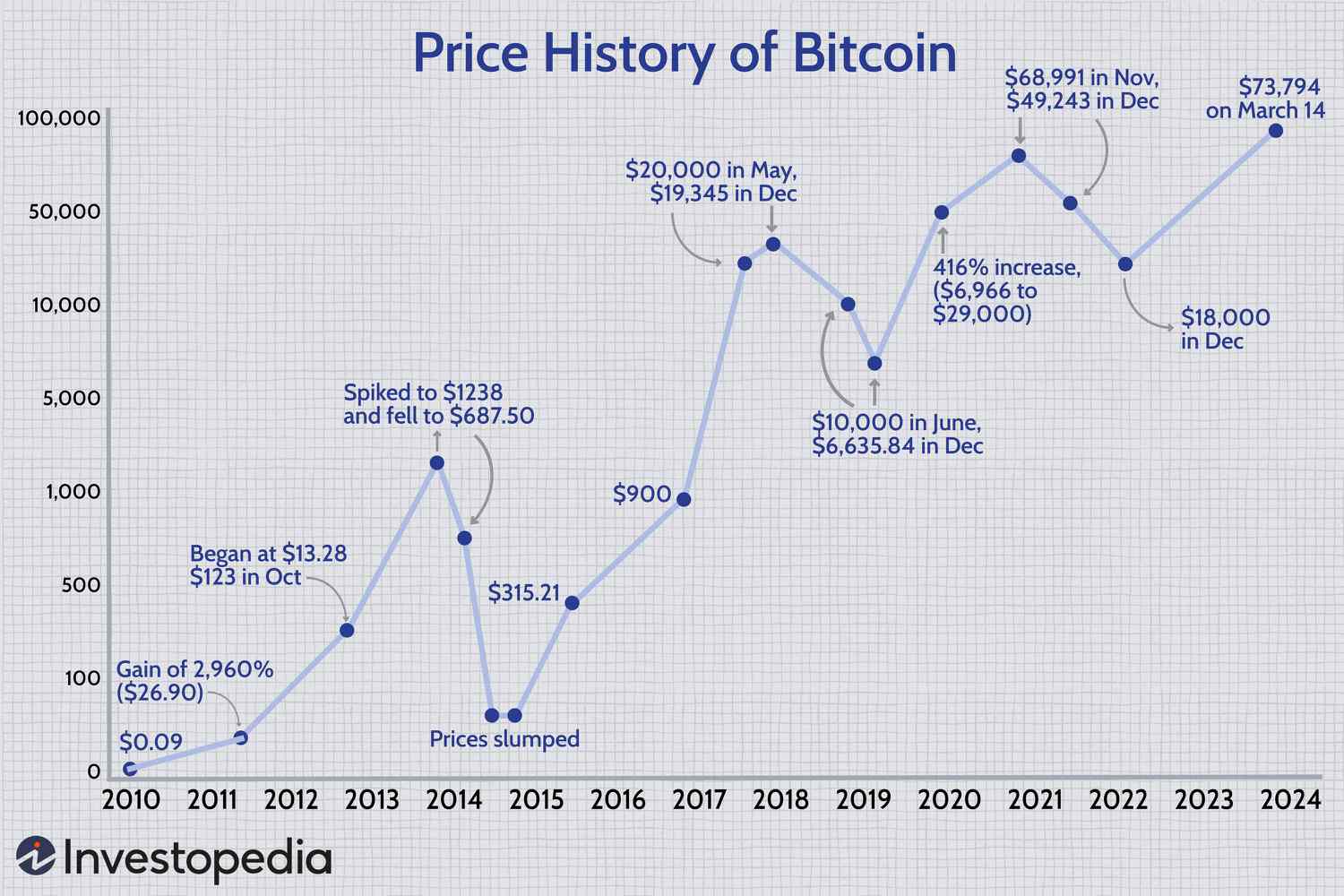

The New Gold? Bitcoin?

But what about Bitcoin? Is it the new gold, or is it just a flash in the pan? While some investors believe that Bitcoin will continue to rise in value, others are more skeptical. One thing is certain, however: the world of cryptocurrency is changing fast, and investors need to stay ahead of the curve to stay ahead of the game.

Conclusion

In conclusion, the world of cryptocurrency is ever-evolving, and investors need to stay ahead of the curve to stay ahead of the game. While Solana may be the next big thing, the fundamentals of cryptocurrency remain strong, and many investors believe that it will continue to be a store of value and a hedge against inflation. But what does the future hold? Only time will tell, but one thing is certain: the world of finance is changing fast, and investors need to stay ahead of the curve to stay ahead of the game.

Solana logo

Cryptocurrency chart

Stock market chart

Yen carry trade chart

Bitcoin chart

Photo by

Photo by