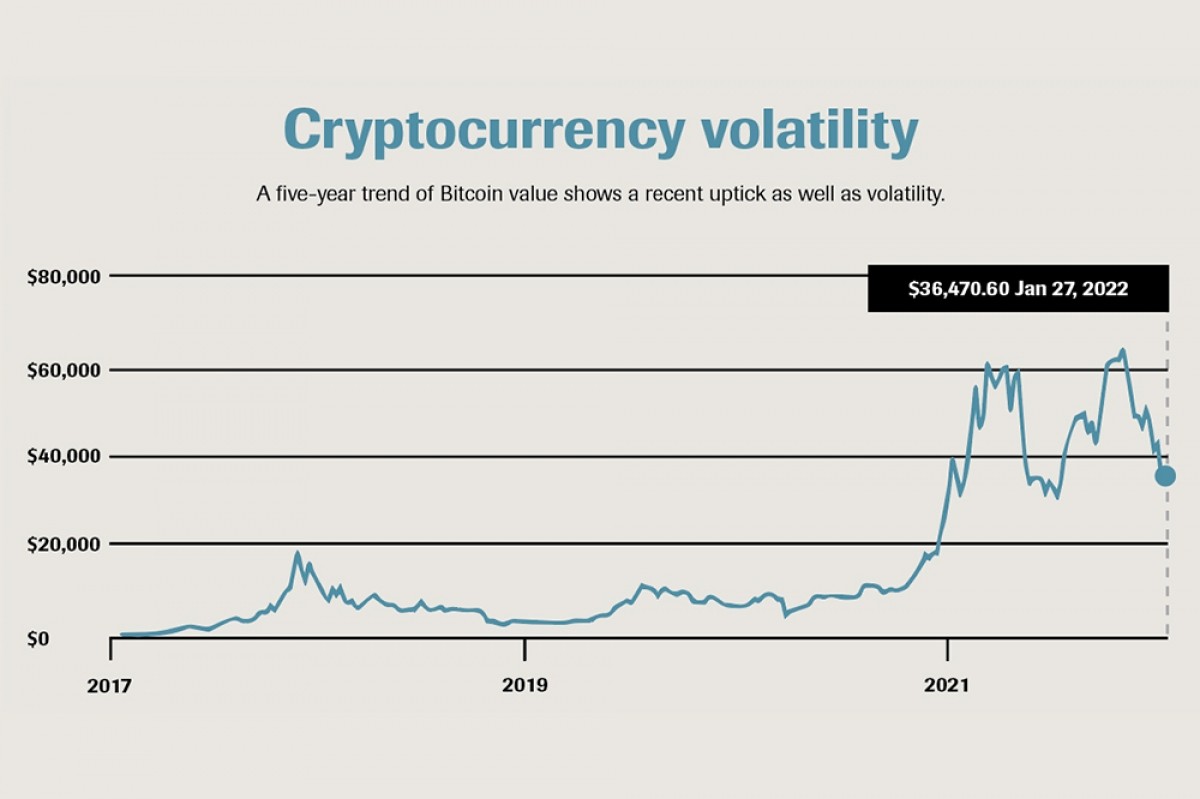

The Crypto Market Soars Ahead: A New Chapter for Bitcoin and Ethereum

The crypto landscape is buzzing with excitement as both Bitcoin and Ethereum continue to climb, marking significant milestones in their trajectories. In recent days, Ethereum has surged by 8.2%, hitting $2,740—levels we haven’t seen since late August. This movement signals a robust recovery and hints at even greater potential in the months to come.

Bitcoin and Ethereum on an upward trajectory.

Bitcoin and Ethereum on an upward trajectory.

Bitcoin Reaches New Heights

Bitcoin’s recent performance has been even more noteworthy; it reached a peak of $69,500 on Monday, a figure that hasn’t been achieved in nearly three months. This price surge comes amid a significant influx of investments into Bitcoin ETFs, with inflows of about $2.13 billion last week, bringing the yearly total to a staggering $20.94 billion. As we assess the potential, Bitcoin is now eyeing the late July highs, with the psychological resistance of $72,000 looming large on the horizon.

This uptick has rekindled discussions among investors about the prospects for Bitcoin as it battles previous records, igniting a sense of FOMO (fear of missing out) across the trading community. As we move deeper into 2024, the bullish sentiment shows no signs of waning, reflecting the optimistic outlook of many traders.

Ethereum’s Resurgence

Ethereum too has shown resilience, climbing back from its fatigue as it finds renewed vigor. At $2,740, it is positioned well, with eyes set on the $2,900 mark, a pivotal point surrounded by the 50-week moving average and earlier price support levels. As much as Bitcoin’s performance drives the narrative, Ethereum’s rise begs attention for its vital role in decentralizing finance and the burgeoning NFT market. This resurgence is fueled not just by price, but by the inherent functionality and adaptations of the Ethereum network, which continue to evolve.

The recent growth in Ethereum ETFs, paired with a $78.9 million inflow after two weeks of outflows, signifies a shift in sentiment. Despite previous struggles, it appears the Ethereum market is regaining its footing and preparing for what may become an explosive end to the year.

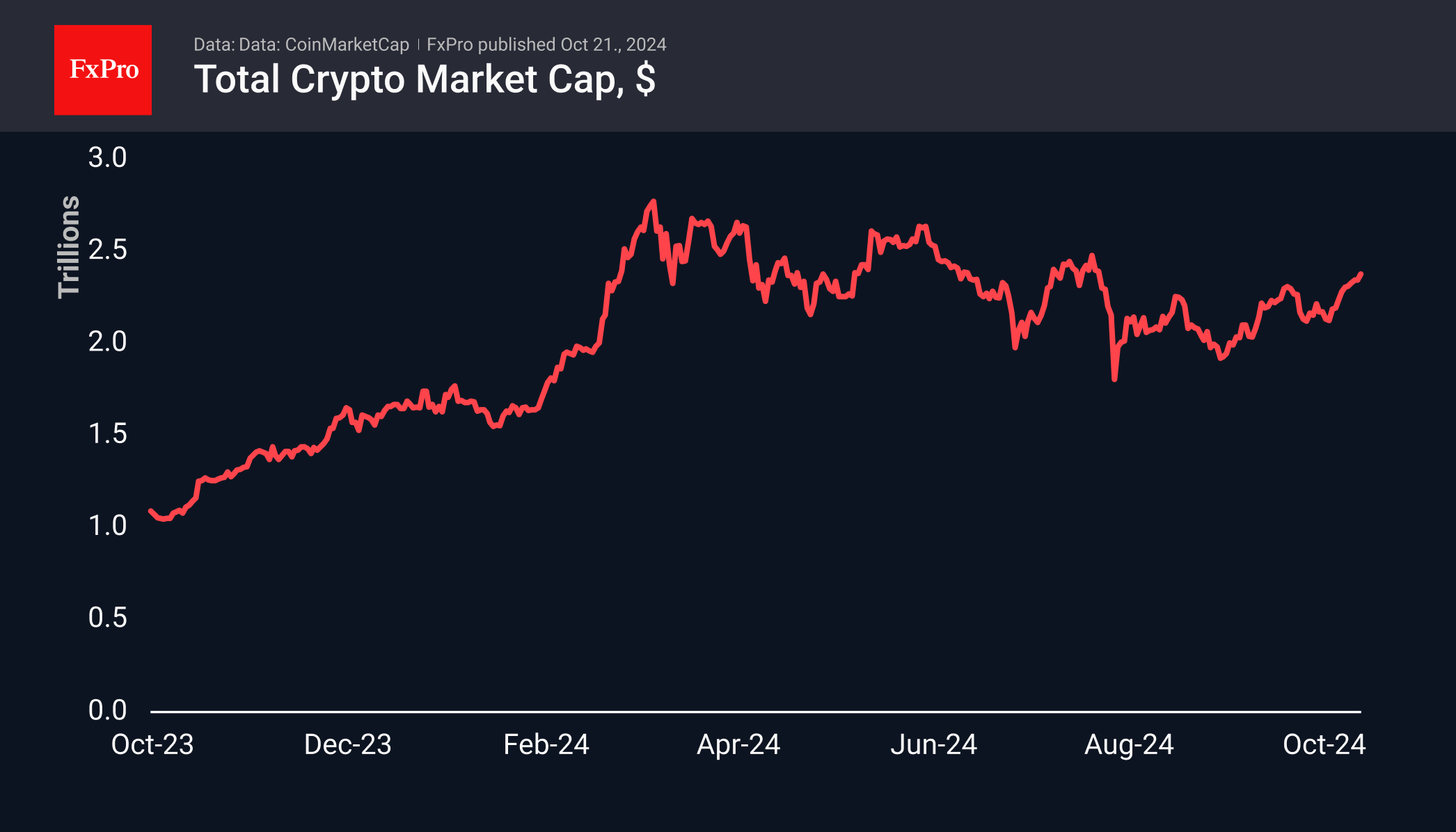

The Broader Crypto Context

But the excitement isn’t confined to just Bitcoin and Ethereum. The overall cryptocurrency market cap has surpassed $2.39 trillion, marking a 7% increase over the last week. The Cryptocurrency Fear and Greed Index has storied peaks around the 71-73 mark, indicating a market mentality that is clearly leaning towards greed—an interesting parallel to the highs we witnessed in late July.

In another notable development, the U.S. SEC has recently approved trading options on spot Bitcoin ETFs on NYSE and CBOE, a regulatory shift that could influence market dynamics significantly. Yet, the regulatory landscape remains complex; as Ripple continues its legal battles concerning XRP, the cryptocurrency community holds its breath. Ripple CEO Brad Garlinghouse remains optimistic, asserting that XRP is primed to become a powerhouse within the payments sector despite the looming uncertainties.

“XRP is poised to lead in the crypto space due to its unique utility,” says Garlinghouse, capturing the sentiment amidst the ongoing tussles with regulators.

The growth of Ethereum continues to excite investors.

The growth of Ethereum continues to excite investors.

Future Prospects

Tron has also made headlines, boasting a 30% profit increase following the launch of the SunPump meme coin platform, exemplifying how innovation keeps pushing the boundaries within the cryptocurrency domain. It’s clear that as more projects, technologies, and use cases emerge, the crypto market is not just weathering the storm but thriving.

As we continue to witness the rapid oscillations of this market, the key takeaway is that its inherent volatility is not merely a risk but an invitation to innovate and explore. Those who embrace this narrative might find rewarding opportunities amidst the chaos. I personally feel invigorated by the energy of the sector, seeing it evolve and attract both seasoned investors and newcomers alike.

Let’s keep our eyes peeled as we traverse through the remainder of the year; will Bitcoin’s psychological resistance yield to eager bull runs? Will Ethereum transcend its price barriers once again? The world of cryptocurrency is as unpredictable as it is exhilarating, and that’s what keeps us all engaged.

Conclusion

The upward momentum is clear, and whether you’re an investor, a developer, or simply an onlooker, the current landscape of cryptocurrency is surely captivating. The trends in the coming months will be determined by regulatory movements, market sentiment, and technological advancements. Stay tuned, as this saga is far from over!

An overview of the current state of the cryptocurrency market.

An overview of the current state of the cryptocurrency market.